Tax Deducted at Source (TDS) is the advanced tax paid by any individual or entity for making payments, payments of professional fee, interest, salary, dividends and royalty among others as per prescribed tax slabs by the government on behalf of the payee. TDS return filing helps the government to prevent tax evasions. In this blog we will discuss, benefits of TDS Return Filing.

Overview of TDS Return Filing

Tax Deducted at Source or commonly known as TDS in India. Any company or any individual making payment needs to deduct tax at source if the payment exceeds the prescribed limit by the government. The rate at which TDS will be deducted is decided by the Income Tax Department of India. The company or individual which deducts the TDS amount is known as Deductor and the individual whose tax is deducted is Deductee. It is the accountability of the Deductor to deduct Tax Deducted at Source (TDS) before making the payment and deposit the TDS amount to the Government of India.

Categories under TDS Return Filing

The employer has a Tax Collection and Deduction Account Number (TAN) through which the employer file TDS return. Following are the payment categories under which TDS return filing is done for businesses and individuals.

Those are as follows:-

- Salary of an Individual

- Income from Insurance Commission or income from any other source such as lottery puzzles, etc.

- National saving scheme payment.

If there is delay in TDS return filing the individual or entity will be penalized. The eligible categories under which TDS return filing is done electronically:-

- Any Company

- Any person whose account is audited under section 44AB.

- Any person who’s holding government office.

Benefits of TDS Return Filing

Tax Deducted at Source depends on the amount an individual earn. Both the government and the tax payers enjoy benefits of TDS return filing. When an individual make payment via cheque, cash or credit card, a certain amount of tax is deducted this gets deposited to Income tax department.

Following are the benefits of TDS return filing:-

- Filing TDS return helps the government agencies prevent people or entities from tax evasions. The government agencies keep track of the TDS filed by the individuals or entities and if someone has missed the due date of filing TDS a penalty will be imposed on such person.

- Filing TDS returns provide government of India a steady source of revenue, as the TDS is filed every month by the dedcutors who come under the prescribed slab. It helps the government to keep track and record the people who are filing TDS regularly.

- Filing TDS returns widens the base of tax collection for the government. As the TDS is filed by the employer and a certificate is provided for the same to the employee whose TDS ID filed so there are less chances of Tax evasion and increases the number of Tax payers in the country.

- The tax collection agencies have a huge responsibility to keep an eye on every earning person who comes under taxpaying slab to make sure that the tax is paid, so the TDS return filing makes it easy for the tax agencies as well as for the deductor as the tax is deducted at the time of payment.

- The TDS return is filed by the Deductor on the income of the Dedcutee so the Deductee does not have to file tax again and the job of deductee as tax is deducted automatically.

Read our article:TDS Returns Filing: Due Dates and Procedure for Filing

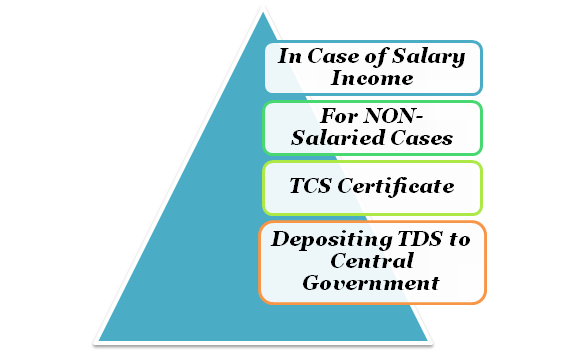

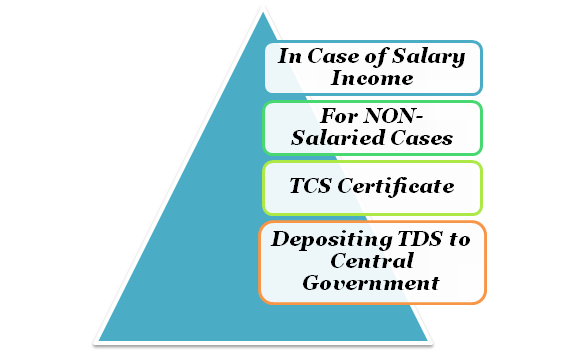

TDS Return Filing Certificates

Under Section 203 of the Income Tax Act, any person who deducts TDS must provide a certificate to the respected deductee mentioning the deducted amount along with other necessary particulars.

In case of Salary Income

- The Deductor has to provide Form 16 to the deductee and mentioning the TDS amount deducted.

- Form 16 has all the other necessary particulars related to deduction, computation and payment of tax.

For Non-Salaried Cases

- In non-salaried cases Form 16 is provided by the deductor specifying all the necessary details of payments, computation and deductions.

- Form 16 needs to be issued by the deductor to deductee within 15 days of due date of TDS Return Filing.

TCS Certificate

- Tax Collected at Source (TCS) certificate that specifies the TDS amount collected and deposited with the Tax Department of India. TCS certificate is issued through Form 27D

Depositing TDS to Central Government

- The Deductor has to deposit the tax deducted at source to the central government by making payment via NSDL by using a physical form that can be submitted in certified bank branches.

- By using Challan 281 on the official online portal of NSDL the payment can be made or by net banking.

- Before TDS return filing the amount deducted as tax needs to be deposited.

- Under section 44AB the e-payment is compulsory for all assesses.

What are the situations when TDS will not be deducted?

To answer this question, you must know that when an individual makes a payment to the Reserve Bank of India[1] (RBI) or to the Government of India, no TDS will be deducted.

No TDS is deducted if the payment is made to the following:

- UTI, LIC and other cooperative or insurance societies;

- Banks;

- State or Central Financial Corporations;

- Interest in Indira Vikas Party, KVP or NSC;

- Interest paid under direct tax or refund from the Income Tax Department;

- Interest received from savings accounts in cooperative societies;

- Banks or from recurring deposit;

- Interest received in NRE account;

- All other institutions notified under no TDS.

Apart from these institutions, there are other where tax deducted at sources is applicable,

Conclusion

Tax Deducted at Source or commonly known as TDS in India. Any company or any individual making payment needs to deduct tax at source if the payment exceeds the prescribed limit by the government. Benefits of TDS Return filing are enjoyed by both government and taxpayers. Tax Deducted at Source (TDS) is the advanced tax paid by any individual or entity for making contact payments, payments of professional fee, interest, salary, dividends and royalty among others as per prescribed tax slabs by the government on behalf of the payee.

Read our article:Latest guide on TDS under Section 194N of Income Tax Act: Cash Withdrawal