In this article, we will provide the step by step guide to change or update GST Registration details. Human-errors are apparent even with the less technical tasks, and GST registration is no different here. There are instances when a taxpayer makes a mistake while entering their info for GST Registration. Thanks to the updated GST provisions, which allow mending those mistakes with ease, but before we get to our topic, let have a look at the given list that implies what category of the applicant is eligible for this alternation.

What are the Categories of applicants eligible for making changes?

- Normal taxpayers

- New applicants

- Applicant having UIN card or associated with UN bodies

- Embassies across the nation & other notified person

- Overseas taxpayer

- Applicant indulges with GST activity

- Retrieval service provider

When a taxpayer can opt for the alternation of GST Registration details?

A taxpayer can opt for the alternation of GST Registration when-

- The business is already enrolled & operating under the canopy of GST provisions.

- The application is already prepared.

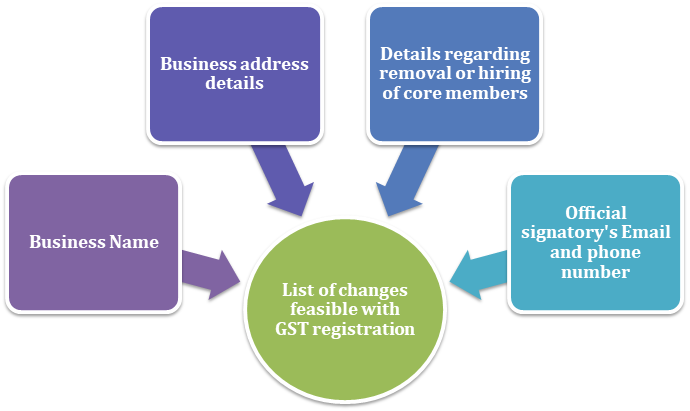

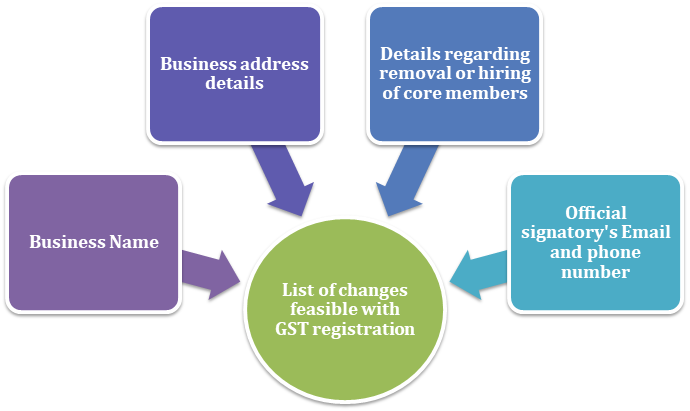

What are the Lists of changes that are feasible with GST registration?

- Business name (Note: Business with multiple branches needs to work with a single name)

- Address related to the main business place

- An additional business location, if any.

- Addition or removal of the company’s core employee such as CEO, MD, or anybody taking care of day to day operations.

- Email address or contact number of the official signatory

- Mobile number or email address of the official signatory (this can only be feasible when the applicant submit the FORM- GST REG-14 or use online portal)

- Primarily authorized signatory, if the alternative is available.

Apart from these details, there are some other attributes than cannot be altered by any means. Here’s the list of those details.

Timeline provisions for GST registration Attributes that are not subjected to changes

- PAN card related information.

- Constitution of business as it seeks an alternation in PAN number.

- Since GST registration is state-specific, the applicant cannot modify the business place from one place to another.

Those who seek a modification in the GST registration must submit the application alongside mandatory documents on the GST portal within the time span of 15 days. After the GST REG 14 amendment form’s successful approval, the further proceeding will be completed in form GST REG 06.

The registration amendment application can be spared for 15 days. If an applicant cannot furnish the application for any reason, the amendment application will be discarded automatically.

Read our article: AAR: Applicability of GST & its Registration for Charitable Medical Stores & Security Service

What are the Steps to alter GST registration details?

- Head over the GST’s official website. Initially, the applicant needs to explore the GST portal[1] to fulfill such requirements.

- Next, opt for the login option.

- Next, provide your account credentials such as – password & username along with the captcha and then click on the login tab.

- Once you get access to the home page, find & select “Amendment of registration Core Fields.”

- Head over to the Menu bar & click the Registration tab.

- Choose “Edit” and opt for the field for which you seek changes.

- Next, pick the detail that seeks editing and select the date via calendar option.

- As soon as you complete this requirement, provide the reasons for changes in the relevant field.

- Lastly, click on the Save button.

- Next, click on the continue tab when you are done with the changes. A blue tick icon will appear on your screen.

- Scroll down a bit and select edit and make the relevant changes.

- Click the ‘Submit” tab.

Advantages of GST

- The cascading effect of tax cannot be flourished under the canopy of GST

- Higher registration

- Small businesses can get access to the composition scheme

- The simple online procedure

- Equipped with lesser compliances

- Relaxed provisions for E-commerce operators

- Provide tons of benefits to logistics

- Having better coverage also take the unorganized sectors into account.

Disadvantages of GST

- Essential software purchase leads to extra cost.

- GST can contribute to increased operational costs

- GST came into effect in the middle of the financial year

- Being an online taxation system, it may not be accessible to all taxpayers for filling or other purposes.

- Tax liabilities are higher for SMEs

Conclusion

Under the GST regime, registration is one of those requirements that taxpayers cannot afford to overlook. Filling the legitimate info in the registration form is vital but, if you accidentally commit some mistake regarding that, then you use this article as your guiding light. So that’s all about GST Registration details and its alteration. Don’t hesitate to ask any question from us in case you need any clarification. We are always open to discussion.

Read our article:GST Registration for E-commerce Operators under GST Regime