Overview of Branch Office Registration

India is among the world's largest consumer markets and top global economy. The fact that India is a fast-paced developing economy makes it an attractive destination for corporates all around the globe to invest and have commercial ventures in India. Hence, we see a growing number of foreign corporates have their branch office registration in India. The purpose of opening such a branch is to expand their business interests in India.

The Reserve Bank of India is the approval authority for registration of branch office. The establishment of the branch office is regulated under Section 6(6) of the Foreign Exchange and Management Act 1999. In addition, the RBI master direction prescribes the rules regarding governance, competitive authorities, and reporting requirements.

The branch office registration gives a foreign company the right to operate as a legal business entity in India. The branch office can carry out similar business activities as conducted by the parent company in their homeland.

Though, when it comes to manufacturing activities, BO is restricted. For example, a branch office cannot conduct manufacturing activities directly though it can sub-contract these activities to an Indian manufacturer.

Eligibility Criteria

For Setting up Branch Office in India, the company must fall under the Following Criteria:

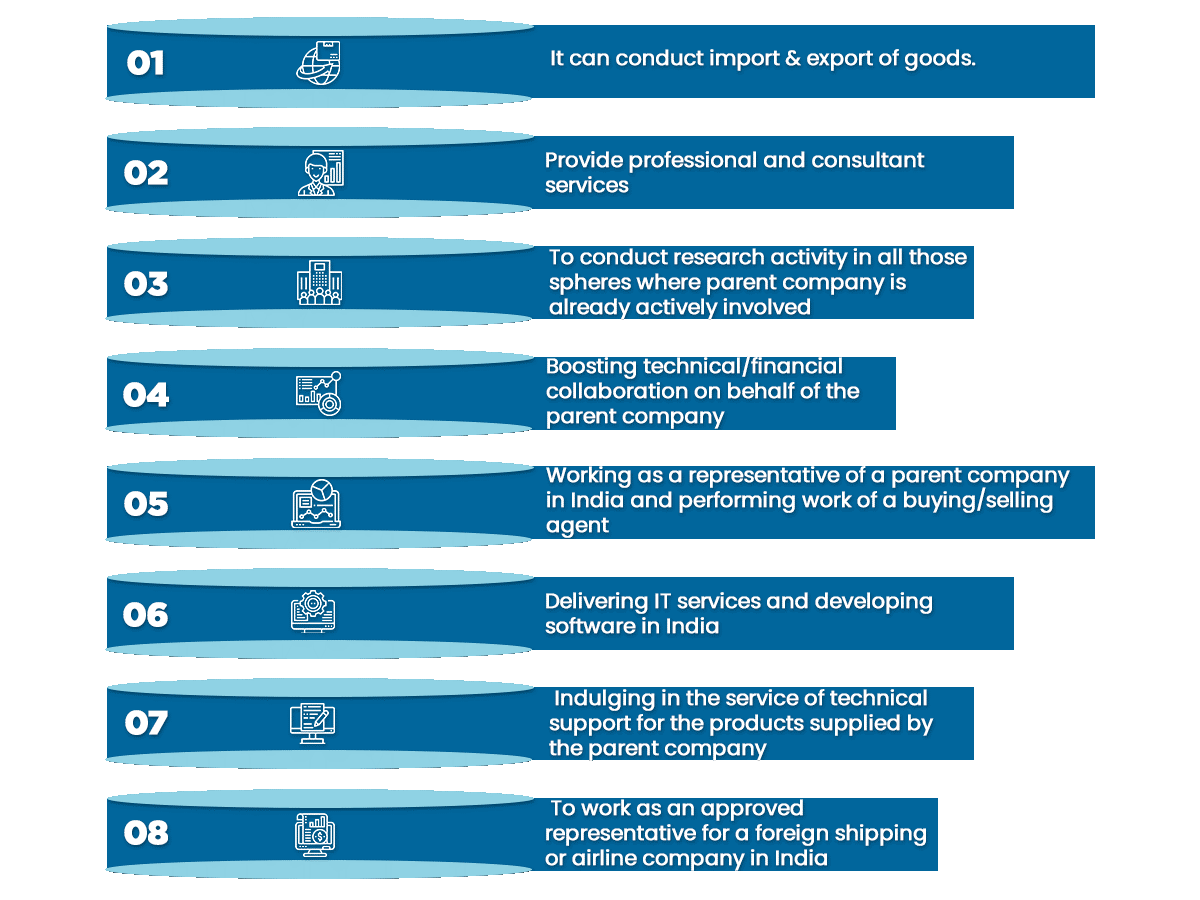

Prescribed Activities of Branch Office in India

Points to Consider for Branch Office setup in India

The name of the Branch Office must be similar to that of the parent company. Below is the list of other crucial facts that one should keep in mind before applying for branch office registration:

Net Worth Requirement

A foreign parent company must have a beneficial track record of the past five working years in a row with a net worth of more than $ 1 00,000 aptly mentioned in the financial statement.

Profit Remittance Allowed

The amount of profit earned by the branch office can be remitted from India to the parent company once all taxes are cleared, and an audit of all books of accounts is done.

Name of Branch Office

A branch office must share the same name as a parent company.

Taxation in India

The income tax applicable on the profits of the branch office of the foreign parent company in India is 40%, surcharges are also applicable. GST is imposed on the supply of goods and services.

Registration timelines

The estimated timeline is 3 to 4 weeks. However, it can vary from case to case.

Annual filing

The branch office is expected to be compliant with the filing requirements of the Ministry of Corporate Affairs, ROC, and Income tax department.

Book a Free Consultation

Get response within 24 hours

List of Documents Required for Branch Office Registration

Exact and accurate paper works plays a crucial role in the process of Branch Office registration. Therefore, Documents have to be latest and eligible.

Documents Required From Parent Company

Documents Required For the Office Address Registration

Drafting of Government Forms and Documents

On receiving the complete set of authentic Documents, the next step is to draft the following Documents for the signature purpose by the applicant company and the authorized signatory.

Branch Office Registration Process in India

Filing Of Application With RBI Through AD Bank

Branch office application for a foreign company is filed in FNC. The application is filed to the Reserve Bank of India via AD Bank (Authorised Dealer Category 1 prescribed by RBI). The AD bank has an important role since all the communication to the RBI is dispelled through them.

Prior Approval from RBI in special cases

The AD bank needs prior approval in special cases mentioned by the RBI. The entities whose principal business activity falls in sectors where 100% FDI is allowed get the automatic route,

The cases where prior approval is needed by the bank ;

1. The applicant company is registered/incorporated, or an applicant is a citizen of Pakistan,Afghanistan, Iran, China, Bangladesh, Sri Lanka, Hong Kong, or Macau, and the application is for opening a BO/LO/PO in North East region, Jammu and Kashmir, and Andaman and Nicobar Islands;

2. The principal business activity falls in the four sectors, namely Telecom, Private Security, Defence and Information and Broadcasting.

3. The applicant is an NGO.

Verification Of KYC From Banker Of Parent Company

A request about the scrutiny of Documents is sent to the foreign company's banker. This process of sending a request for verification is also called swift-based verification. Once the Documents are confirmed by the foreign banker, the application is preceded for approval purposes. The RBI/AD can also ask for the additional Documents as the case may be.

Approval Of RBI For Branch Office Registration In India

A specific policy is followed for approving the branch office in India by the AD Banker itself. Priority is given to the cases where the automatic route is not available.

Registration Of Branch Office With ROC

Once the approval is received from RBI to establish Branch Office in India, an application is filed in form FC-1 for branch office registration of the foreign company within 30 days of such approval. DIN is required in case of Indian director in board and the digital signature are needed of the authorized signatory for e-filing statutory forms with the ROC.

PAN Card, Tax Deduction Number, And Bank Account Opening

The income tax department of India issues a unique 10 digit number, known as PAN number. Once the PAN number is obtained, the branch office is eligible to open its bank account. And it is necessary for every taxpayer to obtain a Tax Deduction Account Number to obey all the TDS norms.

GST Registration & IEC

On obtaining Bank Account and cheque book, the need arises for a copy of the check to apply GST registration and Import Export Code.

Frequently Asked Questions

A foreign company can open a branch office in India if it has a reputation of profit generation for as far back as five years and having sufficient capital resources. A budget summary properly verified by the legal inspector of the parent organization is required.

- Pakistan

- Bangladesh

- Sri Lanka

- Afghanistan

- Iran

- China

- Hong Kong

- Macau

- Or any kind of application for opening a branch office in Jammu and Kashmir, North-East Region, and Andaman and the Nicobar Islands.

The rate of taxation is 40% exclusive of cess.

- It can conduct import & export of goods

- Provide professional and consultant services

- To conduct research activity in all those spheres where the parent company is already actively involved.

- Boosting technical/financial collaboration on behalf of the parent company

- Working as a representative of a parent company in India and performing work of a buying/selling agent

- Delivering IT services and developing software in India

- Indulging in the service of technical support for the products supplied by the parent company

- To work as an approved representative for a foreign shipping or airline company in India

The net worth of the foreign parent company should be above $ 1,00,000

The company must have a profitability track record of the past five years.

- Net Worth Requirement

- Profit Remittance Allowed

- Name of Branch Office

- Taxation in India

A branch office is an extended work premise of the business other than the head office. Most big corporations divide their workforce into branch workplaces. This comprise little divisions of various parts of the organization, such as HR, advertising, and accounting.

A Branch office is a progressively autonomous substance that conducts business in its name yet acts on behalf of the organization. A Branch isn't lawfully independent from the remote parent organization as it is likewise dependent upon the local laws administering the outside parent organization.

On receiving the complete set of authentic Documents, the next step is to draft the following Documents for the signature purpose by the applicant company and the authorized signatory.

- Board Resolution allowing the starting of a branch office in India

- A declaration was given by the applicant on the eligibility of FDI and source of fund

- A declaration regarding the nature of the activity that the business will conduct, the location of the activity of the proposed BO

- A declaration regarding the nature of business activity along with the location of registered business premises.

- Form FNC

- A letter of comfort from the holding company