Nearly every expert in the taxation domain expects GST to render countless benefits to the agriculture sector. The agricultural sector is one of the major contributors to the Indian GDP. It encompasses around sixteen percent of Indian GDP. The implementation of GST has affected various sections of society in one way or another.

One of the several problems encounters by this sector is transportation. GST is likely to undermine this problem gradually. In this article we will be eyeing on the significant GST impact on the agricultural sector.

Consequently, this may empower the government to set up the country’s first national market for agricultural goods in the future. Farmers across our nation are still in a state of confusion as far as the tax rates under GST are concerned. Additionally, the special reduced rate for the item like coffee, tea, or milk is yet to be declared under Goods and services tax.

Existing Tax Laws

The food item like salt, rice, flour, sugar, and wheat flour are exempted under CENVAT (Central Value Added Tax). In the state VAT regime, grains and cereals attract the tax @ 4%. Agricultural items undergo plenty of licensing and various indirect taxes such as excise duty, VAT, service tax as per the existing tax laws. Currently, the State VAT is not applied to all the agricultural goods in each state. However, a their certain category of food item that doesn’t come under the ambit of State tax. These food items are eggs, meat, and vegetables, etc.

Read our article:Impact of GST on Restaurants or Food Service Business

GST Impact on Agricultural Sector

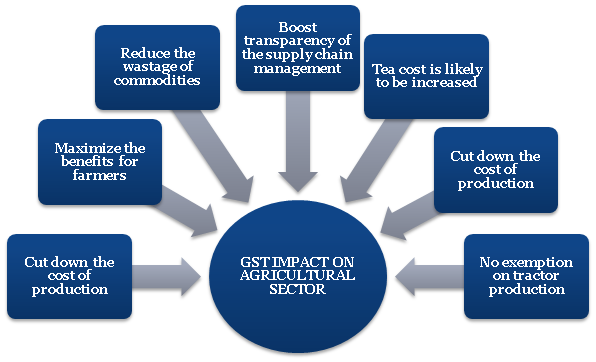

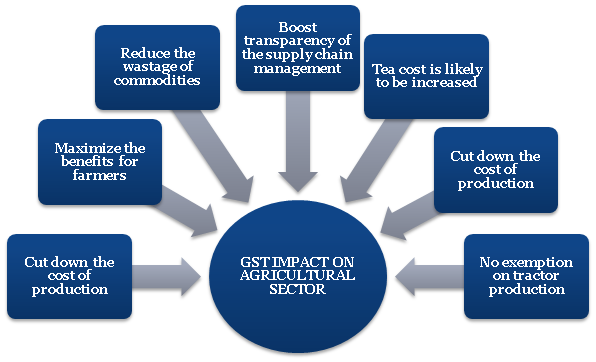

Following Section explains the GST Impact on Agricultural Sector

Enable Farmers to Avert Inadequate Expenses

GST is crucial to boost the transparency, timeline, reliability, of the supply chain mechanism. The improved supply chain mechanism would reduce the wastage of commodities and maximize the benefits for farmers. GST would also enable the farmer to cut down the cost of production for agricultural commodities. Under the GST regime, no exemption is given on poultry farming, stock breeding, and dairy farming.

Increased Tax Rate on Fertilizers

Fertilizers an essential agriculture element that was taxed @ 6% under the previous tax regime, Under GST, the tax rate on fertilizers has been doubled i.e. 12%. Coming to the agriculture machinery, the tax relaxation on the production of the tractor is now removed. The manufacture has to pay the GST of 12% on the same. However, this would enable the manufacturers to claim the Input Tax Credit.

Milk and Tea Lures More Taxes

Coming to milk production, currently, only two percent of VAT is imposed on milk and milk products. However, under the GST regime, no tax is levied on fresh milk. But the skimmed and condensed milk attract 5% and 18% tax rate respectively. Tea is one of the essential items in the household. The government might crank up the price of tea by imposing GST @ 5% from the existing average of VAT rate of 4-5%.

Increased Tax Rate for Agricultural Tools

The following section shows the list of agricultural tools that attracts 12% GST

- Power-driven water pumps, centrifugal pumps (horizontal and vertical), submersible pumps, deep tube-well turbine pumps, mixed flow and axial flow vertical pumps.

- Agricultural, forestry, or horticultural machinery for the preparation of soil or cultivation. This is also includes lawn or sports-ground rollers.

- Milking & dairy machinery.

- Composting Machines.

- Self-loading trailers for agricultural purposes.

- Germination plant equipped with mechanical or thermal machinery.

- Poultry incubators and brooders.

- Harvesting or threshing machinery, including straw or fodder balers; grass or hay mowers; machines for cleaning, sorting or grading eggs, fruit or other agricultural produce.

Introduction of National Agricultural Market (NAM)

In the year 2016, the central government comes up with a scheme called the National Agricultural Market that facilitates unbiased trading of agri-commodities. The National Agricultural Market facilitates traders, buyers, and farmers with online-based trading in commodities. Due to complex VAT and APMC law, the implementation of NAM could be a daunting task for the government.

GST is essential for the seamless implementation of NAM. The numbers of indirect taxes imposed on agricultural products would be integrated under GST. GST would allow traders to reap input credit for the paid taxes on every value addition. This would also help in creating a transparent, seamless supply chain that would result in a hassle-free movement of agri-commodities across India.

The majority of the agricultural commodities are consumable in nature. An effective GST implementation would improve the supply chain mechanism and reduce the transportation time between the states. This increased efficacy would provide plenty of benefits to farmers and retailers.

CST/OCTROI/Purchase Tax is the major contributor to transportation cost. The states like Haryana, Maharashtra[1], and Punjab reaps more than Rs 1000 crore via such form of taxes. Under GST all these taxes shall be subsumed. Henceforth, the central government is required to find some ways to compensate these states for such loss of revenue.

Conclusion

A rise in the cost of a few agricultural commodities is inevitable due to the surge in the inflation index for a short period. However, GST is very much capable of filling these gaps. Its implementation would certainly help the farmers in many ways, particularly in the longer run. With a unified national agriculture market in place, the farmers can avert the scope of manipulation in terms of cost.

GST implementation can get rid of steep expenses, particularly in terms of transportation of Agri commodities. By integrating all the indirect taxes, the GST would definitely be a great help for the farmers. To avail of more info on the topic i.e. GST Impact on Agricultural Sector, drop the queries in the comment section.

Read our article:Everything you Need to Know about Benefits of GST Registration