After obtaining the recommendations from the Advisory Committee, the Central Government notified certain standard for classifying the enterprises as micro, small and medium enterprises and specified the procedure and form for filing the memorandum (Udyam Registration) with effect from 1st July, 2020.

The Union Ministry of Micro, Small and Medium Enterprises (MSME), through Notification dated 26th June, 2020, came up with the new process of Registration of enterprises. For this purpose, the enterprise shall be known as Udyam and ‘Udyam Registration’ will be known as its Registration Process. Continue to read this article to learn more about MSME Udyam Registration Process with Penalty.

What is Udyam Registration?

Any person who plans to establish a micro, small or medium enterprise may file the online Udyam Registration in the udyamregistration.gov.in. The registration takes place on Udyam Registration portal on self-declaration. There are no fees charged for applying Udyam registration but it is mandatory for the owner, partner, director or promoter or Karta to submit their aadhaar card if required while registering under Udyam registration. The classification is given below:

| Type of Enterprises | Micro Enterprise | Small Enterprise | Medium Enterprise |

| Manufacturing OR Services Sector, Both | Investment upto ₹ 1 Cr And Turnover upto ₹ 5 Cr | Investment upto ₹ 10 Cr And Turnover upto ₹ 50 Cr | Investment upto ₹ 50 Cr And Turnover upto ₹ 250 Cr |

- Self-Declaration

Any person who plans to start with a micro, small or medium enterprise may file in the Udyam Registration portal, and there is no requirement to upload any paper, documents, certificates or proof but it will be based on self-declaration

- Udyam Registration Number

After the registration is done, the enterprise referred to as “Udyam” will be given a permanent identity number which shall be known as “Udyam Registration Number”.

- Udyam Registration Certificate

On completion of the MSME Udyam registration process, the applicant shall be issued an e-certificate, termed as “Udyam Registration Certificate”.

- GSTIN and PAN

All the units with Goods and Services Tax Identification Number (GSTIN) that are listed on the same Permanent Account Number (PAN) shall be together treated as one enterprise and the investment figures and the turnover for all those entities shall be seen collectively and only their aggregate values shall be considered to decide the category as micro, small or medium enterprise.

- Verification of the Details

In case of any inconsistency or complaint in the particulars of Udyam Registration that is submitted by the enterprise, the ‘General Manager of the District Industries Centre’ of the respective district is authorized to undertake an inquiry for verification. Furthermore, after verifying the matter with the required remarks it will be forwarded to the Commissioner or Director or Industry Secretary of the relevant State Government.

In accordance with the notification, the person may make corrections and make improvements in the details or can also recommend to the Ministry of Micro, Small or Medium Enterprises under Government of India[1] after giving a chance to present its case and after giving a notice to the enterprise based on the findings, for cancelling the Udyam Registration Certificate.

- New Laws

The Government is constantly working on several initiatives because of the corona virus turbulence, such as Indian Government has relaxed various provisions of MSME law & re-framed it accordingly so that many business enterprises and start- ups can avail its benefits.

What is the Practice of MSME Udyam Registration in India?

- The registration form shall be provided in the Udyam Registration portal.

- There shall be no fee required for filing the Udyam Registration.

- It is mandatory to submit the Aadhaar number as it will be required during the MSME Udyam Registration process.

- In the case of a proprietorship firm, the proprietor shall submit his Aadhaar number and in the case of a partnership firm, the managing partner’s aadhaar card shall be required and where in the case of a Hindu Undivided Family (HUF), that of a karta.

- GSTIN and PAN together with its Aadhaar number shall be provided by the organization or its authorized signatory in the case of a Company or a Cooperative Society, or Limited Liability Partnership or a Society or Trust.

- Where the enterprise is registered as an Udyam with PAN, and in its previous years when the enterprise did not have PAN it has provided information that were inconsistent then in such a case it shall be filled up on self-declaration basis.

- It is not permitted for the enterprises to file for more than one Udyam Registration but this is subject to a condition that any number of activities together with service or manufacturing or both may be added or specified in one Udyam Registration.

- Anyone attempting to suppress the facts or with the intention to misrepresent the self-declared figures and facts appearing in the Udyam Registration or in the updation process shall be liable with a penalty as provided under section 27 of the Act.

- All the enterprises that are already existing and registered under EM–Part-II or UAM shall again register themselves on the Udyam Registration portal on or after the 1st day of July, 2020.

- All the enterprises that are registered till 30th June, 2020, shall be re-classified in conformity with this notification.

- The existing enterprises that are registered before 30th June, 2020, shall continue to remain valid for a time period up to the 31stday of March, 2021.

- Any enterprise registered with some another organization under the Ministry of Micro, Small and Medium Enterprises can also register itself under the MSME Udyam Registration.

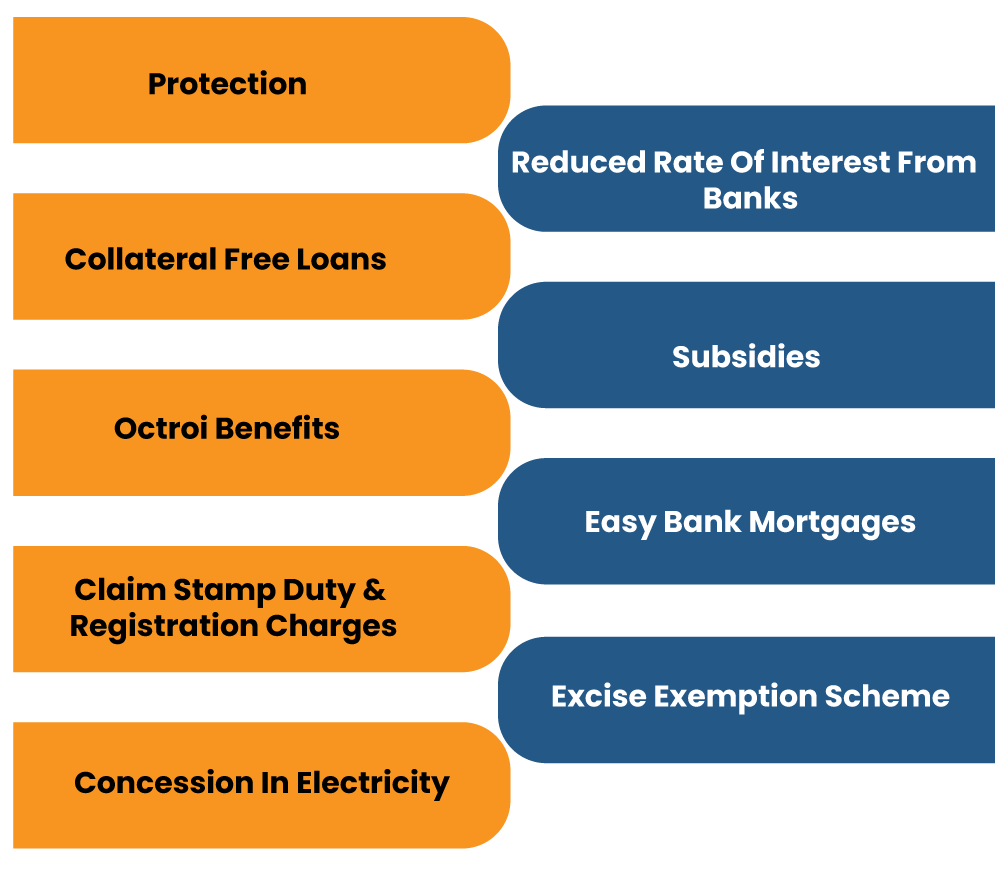

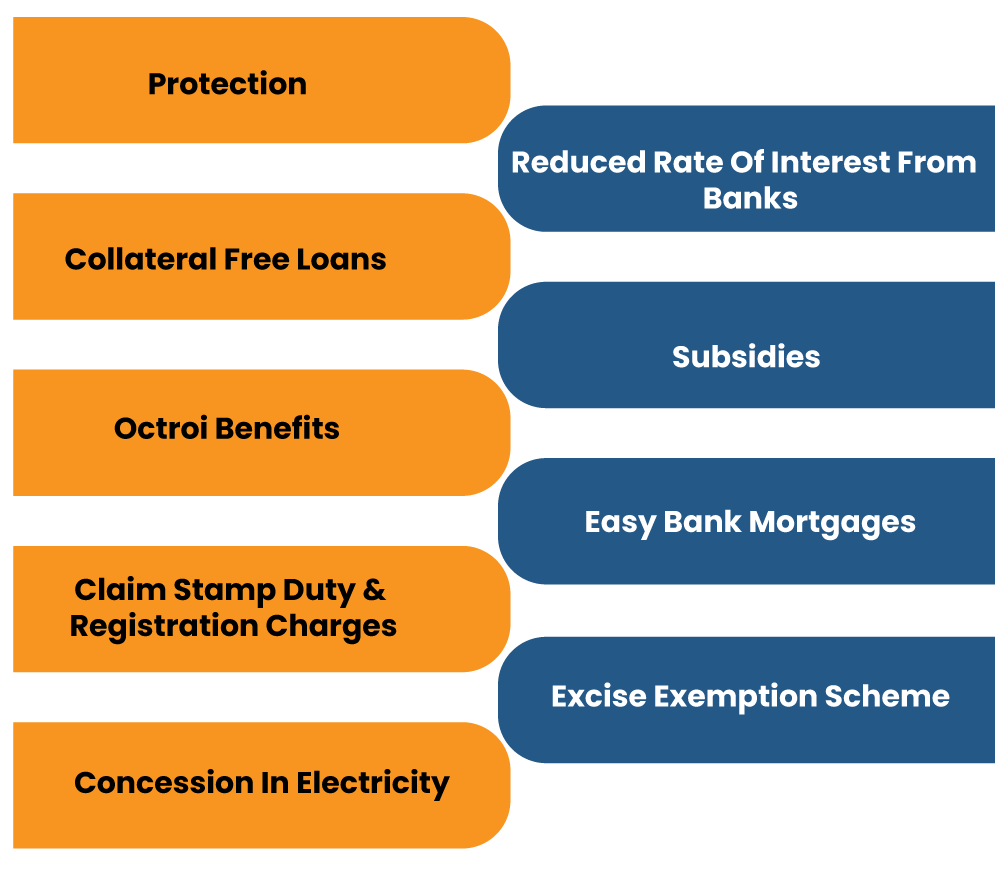

What are the Benefits of MSME Udyam Registration?

Udyam registration plays an imperative role particularly for small and medium size business throughout India. MSME is the backbone of Indian economy and it is found that MSME has fostered the economic growth of our nation as majority of the population depends on the small and medium size businesses. Few of the benefits of MSME Udyam Registration are given below:

Penalty

Whoever with the intention to misrepresent the facts or attempts or tries to actually suppress the figures and facts in the MSME Udyam Registration shall be punishable

- With fine which may extend to Rs.1000/- : In case of first conviction,

- With fine not less than Rs.1000/- and may extend to Rs.10,000/- : In case of second or subsequent conviction

Conclusion

MSME Udyam registration offers the entrepreneurs with incredible benefits under the existing MSME scheme of the Indian Government. One of the major advantages of registration is that the business can be included in both the central as well as state government business schemes. If you want to avail the benefits of these government schemes, you need to comply with the registration process.

Read our article:New Enterprise under Udyam Registration: Aadhaar Number