Offences and penalties under GST are not really known by everybody. It is a fact that when you fall down in this situation then only you come to know about it. Today in this article we will explain you about the consequences you may face if you ignore offenses and penalties under GST. So, let’s start! The very first question that pops here is what amounts to Offences under GST?

The outcome of Union Budget 2021

- Interest to be on net tax liability – the Amendment ofsection 50 of the CGST Act is being done to grant for a retrospective interest charge on the net cash liability which shall be with effect from 1st July, 2017.

- With regards to conveyance under section 130 and received orders for seizure and detention of goods – penalty of 25% is required to be paid to make an appeal application under section 107 of the CGST Act. Both conveyances in transit and seizure & detention of goods are now a separate proceeding under Section 74 from the recovery of tax.

- Under section 75, the self-assessed tax with reference to the CGST Act shall also include the sales or outward supplies as described in GSTR-1 in section 37 under the CGST Act but that which has been missed during reporting under GSTR-3B in section 39.

- The validity of provisional attachment shall remain for the whole period which shall start from the beginning of any proceeding and continue till the expiry period of one year from the order date made hereunder.

What are Offences under GST?

Offences under GST mean a breach of the provisions of GST Act and GST rules under GST law. In other meaning, an offence is a breach of law or rule that amounts to an illegal act. Following are 2 offences that come under the Offences and penalties under GST –

Offences under GST by Individual Taxpayer

There are total 21 offences under GST and has been grouped as given below:

- Tax Evasion

- The taxpayer collects any GST but does not submit it to the government within 3 months

- Even if the taxpayer collects any GST in contravention with provisions then the taxpayer has to deposit it to the government within the period of 3 months. Furthermore, if in case, the taxpayer fails to do so then it will amount to an offence under GST.

- The taxpayer obtains a refund of any CGST/SGST by the manes of fraud.

- If taxpayer utilizes any input tax credit without the actual receipt of goods or services.

- If the taxpayer deliberately suppresses his sales to evade tax

2. Wrong invoices or Fake invoices

- If a taxpayer without any invoices or issues a false invoice supplies any goods or services.

- If issues any invoice or bill without the actual supply of goods or services amounting to the violation of the provisions of the GST

- If issues any invoice with wrong identity or user identification number of any innocent taxable person

3. Fraud

- If the taxpayer submits any false information while registering under GST it comes under Offences under GST.

- If submits any fake financial records or documents or fake files returns to evade the tax

- If it does not provide the required information or gives only false information during the proceedings

4. Transport of goods or supply of goods

- If the taxpayer transport goods without proper documents.

- If taxpayer deliberately supplies or transport of goods that he knows will get confiscated.

- If the taxpayer destroys or tampers any goods which have been seized earlier

5. Others offences under GST

From above-mentioned offences under GST, their other offences that to also fall under Offences under GST –

- If the taxpayer is not registered under GST although he is required to by law.

- If he does not deduct TDS or Deducts TDS in very less amount where applicable.

- If he does not collect any TCS or collects less amount where applicable.

- In the case of Input Service Distributor, he takes or distributes input tax credit in violation of the rules.

- If he obstructs the proper officer during his duty.

- If he does not maintain all the books that are required to be maintained by law.

- If he destroys any evidence with all conscious.

Also, Read: Impact of GST on Tourism Industry.

Offences under GST by Companies, LLPs and HUFs and Others

For any above said offences under GST committed by a company, both the officer in charge or director or manager or secretary as well as the company will be held liable for it. In addition to this, LLPs, HUFs, Trust, or the partner/Karta/managing trustee will be held liable.

For the above-discussed offences the penalty will be 100% starting with the minimum amount of RS 10000.

Penalties under GST

As we have discussed the offences under GST[1], the other thing that needs the explanation is the Penalties under GST. So, firstly, let us know what we mean by penalty.

The literal meaning of penalty is not defined under GST so in that case, it takes the meaning from the judicial pronouncement and principles of the jurisprudence. Penalties can be corporal or pecuniary, civil or criminal.

If any offence is committed in the GST then the penalty is definitely going too imposed according to the GST act. The principles on which these penalties are based are clearly determined by the law.

Not only this, if any person other than the taxable person is caught by doing any of the following activity then he will have to pay a penalty exceeding up to Rs 25000-

- If he found helping any person to commit fraud under GST.

- Acquires or receives any goods or services with complete knowledge that amounts to violation of GST rules.

- If he fails to appear before the tax authority on receiving the summons

- If he fails to issue an invoice according to the GST rules

- If he fails to account/vouch any invoice appearing the books

General Rules regarding Penalty in offences

The general rules regarding penalty are the same in all laws whether we talk about tax laws or contract laws or any other law.

1. No penalty for a minor breach

Many times, a person makes mistakes that may appear as fraud or an attempt to evade tax. But the fact is that sometimes these mistakes are committed unknowingly or without any malicious intention. And the reason could be anything like a poor understanding of tax laws or carelessness in procedures.

Therefore, to save innocent persons from the complexity of penalties or associated processes, the model of GST law has laid down some guidelines:

- If the error in taxes is Rs. 5,000 or less, then the breach should be considered minor & no penalty should be imposed.

- If the mistake committed by the person is easily rectifiable, then the breach should be considered minor & no penalty should be imposed.

2. Penalty should be aligned with the severity of the breach

Now, theseverity of the breach of law is established by analyzing the facts and the situation and after that, the penalty should be imposed accordingly.

3. The reason behind the penalty should be disclosed

Model GST law asks the tax authorities to ensure that the person on whom the penalty is to be paid and has been provided all the relevant information before being penalized. Similarly, the concerned person should be informed of why he is being penalized.

4. Lower penalty on voluntary disclosure of the breach

Penal provisions of model GST law are lenient for those who voluntarily disclose the breach they committed. Amount of Penalty as per GST law

- If an offender commits an offence that results in tax evasion will be punished with a penalty higher than the amount of tax evaded under section 66(1).

- In case a person pays insufficient tax then he can be penalized with amount Rs 10000 or 10% of tax deficit whichever is higher under section 66(2).

Amount of penalty where no separate penalty has been defined

- if a person commits any of the offence for which a separate penalty has not been defined then in that case the quantum of penalty will go high as Rs 25000 as per section 67.

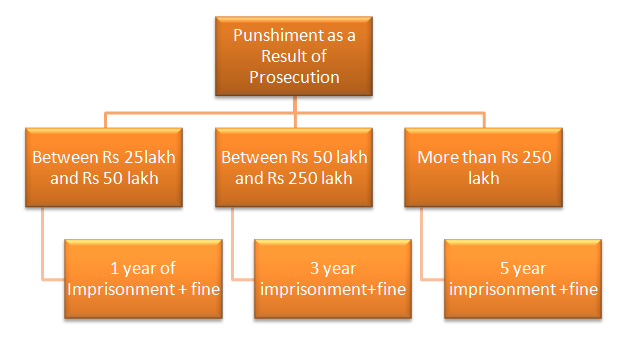

Punishment as a Result of Prosecution

Under section 73(1), if the person is convicted for any offence then he shall be punishable with a penalty as under the following-

Also, Read: Are You Aware Of The Liabilities In GST In Case Of Death And Dissolution?.

Minimum amount of Punishment in result of prosecution

| Types of offences under GST | Action |

| Penalty for incorrect type of GST charged | No penalty. Pay the correct and get the refund of the wrong type of GST paid earlier |

| Penalty for incorrect filing of GSTR | No penalty. But interest @18% on shortfall amount |

| Penalty for delay in payment of invoice | ITC will be reversed if not paid within 6 months. No penalty as such |

| Penalty for wrongfully charging GST Rate- charging lower rate | Interest @18% applicable on the shortfall |

In the absence

of special grounds to the contrary to be recorded in a judgment of the court,

the act provides that the term of imprisonment shall not be for a period of six

months.

Situation when there is no penalty but interest may apply

Conclusion

Hence, it is advisable to all the taxpayer to duly file GST Return and avoid offences and penalties under GST.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty