Capital plays a pivotal role for any organization to support its activities financially & maintain its liquidity. At any phase of service life, a company seeks additional funds for further expansion and plans to increase capital via available options. The capital market of a nation ensures a balance in the flows of funds within the economy, allowing firms to procure funds in a more regulated and secured manner. A company that seeks more funds can select the option of issuing its shares in the primary market and inviting an outsider to be its shareholders. This method of issuing securities is known as “going public”. Such actions are regulated by the government authority known as the Securities Exchange Board of India. This write-up aims to provide details regarding the different SEBI guidelines for IPO.

An Overview on Basics of Public Offer

Before we start exploring the core topic, let dive into some fundamentals that would help you understand the subject matter with a minimum of hassle.

Public offer or Public Issue

Public offer or Public issue refers to releasing securities of a firm to the investors and letting them be a part of a company as a shareholder. A public Offer is typically made to procure additional funds for the company to meet its fiscal needs. Public Offer has been classified as IPO and FPO. Here the term FPO stands for Further Public Offer.

Initial Public Offer (IPO)

When a firm that is not listed on the stock exchange (generally known as an unlisted company) released its securities or made existing securities accessible to the general public for sale for the first time is known as an Initial Public Offer or IPO. IPO enables the firm to list & trade its securities on several stock exchanges and procure a large amount of funds.

Further Public Offer (FPO)

When a listed company releases fresh securities or makes an offer regarding the sale, it is referred as Further Public Offer (FPO) or Follow-On Offer.

Read our article:Amendments in the SEBI (Mutual Funds) Regulations, 1996

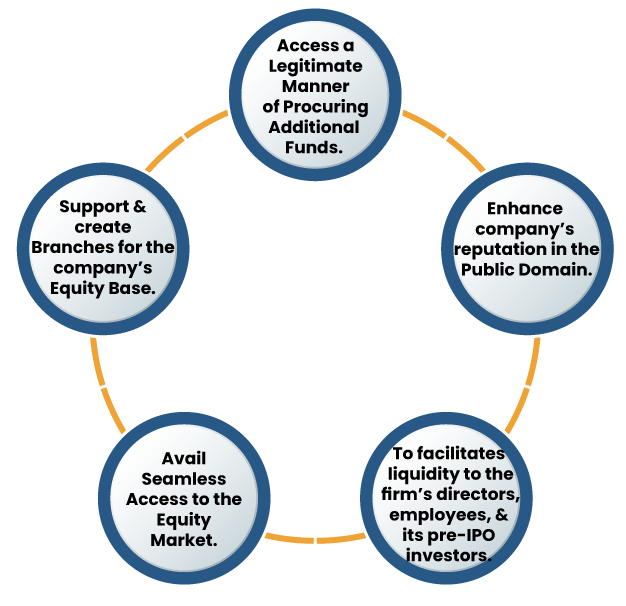

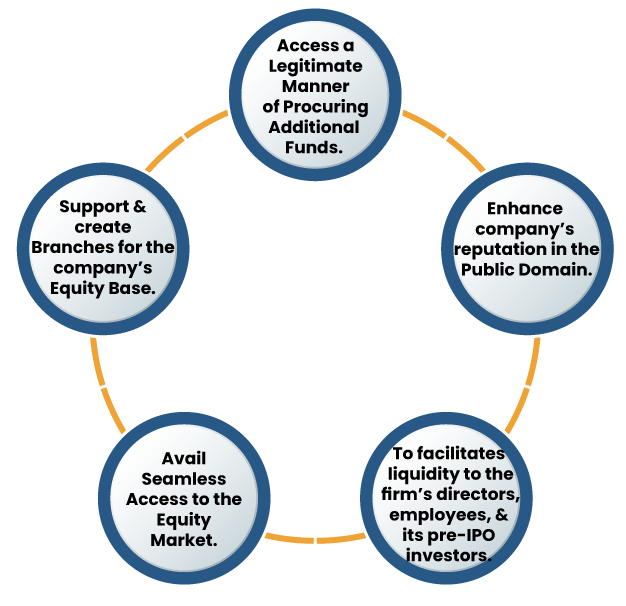

Viable Benefits of Going for Public Offer

A company may opt to go public for various reasons such as product development, exploring new markets, addressing liabilities, business expansion, etc. The viable advantages of making a public offer are mentioned below:-

What are the SEBI Guidelines for IPO in India?

The Securities Exchange Board of India (aka SEBI) was founded by the government in 1988. It is the sole authority that looks after the Indian corporate securities market- primary & secondary market. Private firms and commercial companies (driven by the central government) can enter the primary market to procure funds from the public to meet their financial requirements.

To ensure a transparent and unbiased market, SEBI keeps in amending the process of Initial Public Offer (aka IPO). Previously, SEBI lacks the right to regulate the securities market. During that period, such rights were under the possession of the Controller of Capital Issues. When the Exchange Board of India Act 1992 got the green signal from parliament, SEBI was conferred with various rights to regulates and oversee the securities market.

The SEBI – Securities Exchange Board of India[1] (Issue of Capital and Disclosure Requirements) Regulations, 2009, (aka SEBI ICDR) lays down various provisions related to the public offer. In addition to that, the Securities Contract (Regulation) Rules, the Securities Contract (Regulation) Act, 1957, and the Companies Act, 2013 render the compliances & process related to IPO filing.

The SEBI guidelines regarding IPO are bifurcated into two processes- for listed and unlisted companies.

SEBI Guidelines for IPO (Unlisted Companies)

There are three different routes accessible to an unlisted firm for making its IPO in India.

Profitability Route – Entry Norm 1

Under this route, the following SEBI guidelines for IPO have to be complied with:-

- The mini. net worth of the issuer should be higher than Rs 1 crore each preceding three years.

- The mini. net tangible assets of the issuer should be higher than Rs 3 crore each, & not more than fifty percent of these assets must be present in the form of monetary assets in the preceding three years.

- The mini. average operating profit (excluding tax) of the firm must be higher than Rs 15 crore in the past three years.

- The issue size should not exceed more than five times the pre-issue net worth.

- If the firm has altered its name, then a mini. of 50% of the revenue in the past year should be received from tasks conducted under the new name.

In addition to that, to comply with ease of doing business and permits firms to make their public offer easily, SEBI has rolled out two routers for firms who cannot meet the requirements under the profitability route. The given routes also enable a firm to access the primary market for its public offer:

QIB Route – Entry Norm II

Companies that seek large funding to support their operations but cannot do so under the profitability route can opt for the QIB route to make their public offer. Under this route, the company can get access to the public interest through the book-building procedure.

Under the process, 75% of the firm’s net offer must be allotted to the Qualified Institutional Buyers (QIBs). If the firm fails to meet the minimum subscription of QIB, it has to refund the subscription fee without exception.

Appraisal Route – Entry Norm III

Under this route, the public is appraised & participated to the extent of 15% by Scheduled Commercial Bank or Financial Institutions, of which a minimum of 10% is released by the appraisers. The appraisal route is limit by a condition that a mini. Post-issue face value capital should be Rs 10 crores, or compulsory market-making should be there for a minimum period of two years.

All the norms above also encompass the requirement of a minimum of 1000 prospective allottees in the public issue of the issuer company.

SEBI Guidelines for Public Issue (Listed Companies)

A listed firm that intends to make a further public issue (aka FPO) meets the given SEBI guidelines:

- If the firm has altered its trade name during the last one year, at least 50 % of its turnover for the preceding one year must be from tasks carried out by the firm under its new name.

- The size of its issue should not exceed than five times the pre-issue net worth as per the audited balance sheet of its preceding financial year.

Exempted Entities Covered under the SEBI Guidelines for IPO

SEBI has put certain kinds of entities outside the regime of norms above for making a public issue. These are as follows:

- Private & Public Sector Banks

- Infrastructure Company which has examined its project by the IL&FS or Public Financial Institution or IDFC, and at least 5% of its project cost is financed by any of these institutions. No entry norms are issued for the listed firm that intends to make the right issue.

Conclusion

The SBI Guidelines for IPO by an organization serve an essential purpose- protecting the interest of the firm and its shareholders. Often, a firm may opt for irrational ways to infuse more capital, which may disrupt the shareholder’s interest. SEBI guidelines for IPO ensure a legitimate process of IPO by a company.

On the other hand, the shareholder must conduct an extensive audit before opting for the company’s IPO offer. Besides, a company must ensure conformity with all regulations and guidelines laid down by the SEBI for IPO before its make its first public offer or ‘go public’.

Read our article:How SEBI Protects Investor Right?