The 42nd GST Council meeting held under the supervision of honorable finance minister Smt Nirmala Sitharaman via video conferencing. The other attendances in the meeting were Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur and other officers of States/UT and ministry of finance.

Read our article:GST Can’t be Imposed on Services Provided By Court Receiver

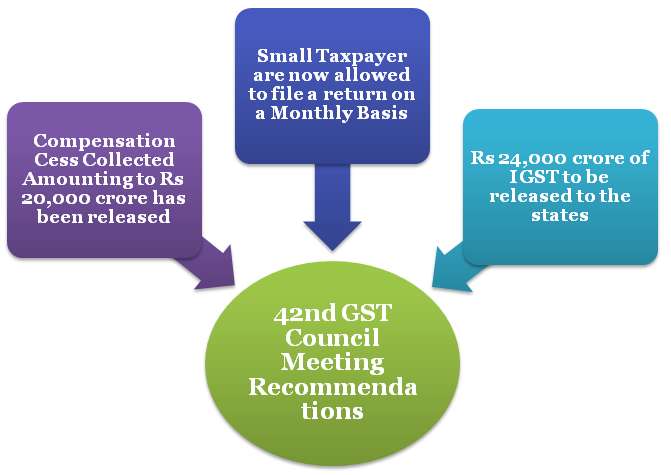

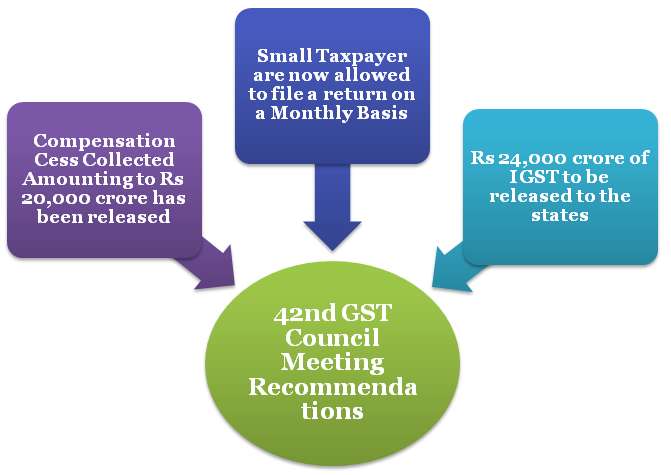

Recommendations that were drawn in the 42nd GST Council Meeting

- The Levy of compensation cess to be extended until June 2020 to fulfill the revenue gap.

- The compensation package of worth Rs 20,000 crore rolled by the government to compensate for the revenue loss occurred during the financial year 2020-21. The package would be transferred to the respective state government. Apart from that, the center has also decided to release a package of Rs 25,000 crore towards Integrated Goods and Services Tax by next week.

- Changes in the CGST Rules: the council recommends various amendments in the CSGT rules and forms including the submission of Nil FORM CMP-08 via SMS.

- The refund will be routed to the validate bank account rather than an account that is not linked with Aadhaar and PAN number[1] of the registrant. The council has mandated this arrangement for all the taxpayers and it will become effective from Jan 1, 2021.

- Satellite launch services would be exempted to boost the launching of the domestic satellite, especially for the new start-ups.

Simplifying Return Filing

About six months ago, the council suggested a gradual approach to deploy features of the new return system in the existing GSTR-1/3B scheme. Since then, various changes have been incorporated on the Goods and services tax common portal.

To improve the compliance experience, the council has approved an entirely new framework to reduce the taxpayer’s burden in the above context. The framework would be capable of generating timely reports related to ITC which will be reflected on the taxpayer’s electronic credit ledger. Apart from that, the council also made the following decisions:-

- The quarterly filing of GSTR-1 has been revised to the 13th of the month. Such a provision will become effective from January 1, 2020.

- Framework for automatic generation of GSTR-3B from GSTR-1s

- Automatic generation of liabilities from own GSTR-1.

- Automatic generation of ITC from GSTR-1 of the suppliers via a newly incorporated facility in GSTR2B form for monthly filers. The commencement of such arrangements will be started on Jan 1, 2020.

- To ensure the automatic generation of liability and ITC in GSTR 3B, the taxpayers are required to file FORM GSTR-1 before FORM GSTR3B. This would become effective from April 1, 2021.

- The existing GSTR-1/3B system received the extension of the timeline from the center till 31/03/2021. The center is also looking to amends the GST laws to make the said system a default return filing system.

Conclusion

The 42nd GST Council meeting has paved a roadmap for the small taxpayers as far as the tax liabilities are concerned. Such taxpayers now have an option to pay thirty percent of tax liability of the preceding quarter via an automatically generated challan. The taxpayers having a yearly turnover of fewer than five crores are permitted for quarterly filing of the return via monthly payments, which will become effective from Jan 1, 2020.

Read our article:Update on 41st GST Council Meeting

PIB1661827