GST council has introduced a composition scheme under GST to reduce the costs for small taxpayers, along with simplifying the compliance process. Small businesses got relief and feel free from the burden of compliance provisions after the emergence of composition scheme in the world of taxes. There is a negligible requirement of maintaining records since the GST composition scheme assures greater compliance.

When GST came into the picture, big businesses were happy, but small businesses were not comfortable with the GST compliance procedures. Thus, in order to provide a sense of comfort to small businesses, the GST composition scheme got introduced in which the individuals need to pay their taxes at minimum rates depending on their actual turnover.

All those taxpayers whose turnover is below the mark of Rs 1.5 crore can opt for this composition scheme under GST. The limit is Rs 75 lakh for Himachal Pradesh as well as the North Eastern States of India. By opting for this scheme, they will be able to get rid of tiresome formalities concerning GST and would pay goods and service tax at a fixed rate of turnover. In section 10 of the CGST Act, 2017, CBIC has increased the threshold limit for availing the GST composition scheme to Rs 1.5 crore from the previous limit Rs 1 crore.

Conditions for Availing Composition Scheme under GST

Opting for composition scheme under GST is possible by fulfilling the following conditions-

- Any dealer opting for composition scheme can’t claim an input tax credit.

- The taxpayer would pay the tax at standard goods and service tax rates for transactions under the RCM.

- No inter-state supply of goods should take place.

- GST exempted goods shouldn’t get supplied by the dealer.

- If a taxable person is involved in various sections of businesses like groceries, textiles, etc. under the same PAN, then either they need to collectively opt for the composition scheme or out of the same scheme.

- It is the duty of the taxpayer to demonstrate the words “composition taxable person” on each bill of supply that has got issued from his end.

- The taxpayer needs to specify the words “composition taxable person” on every signboard as well as a notice at the business site.

- Trader or manufacturer can move ahead and supply services to the extent of 10% of turnover, or Rs 5 lakhs, the higher one among the both. Applicability of this scheme started on Feb 1st, 2019.

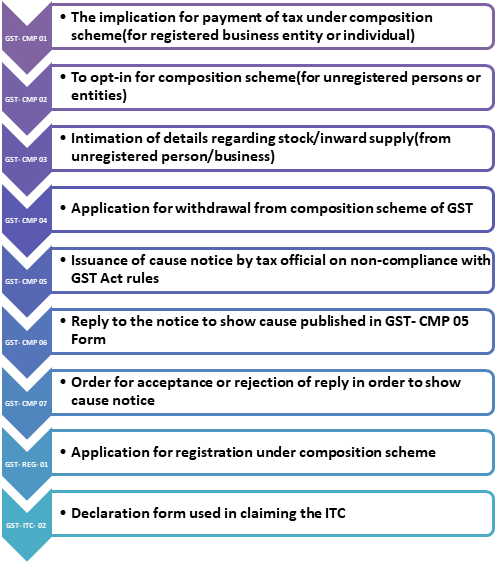

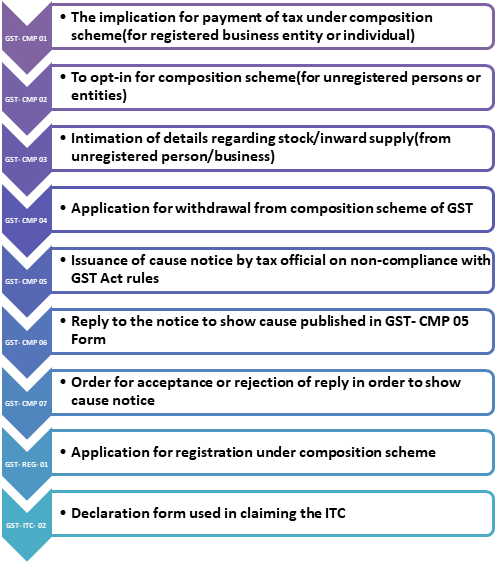

Composition Scheme under GST- Key Forms

Under current rules of GST, individuals along with businesses that are composition scheme registered should fill out different essential forms-

*Besides this, there might be a requirement for other forms for applying or operating under the composition scheme of GST.

Eligibility for the Composition Scheme under GST

- The taxable turnover for the service provider is up to Rs 50 lakh for composition scheme and would have to pay 6 percent GST.

- The taxable turnover for manufacturers, as well as traders of North-eastern states and Himachal Pradesh, is up to Rs 75 lakh.

- The taxable turnover for traders or manufacturers is up to Rs 1.5 crore.

Non-Applicability of Composition Scheme under GST

The following people got exclusions are–

- Non-resident taxable person

- Businesses engrossed in inter-state supplies

- Casual taxable person

- Manufacturer of ice cream

- Manufacturer of pan masala and tobacco

- Businesses supplying goods via an e-commerce operator

- Earlier, service providers besides restaurant services didn’t have the permission to get registered under the GST composition scheme. After the 32nd GST council meeting in January 2019, service sector businesses other than restaurant services got allowed to register under the GST composition scheme.

- Registered individuals and entities are not allowed to involve in the interstate supply of goods along with services. These businesses can procure goods and services from those suppliers that can perform interstate operations under the GST Act.

- Therefore, businesses or individuals registered under the composition scheme of GST can buy goods or services from outside the boundaries of their state but cannot sell goods as well as services to businesses and even consumers outside the state.

Composition Scheme Billing

- A dealer cannot issue a goods and service tax invoice as per the rules of the composition scheme as the tax liability is on the taxpayer[1].

- A dealer should issue a bill of supply as per the composition scheme rules under GST. It is mandatory for every bill to mention “composition taxable person, ineligible to receive tax on supplies.”

Read our article:GST on Legal Services in India: Taxability of Legal Services under GST

Tax Rates Applicable under the GST Composition Scheme

At the time of registering for GST composition, a fixed composition tax rate is applicable to your business turnover. The applicable GST rates under composition scheme-

- 1% GST is applicable for the manufacturers as well as traders of goods. This 1% GST includes- 0.5% CGST and 0.5% SGST.

- 5% GST is applicable for those restaurants that don’t serve alcohol. The 5% GST includes- 2.5% CGST and 2.5% SGST.

- 6% GST is applicable to other service providers. The 6% GST encompasses- 3% CGST and 3% SGST.

| Business Type | Total GST | CGST | SGST |

| Manufacturer & Traders of Goods | 1.0% | 0.5% | 0.5% |

| Restaurants not serving (Alcohol) | 5.0% | 2.5% | 2.5% |

| Service Providers | 6.0% | 3.0% | 3.0% |

Composition Scheme under GST: Filing of Returns

- Form GSTR – 4- To file a quarterly return by 18th of the month after the quarter-end

- Form GSTR- 9A– Annual filing of GST return by 31st December of the proceeding financial year

Composition Scheme under GST- Latest Updates 2020

- The time limit for ordinary and registered taxpayers who want to opt-in the GST composition scheme for the financial year 2020-21 got extended up to June 30, 2020. It is applicable for taxpayers registered under section 10 of the CGST Act along with the taxpayers opting for the scheme.

- The time limit for filing the ITC-03 form got extended till July 31, 2020.

- The time limit for filing GSTR-4 yearly returns for the financial year 2019-20 by the composition dealers got extended till July 15, 2020.

- Till July 7, 2020, in Form CMP-8, dealers can make the submission for challan-cum-statement for the Jan-Mar 2020 quarter.

In the Nutshell

The government introduced the composition scheme under Goods and service tax as an optional method of the tax levy to bring a reduction in the compliance costs for small taxpayers, along with simplifying the compliances. It has lessened the requirement of maintaining adequate records. This composition scheme turned out extremely beneficial for small taxpayers. We at Corpbiz are ready to assist you all the time with respect to any help on GST.

Read our article:GST on Food Services and Food Items: All that you need to Know