At present, our country is in a state of chaos due to the ongoing pandemic. COVID 19 has not only hampered the financial standing of the country but also eroded the GDP resulting in the back lashing of many important sectors including MSME.

At present, the situation of MSMEs is not on-par as the majority of them encountering the liquidity crunch and low capital issues. The Finance Ministry under Modi governance had taken some crucial measures to combat this serious threat. In this article, we would explore the number of initiatives taken by the government for MSMEs in wake of COVID 19.

List of Initiatives Taken by the Government for MSMEs

This portion broadly explains each and every initiatives taken by the government for the betterment of MSMEs

Rs 20,000 Crore Subordinate Debt for MSMEs

This scheme was rolled by the government for the MSMEs dealing with equity crunch and low revenues. It seeks to impart flexibility to the promoters of the existing MSMEs which are in the middle of chaos and have become NPA as of April 30, 2020. According to the scheme, the promoters are eligible for the credit equal to 15% of the stake in the entity or Rs 75 lakh, whichever is lower. This is one of the prevalent initiatives taken by the government for MSMEs.

50,000 crore Equity Infusion via MSME Fund of Funds

On May 13, 2020, the finance ministry came up with another growth-oriented scheme for the stressed MSMEs given COVID 19 pandemic. Under the scheme, a corpus of Rs 10,000 crore was set up by the government for MSMEs to encounter a financial crisis or shortage of capital. The scheme also encompassed those entities which are in the compromising stage and unable to raise funds through professional corporations and venture capitalist.

Rs 3 lakh crores Collateral free Loans MSMEs

As COVID 19 was quite relentless on the economy, it chopped off major sources of revenue for the MSMEs. This left the sector helpless as they continued to face the scarcity of funds. But, GOI responded promptly to this serious threat by launching Rs. 3 lakh crores scheme.

The scheme aims to provide much-needed resilience to the stressed MSMEs through the allotment of Collateral free credits[1]. This scheme enabled the MSMEs to compensate for the ongoing liquidity crunch and meet the demand for production. This indeed was one of biggest initiatives taken by the government for MSMEs till date. The scheme was launched under the Atma Nirbhar Baharat package in May.

Introduction of Udyam Registration for New Registration of MSMEs

This step was taken to ease out the registration process for new entities looking to avail of MSME registration. Compared to the past method, the current procedure for MSME registration is easy and very intuitive. Entities seeking MSME registration are now required to visit the official website of MSME known as Udyog Registration.

Upon reaching the portal, the applicant needs to provide the Aadhaar Card number to get access to the web-based form (also known as the application for MSME Registration). This is the smartest initiatives taken by the government for MSMEs.

Restriction on the Global Tender Procurement

On May 13, the finance ministry took an important decision in regards to the limitation on the global tender as a part of the Atmanirbhar Bharat package. According to the announcement, the procurement of the overseas tender has been capped at 200 cr. That is the minimum threshold limit for all the existing MSMEs. The scheme was rolled to safeguard the MSME sector from unfair competition from overseas counterparts.

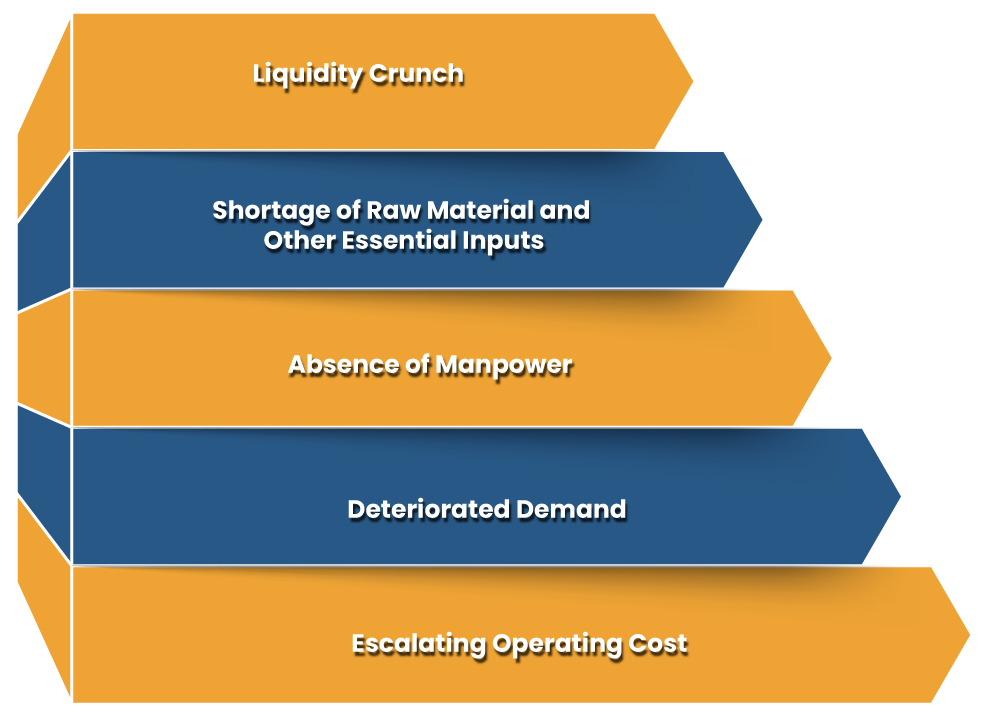

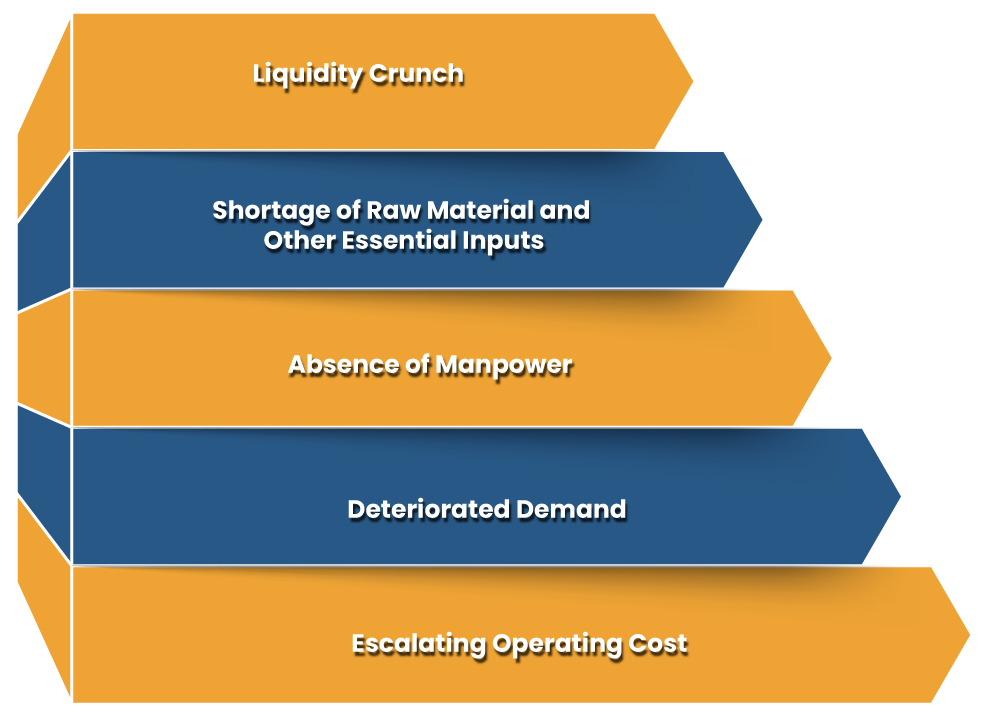

Core Issues Faced By the MSMEs in Wake of COVID 19 Pandemic

Following list exhibits the number of prevalent issues faced by the MSMEs during COVID 19 pandemic.

Liquidity Crunch

The most obvious obstacle that becomes prominent soon after the advent of COVID 19. MSMEs’ contribution to the economy is somewhat unparallel as compared to other sectors. While the pandemic was too drastic for the economy, the MSMEs operating pan India was finding it hard to cope up with its adverse effect.

There was a time when everything was at a halt due to this pandemic and MSMEs were struggling to meet the production demand due to liquidity crunch. As per government sources, almost 90% of the MSMEs, smaller ones in particular hardly manages to complete the daily production target due to the unavailability of funds and necessary resources.

Shortage of Raw Material and Other Essential Inputs

MSME is facing the shortage of the raw materials as they are dependent on the raw materials imported from the multiple countries and due to the COVID-19 virus both the export & import of raw materials have been disrupted creating widespread scarcity

Absence of Manpower

No sector can maintain a sustainable production level without skilled laborers. They have continued to remain the major contributor for the companies, especially MSME. But after the arrival of the COVID 19 everything was changed since the majority of the laborers were forced to remain at home, leaving the industrial sector to face the biggest scarcity of manpower of all times.

Deteriorated Demand

Covid 19 emerged as an unprecedented threat to human life and the global economy. It not only sabotaged the purchasing power of the consumer but also disrupted the supply-chain mechanism. Due to this, the manufacturer was finding it hard to raise the demand for their product.

Escalating Operating Cost

Since Covid 19 virus causes the widespread scarcity of resources, the MSMEs operating nationwide encounter a sudden dip in the production volume that further translated into low revenue generation followed by rising operating costs.

Conclusion

There is no doubt that MSMEs are confronting the relentless economic crisis at present despite the launch of ample government schemes. Although the government is trying its best to contain the after-effects of the Covid 19 pandemic, there are still many gaps that need to be filled.

We hope that the Government will come up with initiatives that can bring the affected MSME sector back on track as anticipated. Share us your views or queries related to this topic i.e. initiatives taken by the government for MSMEs.

Read our article: What is the Threshold Limit of MSME before and after Covid-19 Raised by the Government?