Housing Finance Company Registration

Housing Finance Company is a sort of NBFC that is principally indulged in the business of constructing houses and financing acquisition that includes the improving of plots from the building of new houses. It is compulsory for a Housing Finance Company to have a housing finance business or a business of offering housing finance as its primary objective in the Memorandum of Association (MOA). Further, it shall be noted that only the National Housing Bank (NHB) has the utmost authority to grant Housing Finance Company Registration.

Concept of National Housing Bank

The term NHB or National Housing Bank means the apex financial institution for dealing in housing finance. It has been established with an aim to function as a principal agency to encourage and promote housing finance institutions, both at regional and ground levels. Further, this institution also works to provide financial and other assistance incidental to such financial institutions and for the matters connected therewith.

All the Housing Finance Companies are governed and regulated by the National Housing Bank. It is mandatory for every HFC to acquire a Certificate of Registration (COR) from the National Housing Bank. That means the Registration Certificate plays a significant for an HFC to start its business operations and activities concerning Housing Finance.

Further, based on the guidelines specified in the National Housing Bank Act 1987, if any housing finance company has not obtained the Certificate of Registration but is carrying out the operations and activities of housing finance, then, in that case, the same will be liable to for the levy of hefty penalties.

It shall be taken into consideration that a Registration Certificate is issued by the National Housing Bank based on the prescribed classifications of Housing Finance Companies. The term prescribed classification is bifurcated in terms of types of liabilities, such as National Housing Bank, into non-deposit and deposit accepting Housing Finance Companies.

Role of National Housing Bank

National Housing Bank or NHB plays a pivotal role in the development and growth of the housing finance sector. Also, it shall be noted that the “Indian Housing Finance Sector” is termed to be entering the 2nd phase of its growth and development in terms of mixing with the capital and debt markets. The reason behind the same is that the National Housing Bank has placed an operative system of responsive regulation for maintaining credibility, stability, and reliability in terms of resource development, policy, and building of the Indian housing finance sector.

Benefits of Housing Finance Company Registration

The key benefits of the Housing Finance Company Registration are as follows:

Offers Housing Loans to Individuals

The main reason behind the registration of such companies is to offer housing loans to individuals that, too, at affordable rates.

Offers Housing Loans to Company

The main reason behind the registration of such companies is to offer housing loans to companies that, too, at affordable rates so that they can lease out the premises to their employee.

Redevelopment

The main reason behind the registration of such companies is to carry out redevelopment activities, such as the development and betterment of slums and rural areas.

Book a Free Consultation

Get response within 24 hours

Eligibility Criteria for Obtaining Housing Finance Company Registration

Based on the provisions of section 29A of the National Housing Bank Act 1987, no Housing Finance Company shall start to carry out its operations of providing housing loans unless the same had met all the accompanying guidelines.

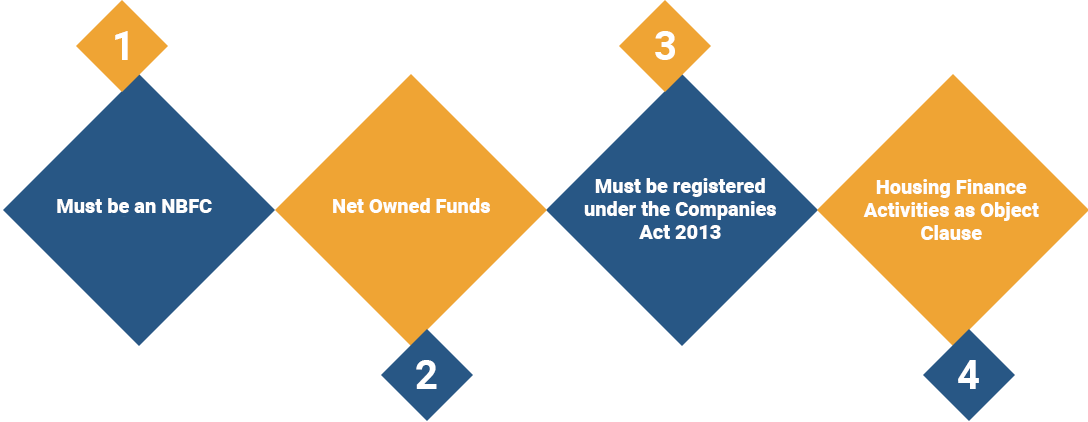

The following list is the eligibility criterion that has to be considered for obtaining the Housing Finance Company Registration:

Must be an NBFC

The business entity that wants to operate as a Housing Finance Company must acquire registration as the Non-Banking Financial Company from the Apex Bank, i.e., RBI.

Net Owned Funds

It shall be noted that the Net owned fund of a Housing Finance Company must be at least Rs 20 Crores. Therefore, an applicant needs to satisfy the requirements of net worth for obtaining Housing Finance Company Registration.

Must be registered under the Companies Act 2013

The said Company requires to satisfy the requirements of a private limited company under the provisions of the Companies Act 2013 or the Companies Act 1956.

Housing Finance Activities as Object Clause

It is the last but the most important requirement of all that the objects of this type of company must mention for financing housing loans and other commercial complexes. Besides providing finance, the said company must also have the predictions of earning.

The management and operations of the company must act in good faith and in the interest of the public and other consumers. That means they need to work in the interests of the public.

Different Regulatory Bodies Operating in India Housing Sector

The different regulatory bodies operating in Indian Housing Sector are as follows:

Further, for the purpose of such financing companies, the NHB (National Housing Bank) has set up certain guidelines in terms of the following:

Also, it shall be noted that to follow the housing finance sector of India, there is a necessity of management between the Reserve Bank of India, National Housing Bank, and the Government. The main function of the National Housing Bank is to regulate the lending process of Housing Finance Companies. In contrast, the main role of the Reserve Bank of India is to advance funds to these Housing Finance Companies.

Basic Conditions for Granting the HFC Registration

Based on the provisions of the section 29A subsection (4) of the National Housing Bank 1987, the basic conditions that are to be fulfilled for the issuance of HFC Registration are as follows:

Documents required for obtaining Housing Finance Company Registration

The Documents required for obtaining Housing Finance Company Registration in India are as follows:

Procedure for Obtaining the Housing Finance Company Registration

The stages involved in the procedure for obtaining the Housing Finance Company Registration are as follows:

Download the Application for Registration

In the first step of the process for obtaining Housing Finance Company Registration, the applicant is required to download the application form from the official website of the National Housing Bank at nhb.org.in.

Attach all the Documents with Application

Now, in the next step, the applicant company needs to attach all the pertinent Documents together with the application form.

Also, it needs to annex the demand draft in favour of the National Housing Bank. The same is required to be submitted to the Head Office of the National Housing Bank.

Checking of Authenticity

Further, the officials of the National Housing Bank will check the authenticity and legitimacy of the Documents and application submitted by the applicant.

Issuance of Housing Finance Company Registration

After being satisfied with the Documents, annexures, and application form submitted, the National Housing Bank will grant the Certificate of Registration to the applicant company. The same will act as the proof for the Housing Finance Company Registration.

Situations Leading to the Cancellation of Housing Finance Company Registration

The situations that lead to the cancellation of Housing Finance Company Registrations are as follows:

Post Registration Compliances for Housing Finance Company

The post registration compliances for a Housing Finance Company are as follows:

Mandatory Compliances for Housing Finance Company

The mandatory compliances for a Housing Finance Company are as follows:

Difference between Housing Finance Company and Banks

Activities and operations of both the Banks and Housing Finance Company are involved in making the investments, deposits, and advancing, however, there are some differences between them, the same are stated as follows:

Frequently Asked Questions

The Housing Finance Company is a sort of Non-Banking Financial Company (NBFC) which is involved in the vital business of "financing of obtaining or development of houses". For the most part, Housing Finance Companies are those kinds of organizations who have the primary object of conveying business of giving money for housing whether straightforwardly or in a roundabout way. They are controlled by the National Housing Bank (NHB).

Housing Finance Companies, Merchant Banking Companies, Stock Exchanges, Companies engaged in the business of stock-broking/sub-broking, Venture Capital Fund Companies, Nidhi Companies, Insurance companies and Chit Fund Companies are NBFCs but they have been exempted from the requirement of registration under Section 45.

With the aim to materialize this sector there is a need to conduct synchronization between the Government, Reserve Bank of India (RBI) and National Housing Bank (NHB).

- RBI regulates – lending to the housing by Banks

- NHB regulates - lending to the housing by HFCs

The housing finance sector growth has slowed down in the last one year due to liquidity crunch. In case the liquidity situation does not improve, HFCs may start seeing stress in the commercial real estate segment. The housing finance sector growth has slowed down in the last one year due to liquidity crunch.

That decision depends on the lender's assessment of the creditworthiness of the person or entity who is attempting to borrow money. However, yes — in general — a business can get a mortgage just like anything else. Getting a loan (even a mortgage — no difference) is legal; it would not be a problem, legally.