Overview of Insurance Web Aggregator License

The web aggregator is the Insurance Intermediary keeping up a site which gives interface to the Insurance possibilities for value correlation and data of products of various insurers and other related issues. The Insurance Web Aggregator License is issued by the IRDAI.

The functions of the Web Aggregators are administered by Insurance Regulatory and Development Authority of India (Insurance Web Aggregators) Regulations, 2017.

Important Terminology

Authorized Verifier

The individual working under the web aggregator or insurance or a Tele-advertiser with the end goal of insurance sales and acquisition through Telemarketing and Distance Marketing mode and who has experienced preparing and breezed through the examination as determined by the IRDAI;

Distance Marketing

It alludes to the procedure of the offer of insurance items without the physical presence of the client, and the procedure is cultivated through phone or Short Messaging Service (SMS) or email or other Internet or web administrations;

Key Management Personnel

Under these guidelines, the KMP implies Chief Executive Officer (CEO), Chief Operating Officer(COO), Chief Marketing Officer (CMO), Chief Financial Officer (CFO), Head - Technical, Head – IT;

Lead

It talks about the data identifying with an individual who has accessed the site of an Insurance Web Aggregator and has presented certain contact data at getting data on costs or features or benefits of different insurance items;

Lead Management System

In this process, the registered insurance web aggregator implements the software for activities like recording, filtering, validating, grading, distribution, follow up and and conclusion of leads from the enquiries got on the site of the Insurance Web Aggregator;

Principal Officer

He/She is the individual liable for the general working of the web aggregator and might be a Director/Shareholder/Promoter and so on.

Book a Free Consultation

Get response within 24 hours

Eligibility Criteria for Certificate of Registration of the Insurance Web Aggregator License

Conditions on which License is Issued

Capital Requirements

Net Worth Requirements

Application for the grant of registration as Web Aggregator

Process for Grant of Registration

Renewal of the Registration

Scope of Activities of an Insurance Web Aggregator

The protection web aggregator, holding a substantial certificate of registration, will convey at least one of the accompanying exercises:

Remuneration Earned by Insurance Web Aggregator

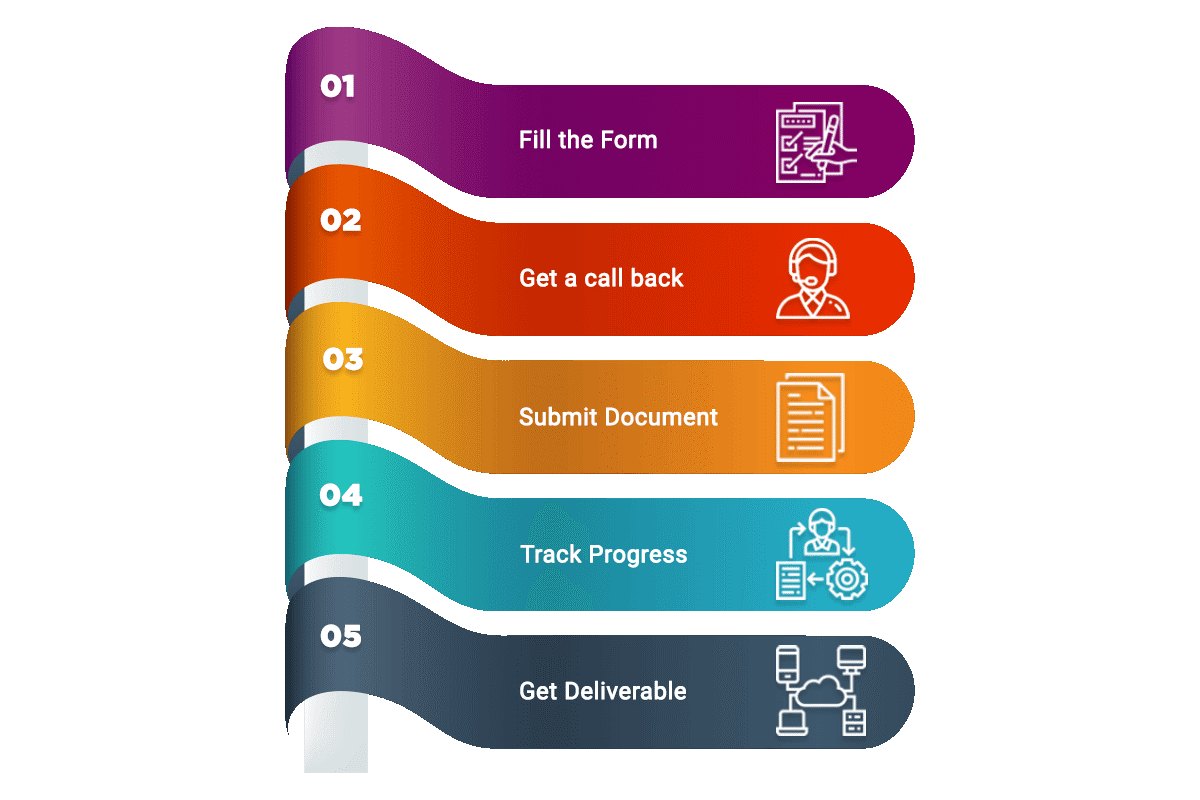

How Corpbiz will help you?

Frequently Asked Questions

The activities of the web aggregator incorporate furnishing the possibilities with various protection approaches to browse as per their prerequisites. Then again, the obligation of the Insurance Broker incorporates proposing the best protection item relying on the money related and different parts of the possibilities.

Truly, the candidate will prepare a working site while making the groundwork for the site. It is additionally required to present the review report of the site known as CISA Report guaranteed by approved experts for this reason.

The Certificate of enrolment is legitimate for a time of three years from the date of enlistment gave it isn't dropped or suspended by the expert on any grounds.

Truly, the COR can be given up gave the equivalent has been endorsed by the power dependent on the benefits of the cases and fundamental records and data is submitted for give up of authentication of enlistment is as Form Y.

- No expenses will be chargeable for transmission of leads from protection web aggregator to safety net provider;

- A level charge of not surpassing Fifty thousand every year towards every item showed by the Insurance Web Aggregator in the examination outlines of its web is payable to him.

- Some other charges as represented by the Authority

The application looking for the grant of registration as Insurance web aggregators will be dismissed by the Authority on the accompanying grounds:

- Fragmented or unauthentic data;

- Inability to furnish the data asked by the Authority within 30 days of the receipt of the data. In such case, the application will be considered as non-accommodation as it were.

- The Insurance Web Aggregator License company is indulged in the request of the insurance products as provided in the law;

- All the elements that are registered as web insurance aggregator must adhere to all the rules and regulations, notifications and information gave by the authority;

- Any huge change in the material data gave to the authority will be timely reported;

- A mechanism for proper redressal of clients’ complaints is present. The grievances are heard within 14 days of receiving the complaint.

- A satisfactory system is available for properly maintaining of the records of the insurance policies solicited;

- A legitimate consistence set of principles will be given by the web aggregators to their Directors, Promoters, Shareholders and so forth.

- Any candidate looking for enlistment under IRDA (Web Aggregator) Regulations, 2017 will entertain the net worth total assets/settled up capital of INR twenty-five lakhs.

- If the proposed Insurance Web Aggregator is an organization enrolled under Companies Act, 2013, the capital will be given and bought in as Equity Shares.

- If there should arise an occurrence of LLP, the commitment of partners will be in the form of money;

- The shares will not be swore in any form or way to make sure about credit or some other office and will be unhampered at all the occasions.

The protection web aggregator, holding a substantial certificate of registration, will convey at least one of the accompanying exercises:

- Show of item correlations on the site;

- Transmission of prompts the back up plans ;

- Offer of the protection on the web;

- Offer of the protection by telemarketing mode or some other computerized advertising mode.

- Once the certificate of registration is issued, the total assets of an Insurance Web Aggregator will at no time fall beneath 100 % of the minimum capital prerequisites;

- The status of its total assets will be looked into by each Insurance Web Aggregator each half year as at 30th September, and 31st March each year.

- A net worth certificate properly confirmed by a Chartered Accountant will be submitted to the Authority every year after conclusion of books of records.