Microfinance companies come under the category of financial institutions that render monetary aid to low-income groups. Since the launch of the RBI-driven financial inclusion program, the growth of the microfinance companies has been skyrocketed. These companies aim to provide hassle-free financial aid to the group of people who don’t have access to renowned financial institutions for credit. If you are aiming to establish such a company then you are on the right page. This blog will provide you step by step guide on how to start a microfinance company in India.

Apart from banks, only NBFCs are allowed to render financial services as per provisions of RBI. However, RBI has embedded some provisions that encourage some private entities to perform financial activities under specified circumstances. There are two business models proposed by RBI that serve this purpose.

- Registered NBFCs under RBI

- Section 8 Company

If you wish to run a microfinance company, choose one of the above business models as per your requirement. The following sections will explain how to register a microfinance company either as a section 8 company or NBFCs.

Registering Microfinance firm as an NBFC

Here are guidelines to register Microfinance Company under the NBFC business model.

Register a company

To adopt the NBFC based business model, the applicant must form a public or private company in the first place. The registration criteria of either of the business model differ slightly from each other. A minimum of 2 members and a capital of 1 lac are required for the private company registration. Meanwhile, in the case of a public company, a minimum of 7 members is required for the formation.

Accumulate capital

Every business needs funds to get established in a particular market, and microfinance companies are not an exception. Therefore, as per legal provisions, you need to procure a minimum of Rs 5 crore as a net owner fund to establish such a business model.

Deposit the capital

After accumulating the specified capital, make sure to transfer it to the bank in the form of a fixed deposit. Do not forget to avail ‘No lien’ certificate from the bank for this fund.

Apply for license

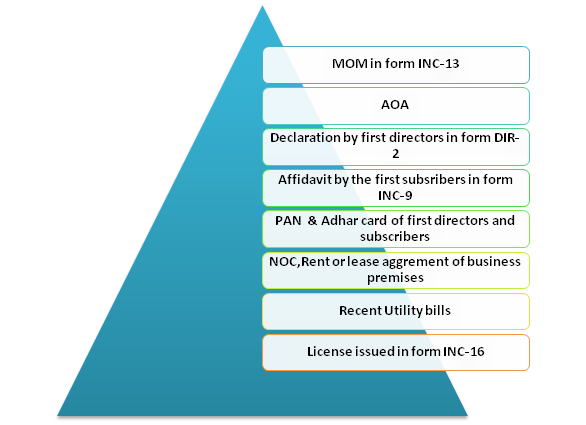

This is the last step in the registration process in which you need to file an online application and upload the scanned copy of the document on the RBI portal. Furthermore, the applicant should submit a hard copy of the same at RBI’s regional office. List of documents that go along with the application, are as follows:-

- Memorandum of Association (MOM) and Articles of Association(AOA)

- Certificate of the incorporation of the firm.

- Copy of the Board resolution prepared in the board meeting.

- Copy of Auditor’s report displaying the fixed deposit receipt.

- No Lien Certification issued by the bank stating the net owned fund.

- A confidential report issued by the bank about the company.

- Directors’ credit reports (only latest ones)

- Director’s net worth certificate

- Certificates displaying academic and professional background of the directors.

- Director’s income proof such as salary certificate, Wages, and tax statement.

- Director’s KYC

- Structure plan showing parametric details of the organization

Read our article:Accounting Treatment of Charitable Institutions under Microfinance

Registering Microfinance firm as a Section 8 Company

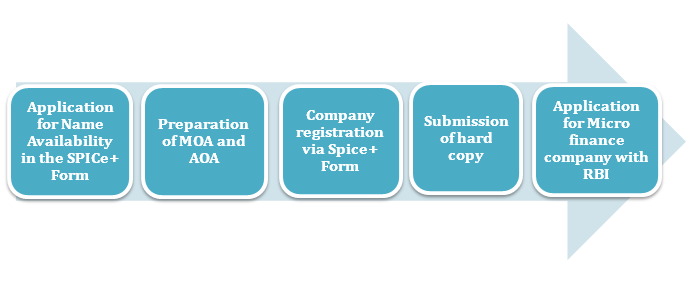

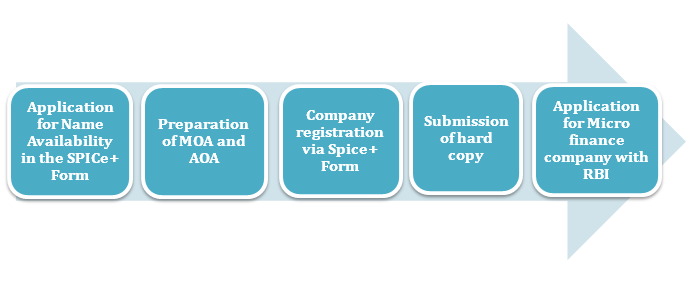

Section 8 company is another form of business that an applicant can adopt to establish a microfinance company. Follow the given guidelines to register your company as a section 8 company. In respect to simplifying the process of incorporating Section 8 companies on 7th June 2019 requirement of prior filling of INC-12 has been dispensed vide the Companies (Incorporation) Sixth Amendment Rules,2019[1].

Attachment of SPICe+

Apply for name availability DSC and DIN through SPICe+ form facility

DSC stands for Digital Signature Certificate. It is generally allotted to the directors and shareholders of the company to verified documents electronically. Meanwhile, DIN, aka Director Identification number allotted to the company’s director, is accountable for day-to-day handling tasks. Keep in mind that DIN is an eight-digit alphanumeric code that comes lifetime validity.

For this purpose, the applicant must submit it to the MCA’s website along with the requested documents. The inclusion of terms like Sanstha or microfinance in the company’s name is a mandatory requirement here.

Draft AOA and MOA

The next step is to Draft the Articles of Association (AOA) & Memorandum of Association (MOA) complying with mandatory documentation.

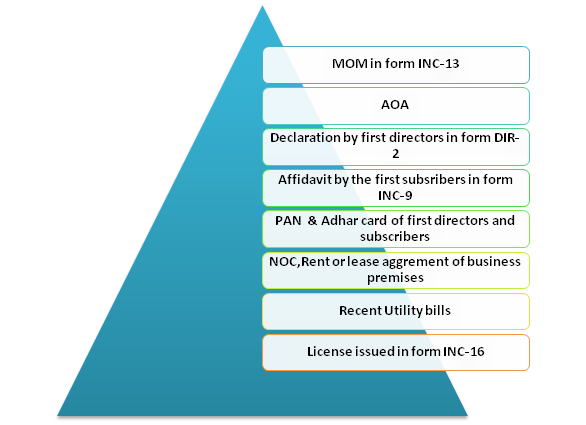

Filing of mandatory documents

This is the last phase of the registration process in which the applicant has to files the following documents. Those are as follows:-

- Identification proof of all directors/promoters such as PAN card or other supporting documents.

- Documents exhibiting proof regarding the address.

- Directors/promoters latest colored photograph.

- The lease agreement of the business premises.

- Ownership certificate of the business place.

- NOC from the legal owner of the business place.

- Applicable stamp duty.

Key points regarding microfinance companies

- Registering the section 8 company is relatively easier than the NBFC based business model.

- The lending capabilities of section 8 companies are lower than that of NBFC based microfinance firm.

- Most of the microfinance companies provide collateral-free credit.

- Microfinance firms typically serve the poor and unemployed people seeking financial aid.

Conclusion

There is no denying that documentation is the core of any registration process. If you don’t get it right, there is no way authority can approve your application, whether it’s a question of obtaining a trade license or availing mandatory registration to run your business. This notion is applied to the registration for microfinance companies as well.

The arrangement of document for any registration process is sensitive affairs, and it should be addressed with a deliberate approach. Having said that, if you have some doubts about this topic, allow our experts to clear it for you.

Read our article:Micro Finance Company Registration: Complete Process