E-Invoicing in GST is the submission of a digital invoice for goods and services on a common portal. The invoice got generated in a standard format. The approval of the e-invoice concept under the sphere of GST is helping in increasing the efficiency of the businesses and eases the compliance burden for taxpayers.

GST Council made a decision to implement e-invoicing of bills under the GST[1] regime from the 1st of January 2020 and whose applicability will be to particularized categories of persons. It automates the multi-purpose reporting process with just a single time input of all invoice details. The concept of e-invoicing is not new at the global level. In more than 100 countries, this concept of e-invoicing in GST has got successfully implemented and is still running.

Under the electronic invoicing (E-invoicing) system, all B2B invoices got electronically uploaded as well as authenticated by the GSTN/IRP portal for further use. Under the E-invoicing system, an invoice reference number would get issued against all the invoices by IRP (expanded as Invoice Registration Portal) to get managed by the GSTN. IRP will be transferring all information related to the invoice to the GST portal as well as the e-way bill portal in real-time. A standard e-invoicing system would eliminate the need for manual along with multiple data entry at the time of filing GST returns, and also it lessens the errors concerning data entry.

Implementation of E-Invoicing In GST (Latest Updates 2020)

- The implementation of E-invoicing in GST got extended to October 1, 2020. On March 14, 2020, the GST Council made a decision in the 39th GST Council meeting regarding the E-invoicing implementation under GST. The CBIC has declared that from October 1, 2020, e–invoice along with QR code would be a necessity for the taxpayers within the GST regime.

- The voluntary adoption of the system of e-invoice was started from January 1, 2020, for giant–sized businesses having turnover of 500 crores and above and businesses having annual turnover between 100 crores and 500 crores was started from February 1, 2020. The revised date of implementing e-invoice in the 39th GST Council meeting that took place on March 14, 2020, for all the businesses having turnover more than Rs 100 crores got extended from April 1, 2020, to 1st of October, 2020.

- Businesses having turnover below Rs 100 crores, armed forces, airlines, banks, telecom service providers, and insurance companies would get an exemption from compulsory e-invoice issuing.

- Invoices without Invoice Registration Number would get categorized under invalid invoices.

- The step-by-step implementation of e-invoicing process would lead to a reduction in tax evasion in India and would prevent data errors as well.

The Indian government has taken only larger businesses into consideration for commencing the electronic invoicing system. In the future, with a reduced limit of turnover, more businesses would come into the purview.

| Annual Turnover | Voluntary E-Invoice Implementation – Old Date | Mandatory E-Invoice Implementation- Revised Date |

| 100 Crore-500 Crore | February 1, 2020 | October 1, 2020 |

| 500 Crore & Above | January 1, 2020 | October 1, 2020 |

Stages Involved in Getting E-Invoicing in GST

- Taxpayers must make sure to use the reconfigured Enterprise Resource Planning System (Also known as ERP) as per the standards of PEPPOL. It needs to be capable enough to produce the JSON file for multiple invoices unitedly. Taxpayers without the software would get offline utility.

- If e-invoicing gets applicable to small taxpayers on a future date, they will be able to make a choice from 8 different accounting & billing software all connected with the GSTN. It is free from all the charges. Its availability will be online, i.e., cloud-based medium as well as the offline medium (Installed on the user’s system).

- The taxpayer should provide relevant details such as transaction value, billing name along with address, rate of the item, GSTN of the supplier, Applicable GST rate, tax amount, etc. The requirement for the taxpayer is to raise a standard invoice on that software.

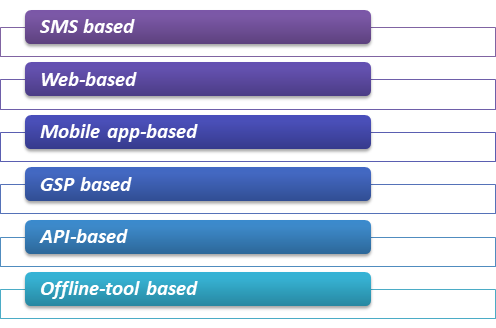

- Use the JSON file and upload the invoice details upon the IRP. The IRP would play the role of the central registrar for e–invoicing along with its authentication. Upload of details would get completed either directly or via APIs or GSPs. various modes of interacting with IRP are-

- IRP has got the task of validating the B2B invoice essential details, duplication-checking, and also it generates an invoice reference number for the purpose of reference. Here, the four parameters are-

- Invoice Number

- Seller GSTIN

- Document Type (DN/INV/CN)

- FY in YYYY-YY

- IRP is likely to generate the IRN, sign the invoice in a digital way, and generates a QR code in the output JSON for the sake of the supplier. On a different side, the seller of the supply would get intimated by the generation of e-invoice via e-mail.

- For GST returns, IRP will be sending forward the validated payload to the GST portal. In the case of applicability, details would get moved to the e-way bill portal.

- For seller ANX-1 and the buyer ANX-2 would get auto-filled for the appropriate tax period. In order, it is responsible for determining the tax liability.

A taxpayer can print his invoice. The system of e-invoicing instructs the taxpayers to get invoices reported in the electronic form on the invoice registration portal (IRP).

Read our article:Elucidation on GST Refund Issues – Recent Updates

How E-Invoicing in GST is Beneficial?

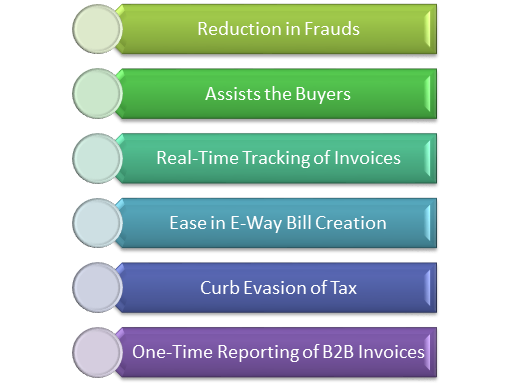

- Reduction in frauds due to real-time availability of data

- Assists the buyers in reconciling purchase order with the e–invoice along with acceptance and rejection of invoice on the basis of real-time

- Faster availability of ITC because of the real-time tracking of Invoices

- Since taxpayers need to update only details of the vehicle, it generates the e-way bill easily

- Reduction in the scope of fake GST invoices and genuine ITC would get claimed only

- One time B2B invoices reporting and get the authentication from GST portal

The Last Words

With the wave of E-Invoicing in GST, various experts have assumed that this new GST filing format would turn out to be a boon for taxpayers as it will make the system seamless, and also it assists with ease of conducting business. It is mandatory for the E-invoice to adhere to the invoicing rules of GST. India will leapfrog from voluntary to the mandatory system of e-invoicing on October 1, 2020. At Corpbiz, we would help you out in sorting out the issues related to the process of E-Invoicing in GST.

Read our article: Composition Scheme under GST- The Next Big Thing