At the very outset, Micro Finance is a home for financial services meant for entrepreneurs and diverse small businesses. Micro Finance institutions got introduced to ease the credit system for small businesses as they don’t get a loan from banks due to their complicated process.

They provide small loans that are less than Rs.50, 000 for rural areas, and Rs.1, 25,000 for urban areas. It provides loans at very reasonable rates guided by the RBI regulations and central government policies. They are the extensive support to all rural and agricultural development, which may even include income and job creation.

There are two forms of business models in India for Micro Finance activities which are-:

Is Micro-Finance allowed under trust?

Yes, Micro Finance is allowed under trust, and it is the base for many aspects of microfinance processes. It is the critical factor of microfinance success in India. The trust administers interactions within borrowing groups, clients, and loan officers or institutions.

To successfully address lots of strategic challenges by microfinance institutions (MFIs), they must design such mechanisms that may address low levels of interpersonal and institutional trust in their target populations. By increasing emphasis on Trust, MFIs can suggestively improve their financial sustainability and social influence too. With this, this blog emphasizes the trust and its essential role in Registrations, existing challenges, and real solutions in the microfinance industry.

What are the Salient Features of Microfinance Institutions under Trust?

- Micro Finance Trust institutions should get registered and included as per the Trust Act 1882 or the general Law of the land.

- They should have the least net worth as titled up by the authority before initiating its operations.

- They should have received the compulsory license or permit to commence the institution.

- They get counted in the low amount of financing institutions to the needy population.

- They should Offer banking assistance at minimal monetary charges.

- They should provide financial support to individuals who work in small trades such as ‘transportation,’ ‘fishing,’ ‘carpentry,’ Household cleaning, etc.

- They should support the participation of women in generating bearable livelihoods in the trust.

- Their motto should be to provide access to featured healthcare systems.

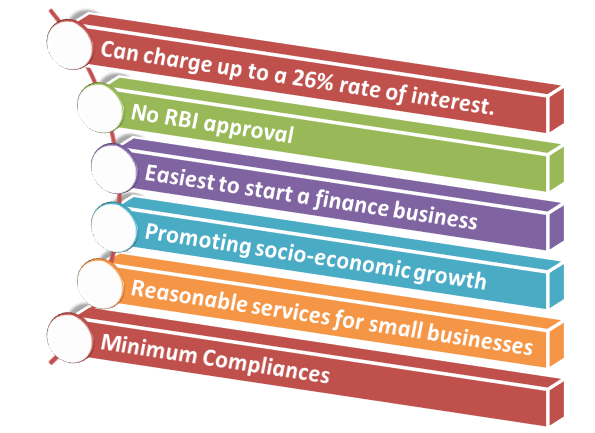

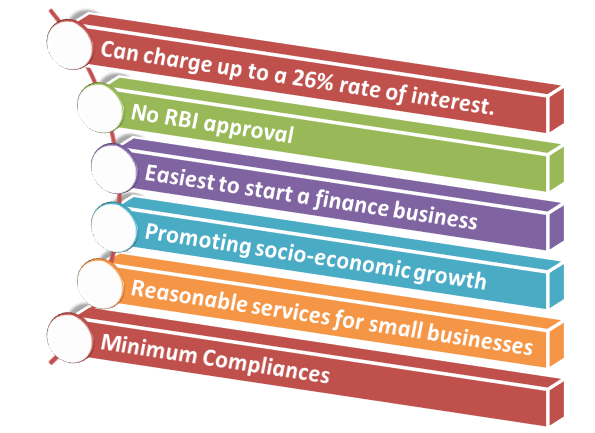

What are the Benefits of Micro Finance Trust Registration?

The Micro Finance Institutions in India get benefits under the guidelines given by Reserve Bank of India. RBI has created a policy framework to provide required legitimacies to the sector.

What are the detailed lists of Documents Required for MFI Trust Registration in India?

- Needs Certificates of Incorporation of a Trust with all licenses and Permits.

- Certified copy of Memorandum of Association

- Certified copy of Articles of Association

- Copies of Board Resolution regarding the proposed Microfinance Trust registration

- Certified Banker’s Statement

- Get Certified by Auditor’s report concerning receipt of the ‘minimum net‘ fund of the Proposed Trust for Micro Finance Registration.

- Get Certificate from Chartered Accountant concerning details of members of Proposed Trust for Micro Finance company Registration.

- Details of investments in other sectors as shown in the ‘Performa Balance Sheet‘ for the Proposed Trust for Micro Finance Registration

- Certified copies of the highest education of all the proposed members of Trust for Micro Finance Registration

- IDs such as PAN card, Aadhaar card/voter identity card/passport/driving license of shareholders, and Members.

- Get Passport size photograph of shareholders and Members.

- Address proof, which may include Rent agreement, Electricity bill, water bill, bank statement, and gas or telephone invoice of Proposed Trust for Micro Finance Registration.

- KYC/income, Net worth certificate, Recent credit report proof of the Director

- Complete Structure and Action plan of the trust and risk assessment policies.

- Copies of Certificate of Income Tax registration u/s 12A as specified in RBI Prescriptions

- An affidavit by the Trustees, making the application before a notary and performed on non-judicial stamp paper of Rs 10/-

- Consent letter, which may be equipped on a plain paper and signed by the Trustee/s other than the Trustee submitting.

What about the Formation and Essentials for the Procedure of Trust Registration for Micro-Finance?

- In general, MFIs get registered under the Indian Trust Act, 1882 either as public charitable Trusts or as private, determinable Trusts with definite beneficiaries/members of the trust. While the Indian Trust Act administers the private Trusts, 1882, public Trusts get served by the General Law of the Land.

- According to the Section 6 of the Indian Trust Act 1882, the essential elements of a Trust are of three parties – the author, Trustees and beneficiary; which also depicts – a) Declaration of a Trust; b) Certainty of the subject matter of a Trust; and c) Certainty of objects of the trust.

- The application for a public charitable Trust for Micro Finance registration should get submitted with adequate fees to the deputy/assistant charity commissioner having jurisdiction over the region/sub-region in which the trust required to be registered.

- The Trust application form should sign up by the applicant before the regional office, or superintendent of the provincial office of the charity commissioner or a notary.

- If one agrees to start a Trust with a token amount of Rs, 1,000/-, the Trust deed must get implemented on a non-judicial stamp paper of Rs40/-.

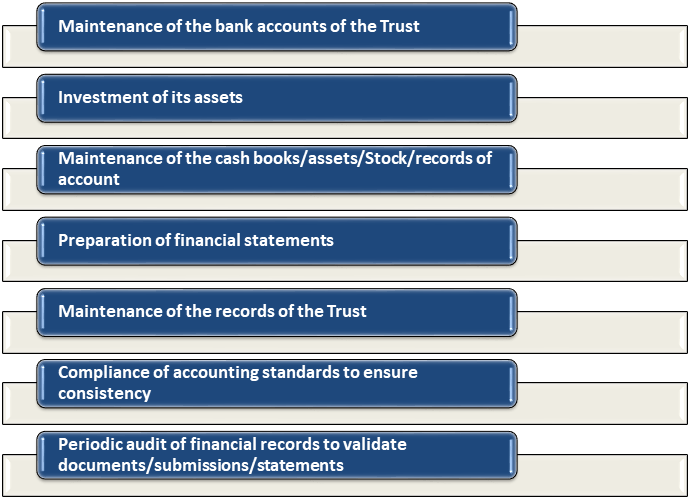

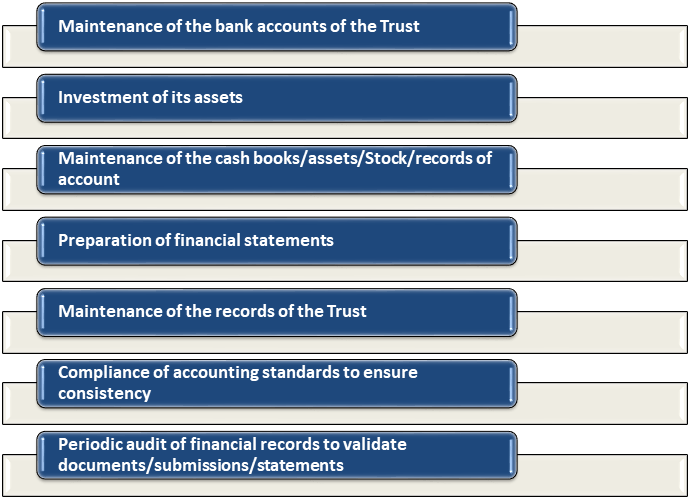

- Trust must Maintain proper set of Books of Accounts; Management must have the following policies:-

- The provisions administering the acceptance of foreign input by the societies for charitable commitments would apply to the Trusts using the funds for related purposes. The Trusts may also need to endure all the required processes and measures that a Trust needs to undergo to gain the foreign aid as contributions.

What do you mean by Transaction Costs under Trusts?

- Trust is the stage where it plays a central role in the financial markets. Not only it is essential for the industry to attain a reasonable advantage, but they identify extended trust as the key in endorsing co-operation in supply chains and clusters/Regions.

- It is crucial for economic growth and an imperative for establishing an operative market economy. It also seems that the fundamental requirements for trust in a well-functioning economy rests where the legal contraptions are a substitute for trust, and transaction costs are effectively higher.

- The importance of building trust among people for microfinance institutions is to effectively overcome market disasters such as high transaction costs, asymmetric information, and lack of security among the poor. Microfinance Institutions in India, aggressively sought to reduce transaction costs by growing the level of trust between financial mediators and poor rural borrowers.

- The role of MFI’s as constructing up trust is to bridge “the gap between the need for financial services through time, geographies, and risk profiles” between the poor that arise out of market miscarriages. Therefore, trust, which sees as a role of information, can lower ‘transaction costs’ in several ways. Most notably through reduced use of documentation and peer-monitoring which decreases the insecurity of borrowers.

Read our article:Know all the Restrictions on the Charitable Trust

What is the importance of Social Capital for the Success of Microfinance Institutions under Trusts?

Micro Finance Institutional Trust has different mission objectives and sometimes numerous, such as refining the livelihoods of the poor while attaining economic self-sustainability. Moreover, Social capital has found to be essential for the success of MFI’s, regardless of their core undertakings.

While intensifying, social capital increases the success of microfinance members. It also promotes the self-sustainability of MFI’s by providing higher repayment and saving rates. Social capital is one of the critical elements of success for small-scale entrepreneurs determined by earnings.

However, trust, as a component of social capital, helps to solve market failures and, in turn, can be used to predict the success of MFI’s (as determined by repayment rates). Trustworthiness can overcome the lack of contract implementation through a measurable positive impact on repayment rates. Thus, it is a significant component in determining the success of group lending outlines and schemes, as stated above.

What is the Scenario of taxation for the Micro Finance Institution under Trusts?

- We all are aware that Section 11 of the Income Tax Act exempts the income of charitable trust from the charge of tax on the completion of certain situations. Moreover, according to the sections 12, 12A, 12AB and 13 and specific clauses of Section 10 of Income Tax Act oversee the issue of taxation of such MFI Trust. Subsequently, the object of microfinance may get reflected as a charitable function.

- The local evaluating officers of the Income Tax Department usually exempt the income commencing from microfinance activities from Chargeable taxes. Nevertheless, MFIs need to apply to the income tax authorities to get this exemption with due process and returns an interval period.

What needs to done for availing exemption under Section 11?

- Registration: The MFIs Trust Proposed for registration under Section 12A, the MFI Trust or institutions should apply within one year from the date of establishment of the trust, in Form No 10A (in duplicate) along with the ‘memorandum of association’ in original. Attach all the documents stated above (Documents required) and apply as per the procedure given. After getting the order, granting or refusing registration has to get approved within six months from the end for which the registration got acknowledged. Moreover, if the Commissioner of Income Tax is satisfied relating everything, he shall, after giving reasonable opportunity of being heard to the concerned trust, passes an order concerning the canceling or accepting the registration granted under Section 12AA.

- Maintenance of Accounts: The Trust should prepare an ‘Income and Expense Account.‘ Any intended contribution received by the trust shall believe to be income resultant from the property held under trust. It shall form part of the corpus, and it should get specified on the receipt issued, as the same will be exempt under section 11 (1)(d) of Income Tax Act.

- Obligatory Audit: Whosesoever the total income of the Trust /institution surpasses Rs 50,000 in any preceding year, the accounts of such trust are required to get audited. The audit report needs to be furnished in Form No 10B as well as with the returns.

- No Income should get spent for the benefit of definite persons: No portion of the income or property of a charitable Trust claiming exemption under Section 11 of Income Tax Act should be used or applied for a profit of any person stated under Section13/3. However, it is a concern of subject to certain exceptions.

What are the Updates on the Indian Micro-Finance Industry concerning 2020-21 Impacts?

- GST Issue

- The Microfinance Industrial body, in its wish-list for Budget 2020-21, has insisted the government apply the charge of goods and services tax (GST) on the facilities and services delivered by the sector. Moreover, by highlighting the key demands, the Executive Director opines that – Micro Finance Institutions offer various services to the microfinance clients. They kindly request the Government of India that Goods and Services Tax (GST) should be done away only on the services, as, ever since, it is a service provided to the low-income section of the population.

- However, the additional tax load at this time has placed on these low-income clients who are counterproductive to the government’s policy on financial enclosures. In contrary to it, the counter has observed as there is no GST on loans from banks, and hence the same should not apply to loans taken from MFIs.

- In the middle of others, the industry expects the Budget to help in speed up lending from the public sector banks to Micro Finance Institutions. Moreover, by gradually slowing down in 2018-19, it came down to 12 percent of total borrowing from 22 percent in 2017-18. They are requesting the finance minister to strengthen plans for adequate funds for PSB that will used for the microfinance sector. It has also questioned for enhanced budgetary allocations to NABARD, SIDBI, and their holdings to increase the on-lending to MFIs.

- Ordinance turned into Law

- The Experts in the sector expect more small finance bank licenses getting issued, and the industry emerging as market-driven consuming all listed entities. Moreover, the Indian microfinance sector strikes out of the period on a low point. In that period- Right after the October 2010 disaster in Indian microfinance, the then Andhra Pradesh government has been reacting to reports of coercive loan repossessions by some MFIs. They were the promulgated an ordinance, commanding immediate drastic curbs on MFI operational.

- As a result of all the efforts taken up by the government, the ordinance that later turned into a law by an Act of the stateAssembly required MFIs to record themselves with multiple state government bodies. They need to declare their interest rates upfront and make all particulars relating to borrowers public, stop looking for weekly repayments, and deny extra credit to borrowers who already have loans unresolved. It had consequences across the sector and in further geographies too.

Closing Remarks

There is no arguing that trust is an essential module in economic transactions. It is exceptionally vital to achieve a high level of growth, and interestingly MFI’s advances the chance to those developing countries which can use social capital for growth. This literary, as well as legal review, has shown the standing of trust as a constituent of social capital in helping microfinance institutions to achieve their aim of improving the poor become successful micro-entrepreneurs and/or develop independent institutions by overpowering market failures.

This blog also sought to give an overview of the literature that describes results in the attainment of MFI’s or whether it is the MFI’s that build up trust in the publics they function in. Herewith, we at CorpBiz have skilled professionals to help you with the process of Registering Micro Financed Trust/institutions, ensuring the successful and timely completion of your work.

Read our article:Micro Finance Company Registration: Complete Process