The Finance Minister in the ‘Union Budget 2019’ has presented Section 194N for ‘deduction of tax at source (TDS)’ on cash withdrawals exceeding Rs. 1 crore, which will be valid from July 1, 2020. By way of this, the Finance Act, 2020, has tightened up the existing provisions for those who have not completed income tax returns.

Overview of TDS under Section 194N

The Government has presented TDS under Section 194N (Section applies to an accumulation of sums withdrawn from a particular payer in a financial year) intending to promote the digital economy and to discourage cash transactions in the country in the ‘Union Budget 2019’.

On the other hand, the Scope of TDS on cash withdrawal has been extended under the amended Section 194N of the Income Tax Act, which has been amended by vide circular under ‘clause 84 of the Finance Act 2020’.

If the with drawer has not finished filling tax return for three years, TDS at the rate of 2% is obligatory to be deduced. It will also be applied to the withdrawal during the year go beyond Rs 20 lakhs, but a lesser amount than Rs 1 Cr. TDS at the rate of 5% is required to be deducted for withdrawal more than Rs 1 crore.

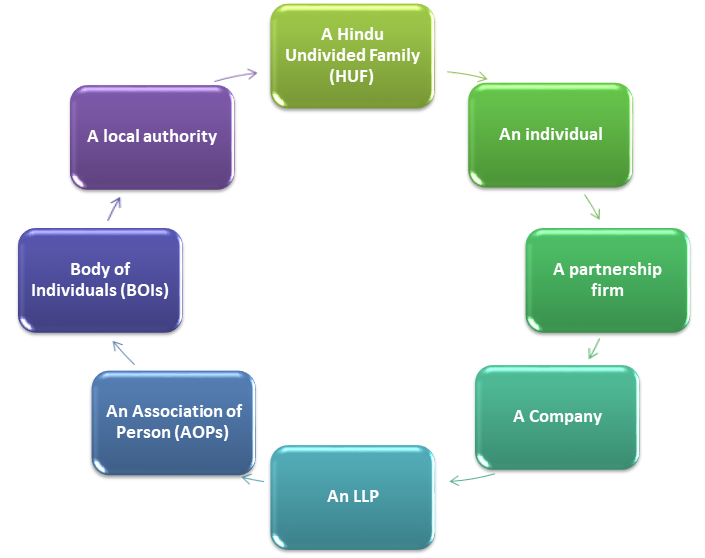

Applicability of TDS under Section 194N

The section applicable to withdrawals made by taxpayers who are as follows:-

On the other hand, TDS under section 194N will not apply to banks, comprising of co-operative banks government bodies, white-label ATM operator of any bank, business correspondents of a banking company, trader, farmers – whom the Central Government identifies the commission agent.

Read our article: How Form 15G and 15H Helps To Save TDS on Interest Income

CBDT Notification on cash withdrawal

CBDT has exempted cash withdrawal only for the ‘authorized dealers.’ The exempted parties from ‘TDS under Section 194N’ can also be comprised of its franchise agent and sub-agent, FFMC (Full-Fledged Money Changer[1]) permitted by the Reserve Bank of India legitimate mediators/agents.

CBDT exemptions for the following recipients:-

|

Specified Person |

Conditions for non-applicability of TDS under Section 194N |

|

|

|

|

|

Cash withdrawal is made only for the purpose of foreign currency for:-

|

CBDT also pronounces that the person (payer), which comprises any bank (both public and private), a co-operative bank, and the post office will deduct TDS under Section 194N, making the cash payment.

Easy Explanation with Examples

If the aggregate amount of cash withdrawal during the previous year by a member from one or another of his bank or post office account goes beyond Rs. 20 Lakhs, then only the ‘TDS under Section 194N’ tax, will be required to be deducted. It is also subjected to condition that the said person has not filed his Income Tax Returns for the last three years.

|

TDS Rate |

Cash withdrawal limit |

|

|

Payer has not filed tax returns for last 3 years & due date for filing tax return has expired |

|

2% |

Beyond Rs. 20 lakh but not considerable Rs. 1 crore |

|

5% |

Beyond Rs. 1 crore |

|

|

Other Payers |

|

0% |

Till Rs. 1 crore |

|

2% |

Beyond Rs. 1 crore |

Example A1: No TDS will be applicable if Mr. ‘A’ withdraws cash up to Rs. 1 Crore, and has filed all his returns.

Example A2: TDS will be applicable if in case Mr. ‘A’ with only 2% if he withdraws cash that is more than Rs. 1 Crore

Example B1: In other cases, TDS will be applicable at the rate of 2% if Mr. ‘B’ withdraws cash from ‘Rs. 20 Lakh to Rs. 1 Crore’ and has not filed all his returns.

Example B2: TDS will be applicable at the rate of 5% if Mr. ‘B’ withdraws cash which is beyond Rs. 1 Crore

Illustrations: TDS will be deducted by the spender to the payee while providing the cash payment beyond Rs 1 crore in a particular fiscal year. Once the total sum is withdrawn exceeds Rs 1 crore in a financial year, the payer will have to deduct TDS from the amount if the payee withdraws a sum of money on consistent intervals.

Conclusion

These are just an evaluation, and we always motivate our readers to examine the subject in-depth based on the stated case laws and amended rules/decided judicial decisions consequently. With this, the group of Corpbiz has experienced professionals to help you with the process of Income-tax fillings and tax exemptions parameters. Our expert will ensure the successful and favorable completion of your work.

Read our article: TDS Returns Filing: Due Dates and Procedure for Filing