The more complexities have been squeezed out from the GST rules for registration in the 23rd GST Council Meeting. This blog will render detailed information concerning the turnover limit for service providers to obtain GST registration and the penalties.

Turnover Limit concerning Service Providers

Like other business categories, all the service providers must obtain GST registration if the entity’s annual turnover exceeds Rs.20 lakh/annum in most states and Rs.10 lakh/annum in the Special Category States.

GST Registration regarding Inter-State Sales Service Provider

For all forms of businesses, the obtainment GST registration is mandatory, irrespective of turnover’s limit, if the enterprises engaged in the trading of goods from one state to another. However, this limitation does not apply to the service providers as per the directions of the 23rd GST Council Meeting. Henceforth, for service providers, engaged in the interstate business and having turnover of 20 lakhs needs not to avail GST registration. Moreover, the entities performing services under the e-commerce framework also don’t have to bear that taxation liability. This is one of the most important aspects w.r.t GST Registration for Service Providers.

Services Providers under GST Registration

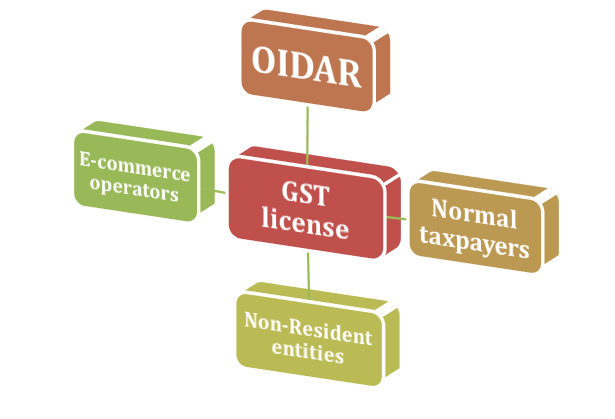

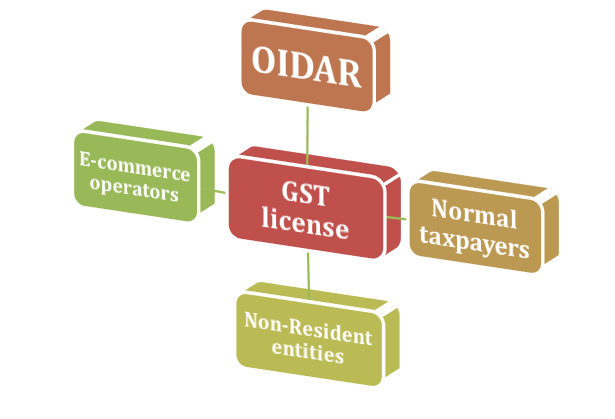

GST Registration is mandatory for the following category, which is as follows:-

However, the given category of service providers will still need to obtain GST registration regardless of the turnover they generate per year. GST Registration for Service Providers list is as follows:-

- Service Providers related to OIDAR

- Operators linked with E-Commerce activities

- Non-Resident entities rendering services to Indian Residents

- Regular Taxable Person

Read our article: GST Registration Documents: A Complete Checklist

What is the best period for obtaining GST Registration?

If you are law-abiding taxpayers with service tax registration, you must seek ways to transfer service tax registration to GST registration. If you are about to launch a new service firm, you must obtain GST registration within one month of commencing. In case if you are a regular or non-resident taxpayer, you need to get registered under GST within five days before starting a business.

GST Invoice for Services

In case if you don’t opt for GST registration, you can take advantage of the supply bill, defying the inclusion of GST details. The collection of GST is prohibited in case if you lack a GST registration.

In case you are a GST registration holder, you are accountable for providing a tax invoice within thirty days of the rendering of services. The supplier must ensure that two copies of the invoice produced whenever the trading occurs. The information in the tax invoice should briefly illustrate the elements such as the nature of service, customer’s GSTIN, date of the invoice, SAC code, and GST rate[1].

Registration Process

The process of GST registration is a simple and straightforward task. Here what you need to do to get registered under GST. After following the guidelines as mentioned below, the portal might authenticate your request for GST Registration.

- Once you logged into your service tax account, a provisional ID and password will be provided to you for the enrollment in GST.

- On the GST portal, you will be prompted to select one of the alternatives for enrollment purposes. All you need to choose the “New user login” option.

- Use your account credentials for the login purpose.

- After logging in, a page will appear on your screen asking you to enter your email address and phone number.

- Once you do that, an OTP will be sent to your phone and email address.

- Recreate the user name and password.

- Set up some questions to enhance the security of the account.

Penalties Structure in GST

There are few penalties prescribed considering the structural works in GST. Those are as follows:-

Late filing

Late filings invoked penalties in the form of late fees. Under the GST regime, 100 rupees per day of late fees are charged. Thus the total amount of late fee will come out to be 200 rupees (CGST-100 Rs + SGST-100 Rs). The provision for late fees has been maxed at 5000 rupees. However, in IGST filing, the provision for a late fee has been deterred by the tax authority. In line with this penalty, 18% of the internet rate needs to be bear by entities on an annual basis. It is basically evaluated on the taxable amount.

Violating the filing norms

If the entity fails to comply with the monthly procedure of filling GST return, the filling for subsequent months will be put on hold. It could lead the taxpayer to stringent penalties and even cascading effect. Any entity involved in the mistreatment of tax provisions or making the short payment will attract a penalty of 10% of the due tax amount. However, such a penalty is only applicable to the sum of the amount exceeding 10000 rupees. An offender will be subjected to a 100% penalty with a minimum amount of 10, 0000. Jail term is also a part of this provision for those who intentionally violate the GST compliances.

Cases of fraud

If the concerned entity has overcome any transaction or avail, the excessive tax credit will undergo inspection under GST provision. The inspection protocol handles by an officer of CGST/SGST as he/she will be responsible for scrutinizing the area of interest.

Conclusion

GST is a refined tax structure that discourages the complexities of the previous tax regime. The Good and Service Tax was rolled out with a slogan- one nation one tax, which means no taxpayers in the country is bound to cater to different taxes such as VAT or excise duty anymore. Now all the taxes submerged in a single entity called GST. Easy filling, clear tax slabs, and less conflict are the few highlights of GST. If you are willing to get registered under GST or want some detailed clarification on GST registration, then we are here to help you out. Also, if you would like to suggest something regarding this topic i.e., GST Registration for Service Providers, then drop your comment without hesitation.

Read our article: Step by Step Guide to Change GST Registration Details