The Finance Act, 2020 has established a new Section 194-O that elaborates on levying 1% Tax Deducted at Source on Payments made to E-Commerce operators that will be applicable for the transactions from 1st October 2020. In this blog, we will talk about TDS Applicable on payments made to E-commerce operators.

Section 194-O should be applicable on Residents or Non-Resident E-commerce operators making payment to resident e-commerce platform in relation to sale of goods and services consisting of digital products like E-book, blogs, podcasting, audio-video etc. aids through its digital or electronic facility or platform.

Who is an E-commerce operator?

E-Commerce operator is a person who holds, manages or operates a digital or electronic facility for the sale of goods and services. They are responsible for making payments to any E-Commerce participant on sale of such products.

An E-commerce participant means any person who owns, manages or operates digital or electronic facility or platform for E-commerce and is in charge for paying to E-commerce participants, like- Amazon, Flipkart[1], Facebook, Myntra etc.

Read our article:Latest guide on TDS under Section 194N of Income Tax Act: Cash Withdrawal

Previous Scenario of TDS Applications on Payments made to E-Commerce Operators

Before the introduction of Section 194-O, there was no tax deduction on payments made to any E-Commerce operator. It was mandatory for them to file their income tax return independently. Consequently, many small E-Commerce operators did not file their Income-tax Return and avoided tax liability.

According to Section 194-O, E-commerce operators will deduct TDS @ of 1% on the total amount of sale of goods or services assisted by any E-commerce operators through digital or electronic means to the participants of the E-commerce. The TDS applicable on payments made to E-commerce operators or payment by any mode where the purchaser of goods and services makes payment directly to any e-commerce participants.

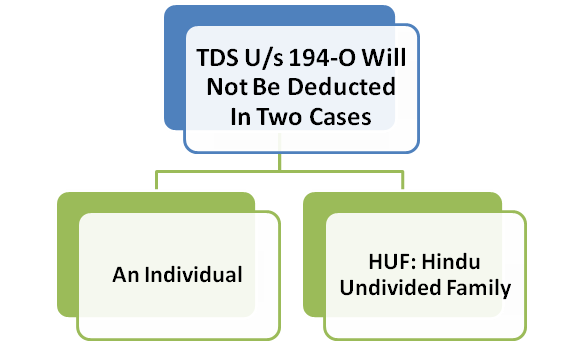

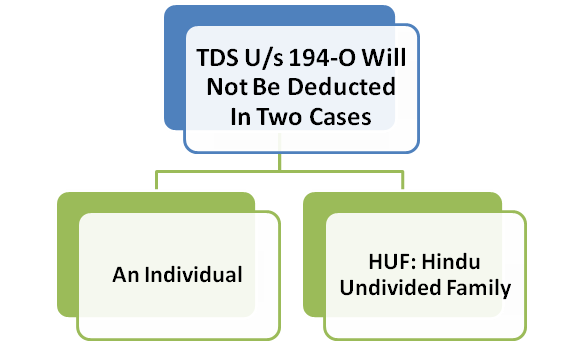

Situations when TDS is not Deducted

The TDS under Section 194-O will not be deducted in two cases-

An Individual or HUF

Any individual or Hindu Undivided Family only, where the total gross sale of goods and services or both not likely to exceed INR 5 Lakhs during the fiscal year; and such person has PAN or aadhar linked to the E-commerce operator, the TDS under section 194-O @ 1% cannot be deducted.

Under Section 194-O

No TDS will be deducted if any payment that is covered under Section 194-O will not be liable to TDS under any other provision of the Act. Morepver, the TDS will be deducted @ 1% on the total amount of sales or services.

Conclusion

Section 206AA now provides that if PAN or Aadhaar is not available, then tax will be deducted @ 5% instead of 1%. Section 194-O states that when paying GST at the time of credit to the party or making any payment, whichever is earlier then tax will be deducted according to Section 206 AA. Therefore introduction of Section 194O will result in an increase in the revenue by reducing tax evasion for the government. The Finance Act, 2020 has established the new Section 194-O that elaborates on levying 1% TDS applicable on payments made to E-commerce operators.

Read our article:All about Benefits of TDS Return Filing in India