A taxpayer seeking GST registration implies obtaining GSTIN from the relevant authority to collect tax and avail tax credit on his inward supplies. In this article, we will provide every bit of detail regarding documents required for GST registration. GSTIN, aka GST registration number, is a unique 15-digit number furnished by the tax authorities to keep eyes on tax payments and relevant compliance of the registered taxpayers.

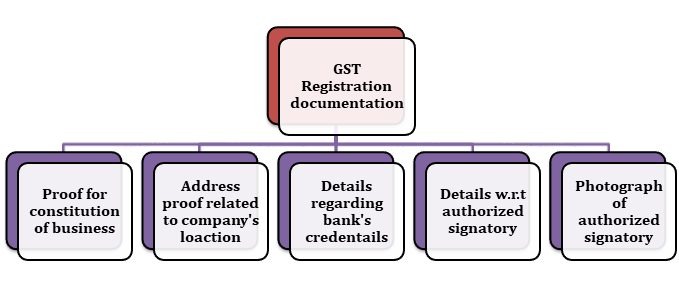

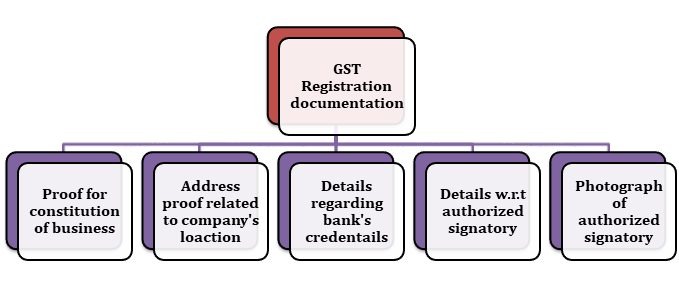

What are the documents required for GST Registration?

Bank account details: In the context of the bank related details, the applicant needs to furnish either a copy of the canceled cheque or bank statement. (Format – JPEG, Size Limit – 100 KB)

Address proof: An applicant needs to furnish the following documents in the context of address proof:-

- Receipt related to the property tax.

- Municipal Khata copy

- Copy of the Electricity bill

- Rent agreement if the firm is established on the rented property. (Note: the rental agreement shall be furnished along with (a), (b) or (c)

- Consent letter or NOC (in case of shared property) along with (a), (b) or (c)

Tabular Brief regarding for GST Registration Documents for Different Entities

|

Entity category |

Documentation for GST registration |

|

Sole proprietor / Individual |

|

|

Partnership firm (including LLP) |

|

|

HUF |

|

|

Company (Public and Private) (Indian and foreign)

|

|

|

Society or Trust |

|

Read our article:Cancellation of GST Registration in India: Full guide

GST Registration Process

The GST Registration can be availed through the online portal powered by Central Govt. Here the steps for the registration for GST.

- The applicant needs to furnish the following documents regarding part A of Form GST REG-01 on the GSTN portal[1].

- The verification of the PAN is done on this portal. Meanwhile, the OTP is used as the medium for the verification of the phone number and email address. Once the verification process reached its completion, an application reference number is sent to the applicant’s mobile number and email.

- An acknowledgment regarding FORM GST REG-02 is issued to the applicant through an electronic medium.

- The applicant needs to complete the remaining formalities by filling up Part-B of Form GST REG-01 and furnishing the application reference number. The applicant requires attaching these documents and finally submitting the form.

- In case if some more detail is needed, Form GST REG-03 will be rolled out. The applicant needs to address this particular form by filling the relevant detail. It is important to note that this action should be complete within the 7 working days from the date of receipt of Form GST REG-03.

If you have furnished all the relevant detail through GST REG-01 or Form GST REG-04, the registration certificate as per Form GST REG-06 will be issued to the applicant that will also support the additional place of business along with the principle place. For instance, if a taxpayer has several business verticles operating within the state, then the taxpayer is eligible to file an independent registration application in Form GST REG-01 corresponding to every business verticles.

If the details submitted are not up to the mark, the registration application will be canceled using Form GST REG-05. The applicant exercising deduction of TDS or collect TCS can opt for registration via Form GST REG-07. However, if the authority finds some invalid element in the furnished information, then the cancellation of the application becomes apparent. It’s extremely vital for the firms to get registered in order to conduct their services with ease.

Entities for mandatory GST registration

- Inter-state supplier

- A non-resident

- Entities who engaged with business activity on behalf of some other person.

- E-commerce client

- Taxpayers

- Companies exercising e-commerce websites for product retailing.

- Companies involved in the sale of service of other clients who are acting a partner as well.

Conclusion

The documentation is a delicate process in the GST registration; thus, the margin of error is quite high here. The applicant must furnish the document to the authority via an online portal, as mentioned above. Let us know if you need some aid regarding the documents required for GST Registration.

Read our article:How To Obtain GST Registration in India?