It’s been more than 2 months since the Union Budget 2021-22 rolled out the Finance ministry. The Budget seems promising as it entails a lot of productive measures for stressed sectors, including MSME. During its release, the finance minister emphasized the impact of Covid-19 on the working sector and pointed out the preceding measures taken by the GOI to revive the economy. Nonetheless, in this article, we shall point out some key measures that were enlisted in the Union Budget 2021 for MSME.

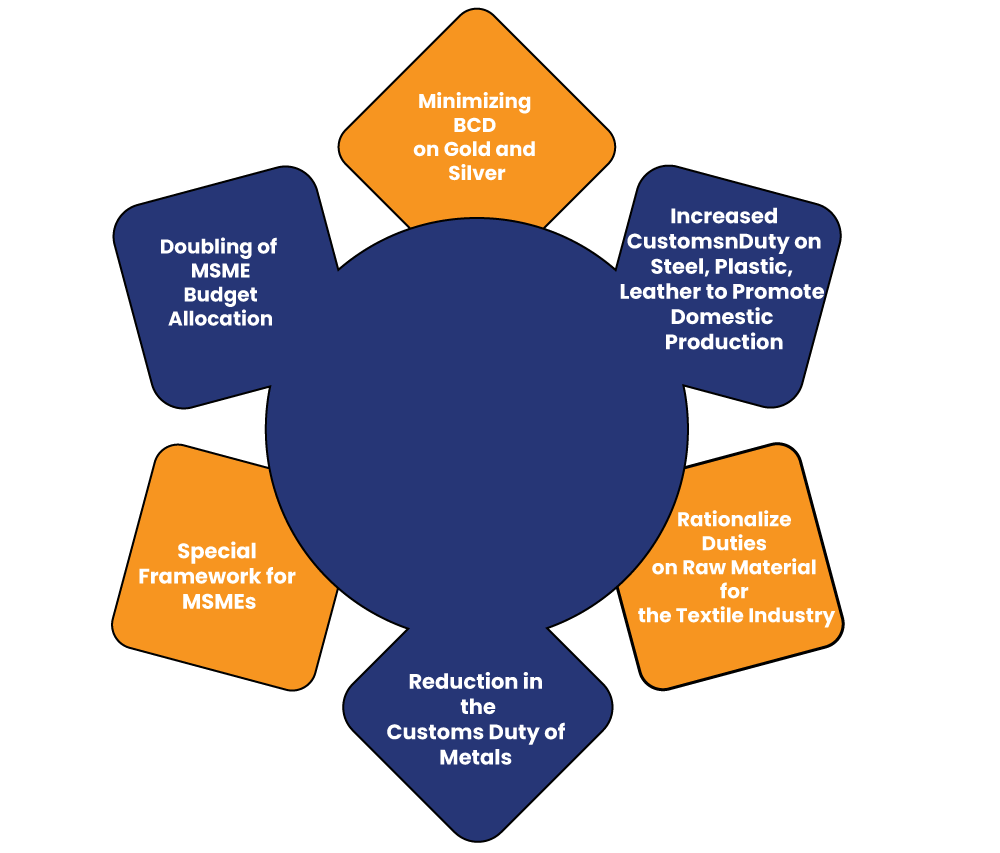

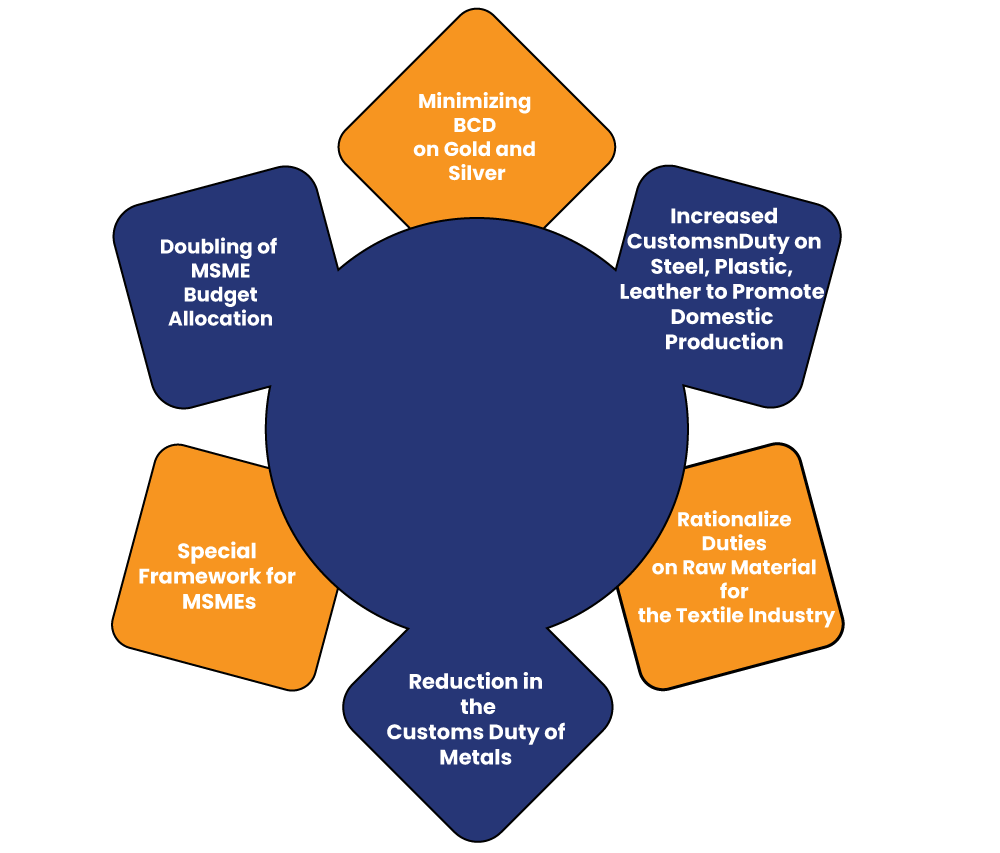

Key Measures Included in Union Budget 2021 for MSME

The section below encloses the key announcements made by the honorable Finance Minister Nirmala Sitaraman in Union Budget 2021 for MSME sector.

Doubling of MSME Budget Allocation

Considering the repercussion of an ongoing pandemic on the economy, the finance ministry has doubled the Budget Allocation for MSMEs. Rs.15700 crores has been deployed by the government in the name of the MSME sector. The aforesaid figure is approximately double the previous year’s figure, which stood at Rs, 7572 crores.

Read our article:MSME Udyam Registration Process & Penalty

Minimizing BCD on Gold and Silver

The basic customs duty rate for Gold & silver has been slashed down to the previous limit, i.e., 10%. Such rationalization of duty will lower prices of precious metals that were skyrocketed in the financial year 2019.

Increased Customs Duty on Steel, Plastic, Leather to Promote Domestic Production

The finance ministry[1] has increased the duty from 10% to 15% on screws, steel & plastic builder wares to promote domestic manufacturing. The ministry further declared the exemption on import for duty-free items, thereby ensuring huge relief for exporters of leather, apparel, and handicraft items.

By withdrawing exemption on the import of certain leather products and finished synthetic gemstones, the government is eyeing to increase domestic production.

Rationalize Duties on Raw Material for the Textile Industry

Textile is one of the critical employment creation sectors of this country. To promote the growth of the sector, the finance ministry has rationalized duties on manmade textiles to raw material inputs. The 5 % reduction in basic customs duty on nylon fiber, nylon chips, and caprolactam is a step in this direction. This will massively support the textile industry and MSMEs across the country.

Reduction in the Customs Duty of Metals

The increased iron and steel prices have been a matter of grave concern for MSMEs for a while. The Union Budget 2021 proposed to cater to this issue by reducing duty to 7.5% on semis, flat, & long products of alloy, non-alloy & stainless steels. Further, the ministry has also canceled CVD and ADD on certain steel products. The duty on copper scrap has also been reduced to 2.5%. This would aid local manufactures in purchasing raw materials at a lower cost.

Special Framework for MSMEs

For the prompt resolution of cases, the government has promised to strengthen the NCLT framework. The inculcation of e-Courts is proposed to come to effect in the upcoming months. The Budget also proposed to set up a special framework for MSMEs.

In view of the above, we have drawn certain points highlighting the benefits of Union Budget 2021 for MSME sector:-

- Ensures increased production rate by reducing the custom rate on metal, leather, and textile product

- Ensuring fiscal stability for tough times via Rs 10,000 corpus

- Strengthening local manufacturers by providing raw material at a reduced rate

- Budget allocation worth Rs 15,750 crore to promote growth and production.

What Government has done so far to Revive the Stressed MSME Sector After the Arrival Of Covid 19?

MSME is one that sector in India that contributes significantly to the nation’s growth. Their undermined existence seeks prompt revival via a government-based scheme. During Covid-19 phase, this sector taken ms

The government of India has taken some proactive measures in FY 2020 for the revival of the MSME sector. These are as follow:

- Rs 20,000 crore Subordinate Debt* for the stressed MSMEs: The scheme ensured the availability of much-needed liquidity for stressed MSMEs who were unable to address the heavy debt obligations. The scheme envisaged support from banks in the form of a guarantee for dispensing loan amounts so that MSMEs can effectively address their financial woes without worrying about repayment.

- Rs 3 lakh crores Collateral free Automatic Loans for stressed sectors, including MSMEs

- Rs. 50,000 crore equity infusion via MSME FoF*

- Inculcation of the new criteria for MSMEs’ classification

- Launch of an online portal, viz ‘Udyam Registration’ under Ease of Doing Business initiative.

- No overseas tenders for procurement up to Rs. 200 crores

Subordinated debt* refers to loan type that is paid post-repayment of all other corporate loans and debit, in case of borrower default. A subordinated debt’s borrowers are generally larger companies or others entities.

Fund of fund* :- A fund of funds (FOF), aka multi-manager investment, refers to a pooled investment fund that invests in other forms of funds. In laymen’s terms, its portfolio entails diverse underlying portfolios of other funds. These holdings supersede any investing directly in stocks, bonds, and other types of securities.

Conclusion

The MSME sector has been through a lots of hardship in the past few years, with pandemics further dented their growth. The announcement made in the Union Budget for MSME seems reasonable as per the prevailing scenario. The Union Budget 2021 for MSME has enough potential to steer its growth in the right direction. The announcements like doubling of budget allocation and Rs 10000 corpus are certainly a welcome move. A reduction of BCD will also aid MSMEs to stay in the game and accomplish their business goals.

Read our article:MSME Udyam Registration Portal: Everything you Need to Know