Overview of Mergers and Acquisitions

Strategies of Mergers and Acquisitions are globally adopted by the companies to excel in this competitive business environment. Mergers and Acquisitions are also known as M&A in acronyms.

A merger can be defined as the collaboration of two or more companies to form a new company in an expanded form. Here, one company will cease to exist, and the other company will absorb the former. For example, Company A merges with Company B to form a bigger company A, and company B ceases to exist.

Acquisition, on the other hand, is defined as a process of selling one company to another. Example Company A acquires company B. Both these entities exist but control of management is in the hands of company A for both companies.

In amalgamation, both the company cease to exist and a new company (the new name would be given) raises out. Company A and B form a new company C and cease to exist individually.

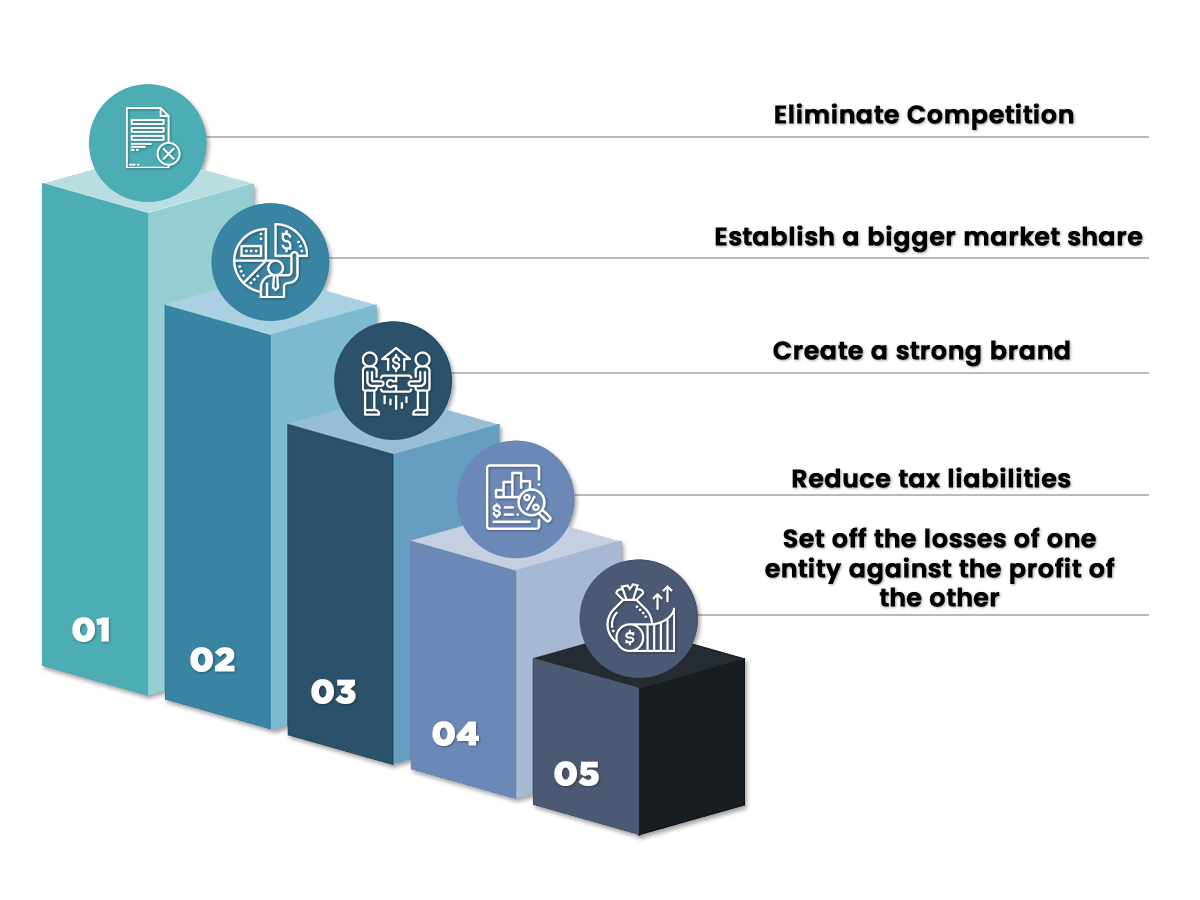

The reason behind Mergers and Acquisitions

Merger and Acquisition are fundamental tools that are considered by organizations to flare their business around the globe and furthermore to render sustainable development for business. Subsequently, coming up next is the reason behind the prevalent practice of mergers & acquisitions.

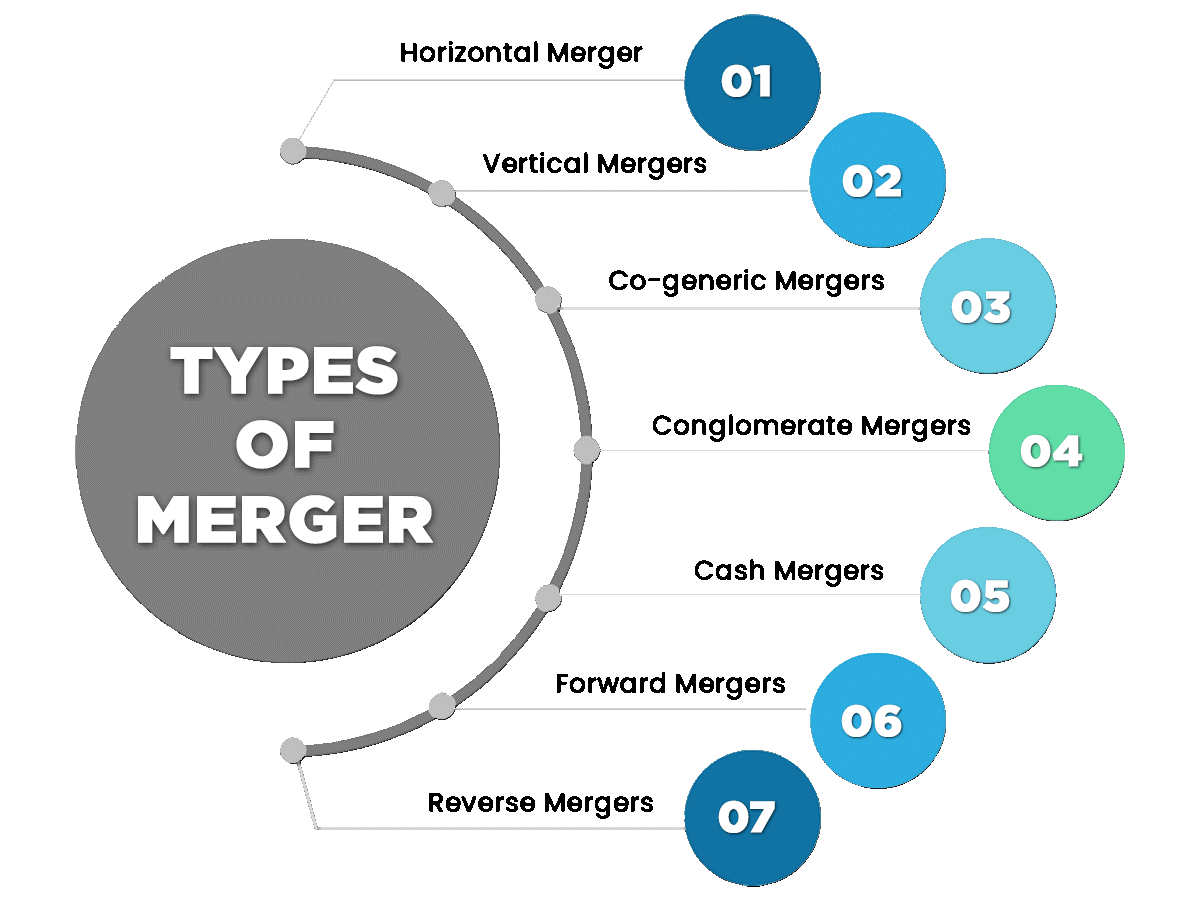

Types of Merger & Acquisition in India

Merger

- Horizontal Merger

A merger between two companies who deal in the same product or services

- Vertical Mergers

This type of merger happens between those entities who are involved in the dealing of complementary goods and services.

- Co-Generic Mergers

A merger between two parties that are somehow related to each other

- Conglomerate Mergers

A merger between organizations that deal in different types of business

- Cash Mergers

A kind of merger where shareholders get cash instead of shares of the merged entity

- Forward Mergers

When an organization decides to merge with its buyers

- Reverse Mergers

When an entity decided to merge with its suppliers of raw material

Acquisition

The acquisition is also known as the takeover that includes selling and buying of entire business between the included entities. An acquisition can happen in either a friendly manner or a hostile manner.

There are two ways to do so. It can be done by either acquiring the assets and liabilities of the target company or buying the shares of the target company.

Joint Ventures

At the point when at least two companies meet up for a characterized reason – it could be entering another market or another business, or for a particular ability, that adjoining is known as the Joint Venture. It could be for a restricted period or for an unlimited term.

Book a Free Consultation

Get response within 24 hours

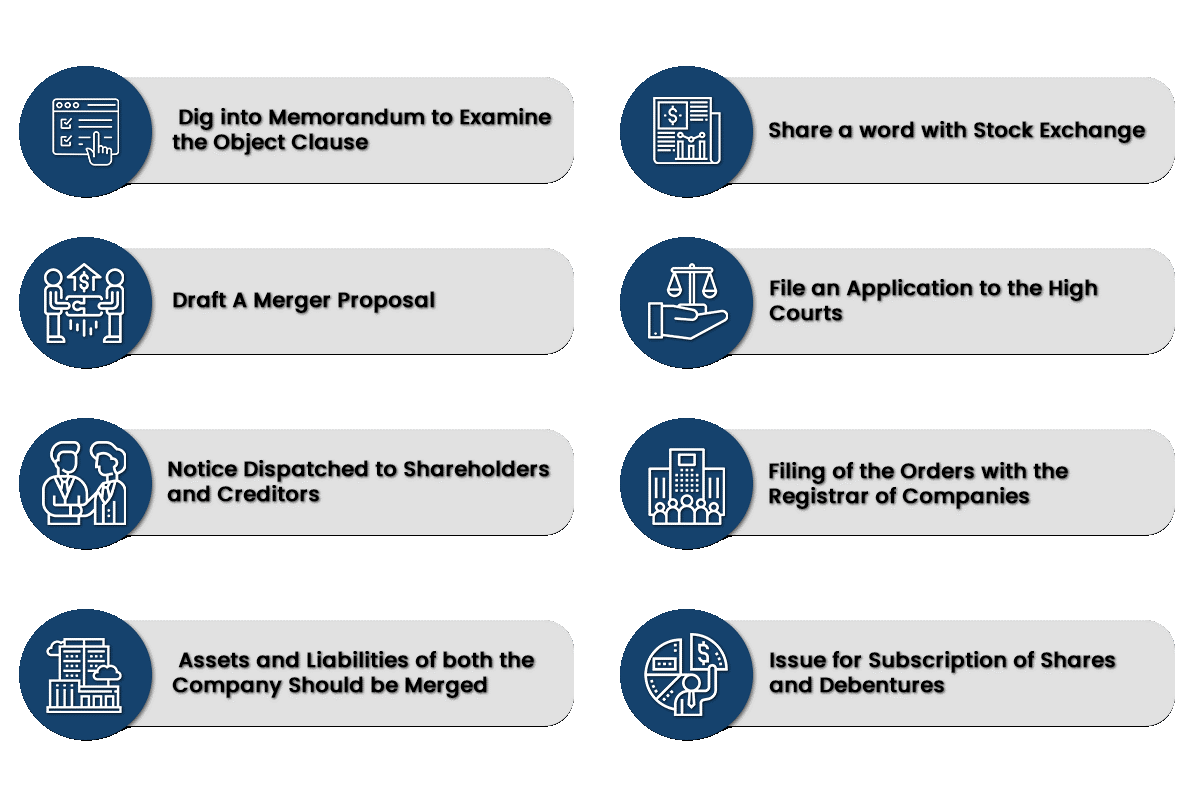

Process of Mergers & Acquisitions in India

Companies Act 2013 defines the whole process of mergers and Acquisitions in India. During the process of mergers and acquisitions, analysis of the companies is done, which includes accessing the company's information, going through its insights, and coming to a conclusion regarding implementing the process of mergers and acquisitions.

Effective and complete execution of mergers and acquisition process includes technique which is structured with the aim to maximize the profit and minimize the level of risk.

Steps To Follow While Going Through Mergers and Acquisition in India

Dig into Memorandum to Examine the Object Clause

The primary and paramount thing to do while going for M&A in India is to scrutinize the memorandum of association of the company with the purpose of carrying a search and check whether the power of the merger is endowed in it or not.

Share a Word with Stock Exchange

It is a good idea to illuminate the stock exchange about the proposed merger and Acquisition occurring and send all the relevant Documents such as notices, resolutions, and orders to the stock exchange within a stipulated time.

Draft a Merger Proposal

The Board of the Director of both the organizations will introduce an affirmation on the draft of the merger proposition and furthermore pass the resolution for approving its key administrative staff and different administrators to further pursue the issue.

File an Application to The High Courts

In the wake of getting the affirmation on a proposal by the Board of the Director, the merger organizations should record an application to the Hon'ble High court of the individual state where the organizations headquarter is situated.

Notice Dispatched to Shareholders and Creditors

With the earlier approval of the High court, a notification ought to be sent to all the investors and creditors of the organizations about the gathering to be held, and 21 days of timely notification is required. The notification will be distributed in two papers, one in the vernacular language of the state, and the other one is an English paper.

Filing of the Orders with The Registrar of Companies

The genuine confirmed copy of the request for the High Court of the state must be necessary papered with the registrar of companies within the limited time period as indicated by the High Court.

Assets And Liabilities of Both the Company Should be Merged

The assets and the liabilities of both the organization ought to be passed on to the blended organization.

Issue for Subscription of Shares and Debentures

When the merged organizations go to the present as a different lawful substance, then the organization can give offers and debentures after listing on the stock exchange.

Need of M&A Advisory Services

Mergers and Acquisitions are an incredible way to accomplish development for an organization yet include complex steps and procedures to be trailed by the involved companies to shape the new business.

The Companies Act, 2013 should be followed for M&A to traverse, with inclusion from Court, SEBI (Securities Exchange Board of India) in the event of listed organizations, the Central Government as an Official Liquidator (OL), and the Regional Director of the Ministry of Corporate Affairs and so on. Since there are various parties involved, the procedure is for quite some time drawn, monotonous, and on occasion problematic.

Consequently, it is insightful to counsel an expert for the merger and Acquisition or to take mergers and acquisitions advisory administrations as the procedure includes rigid ramifications of laws and rules and contradicting which, makes an issue in future.

There are various Mergers and Acquisitions advisory firms that control their customers through this change procedure, including complicated financial, legitimate, and accounting issues.

Mergers and Acquisitions Services Provided By Different Firms

Frequently Asked Questions

- Eliminate Competition

- Establish a bigger market share

- Create a strong brand

- Reduce tax liabilities

- Set off the losses of one entity against the profit of the other

- Horizontal Merger

- Vertical Mergers

- Co-generic Mergers

- Conglomerate Mergers

- Cash Mergers

- Forward Mergers

Mergers and acquisitions occur for some, key business reasons, however the most widely recognized explanations behind any business mix are monetary at their centre. Increasing a competitive advantage or bigger piece of the overall industry. Companies may choose to merge into request to increase a superior distribution or advertising system.

Also, from the getting organization's point of view, it's very normal for the business focal points they looked for – a mix of access to new items, access to new markets or geographies, piece of the overall industry expands, development quicker than natural development, and additionally economies of scale –simply fail to materialize.

A merger happens when an organization finds an advantage in joining business tasks with another organization such that will add to increased shareholder value.

As indicated by examined inquire about and an ongoing Harvard Business Review report, the failure rate for mergers and acquisitions (M&A) sits between 70 percent and 90 percent.

Mergers and acquisitions (M&A) are mind boggling business exchanges with much on the line. If a merger or Acquisition isn't effective, a business can lose considerable resources.

Acquisition is also known as the takeover that includes selling and buying of entire business between the included entities. Acquisition can happen in either friendly manner or hostile manner. Well, it involves the process of either acquiring the assets and liabilities of the target company or buying the shares of the target company. A demerger is likewise a type of Acquisition where a solitary element is divided into at least two elements.

At the point when at least two substances meet up for a characterized reason – it could be entering another market or another business or for a particular ability, that abutting is known as the Joint Venture. It could be for a restricted period or for a boundless term.

- Dig Into Memorandum To Examine The Object Clause

The primary and paramount thing to do while going for M&A in India is to scrutinize the memorandum of association of the company with the purpose to carry a search and check whether the power of merger is endowed in it or not.

- Share A Word With Stock Exchange

It is a good idea to illuminate the stock exchange about the proposed merger and Acquisition occurring and send all the relevant Documents such as notices, resolutions, and the orders to the stock exchange within a stipulated time.

- Draft A Merger Proposal

The Board of the Director of both the organizations will introduce an affirmation on the draft of the merger proposition and furthermore pass the goals for approving its key administrative staff and different administrators to additionally seek after the issue.

- Draft A Merger Proposal

The Board of the Director of both the organizations will introduce an affirmation on the draft of the merger proposition and furthermore pass the resolution for approving its key administrative staff and different administrators to further pursue the issue.

- File An Application To The High Courts

In the wake of getting the affirmation on a proposal by the Board of the Director, the merger organizations should record an application to the Hon'ble High court of the individual state where the organization’s headquarter is situated.

- Notice Dispatched To Shareholders And Creditors

With the earlier approval of the High court, a notification ought to be sent to all the investor and creditors of the organizations about the gathering to be held and 21 days timely notification is required.

The notification will be distributed in two papers one in the vernacular language of the state and the other one is an English paper.

- Filing Of The Orders With The Registrar Of Companies

The genuine confirmed copy of the request for the High Court of the state must be Documented with the registrar of companies within the limited time period as indicated by the High Court.

- Assets And Liabilities Of Both The Company Should Be Merged

The assets and the liabilities of both the organization ought to be passed on to the blended organization.

- Issue For Subscription Of Shares And Debentures

When the merged organizations go to the presence as a different lawful substance then the organization can give offers and debentures after listing on stock exchange.