The Accounting Standards apply to NGOs, even if some of their activities are not so commercial or of business nature. Moreover, the facts say that there are various NGOs as Microfinance that lacks in commercial content in their daily activities. However, it would be reasonable to follow the Accounting Standards laid down by the Institute of Chartered Accountants of India. It will help in the sufficient flow of finance and monitoring as well.

Microfinance Institutions Operations

The prime operations held by the Microfinance are as follows:-

- Making small and flexible loans according to clients’ requirements

- Providing secure deposit facilities to the poor

- Includes collateral substitutes, such as group guarantees and compulsory savings

- Continuous monitoring and following up to ensure timely repayment of loans.

What are the Internal Financial Sources for Non-Profit Microfinance?

- Income from loan portfolio: It is the income that a Non-Profit Microfinance derives from its lending operations.

- Investment income: The second income for Microfinance is from its prudent as well as cautious investments. These Investments generally are of excess cash invested by the Microfinance into ‘fixed deposits,’ ‘savings bank accounts,’ ‘marketable securities,’ etc.

What are the External Funding Sources under Non-Profit Microfinance?

- Promoter’s contribution: Non-Profit Microfinance can collect funds as a promoter’s contribution. It could be as a donation for not-for-profit existences only.

- Share Capital: Share capital is an advanced instrument primarily for earning a return automatically.

- Commercial Debt: These borrowings evolve from commercial banks, development banks, and other regional and foreign funding bureaus for lending to clients.

- Preserved earnings from Schedule operations: By way of reserve in the profit and loss statement, some Microfinance keep part of their earnings and incorporate them in the’ balance sheet’ as retained earnings.

- Grants from global and national donor bureaus: These are either as a revolving grant or as a grant for operational deficit, or could be grants for program support.

- Grants from the government: The government combines different development programs with Microfinance, such as by way of donations, grants, etc. Though this is not significant in terms of volume, it has contributed too many Microfinance to move forward.

- Promotion funds/subsidized funds from NABARD: NABARD provides promotional grant to Self Help Promotion Institutions.

- Corporate Donors: In this corporate world, Non-Profit Microfinance is getting identifying with social causes, receive contributions from corporates by way of donations in cash or kind, etc.

- There are few considerations that need to be taken care of in terms of Internal and external circle of Accounts treatment. The cycle is as follows:-

Non-Profit Microfinance Enterprises Registered as Societies and Trusts

- Non-Profits Microfinance activities are often gets registered under the Societies Registration Act, 1860. As they got instituted as a not-for-profit, the Microfinance activities also need to get created under the same legal umbrella.

- Few of the Non-Profit Microfinance gets registered under the Indian Trusts Act, 1882 either as public charitable trusts or as private, determinable trusts with specified beneficiaries/members.

- By considering the public nature of Microfinance actions, it gets a widely accepted notion that it works for the relief of poverty. Under this law, the registered society would need to consider ‘Microfinance’ clearly as an activity it would be taking up as part of its ‘charity’ work – as one of the objectives in its ‘Memorandum of Association.’

What are Micro Finance Operational Expenses?

- Funds for Microfinance clients can be obtained either by obtaining wholesale loans from the formal sector or by building up their surpluses. It is possible only if Microfinance charges their clients, not only the full cost of providing services but also a small additional amount that enables them to generate a miand build up their net worth.

- Microfinance institutions usually incur three types of costs while delivering financial services to clients:

- Operating costs: – The Microfinance experiences these costs in delivering credit to the clients, including visits to the clients, completing paperwork, disbursing loans and collecting repayments. It includes the cost of minimizing risk through monitoring and follow-up of disbursed loans, exercising internal control, and undertaking an external audit of the Microfinance.

- Risk costs: – These are the cost of portfolio losses incurred despite undertaking every effort to minimize it. They are the provisioning expenses reserved to meet the possible losses. These represent non-cash operating expenses for Microfinance.

- Cost of Funds: – The third cost that Microfinance incurs is the cost of funds. This cost gets incurred in borrowing or raising funds for on-lending to Microfinance clients. Here, Funds mean the borrowed funds as well as the interest-bearing savings, if any.

What are the Parameters of Taxation for Microfinance Registered as Societies and Trusts?

- Microfinance institutions registered under the Societies Registration Act, 1860 and Indian Trusts Act, 1882 as societies and trusts respectively, are subject to standard rules of taxation under the Income-tax Act, 1961[1].

- Section 11 of the Income-tax Act, exempts the income of charitable societies and trusts from the charge of tax on the fulfillment of certain conditions. The sections 12, 12A, 12AB, 13 administer the issue of taxation of such enterprises.

- To get exemption under sections 11 and 12, a Society/ Trust engaged in Microfinance is required to fulfill the following conditions:

- Registration: For registration under section 12A with the Commissioner of Income-tax, the Society or Trust should apply within one year from the date of creation of Society or Trust

- Compulsory Audit: The total income of the Society/Trust is required to get audited, and the audit report in Form No. 10B, is expected to be furnished along with the return.

- Application of income: If the Society/Trust has applied the entire income or at least a specified percentage of income for the year (85 %) for charitable purposes (Microfinance), the whole of the income shall be exempt from tax.

Read our article:Setting off Excess Expenditure against Income of next year by Trust and NGO

What is the Applicability of Accrual Basis of Accounting Standards?

- The term ‘basis of accounting’ refers to the timing of recognition of revenues, assets, expenditure, and liabilities in accounts. The commonly prevailing bases of accounting are:-

- Cash Basis Accounting

- With this, transactions get documented when the related ‘cash receipts‘ or ‘cash payments‘ take place. Thus, the interest received on loans advanced is recognized when cash is collected.

- Similarly, expenditure on ‘acquisition‘ and ‘maintenance of assets ‘used in the rendering of services as well as on employee remuneration and other items gets recorded when the related payments take place.

- The end-product of the cash basis of accounting is a statement of ‘receipts and payments,’ which classifies cash receipts and cash payments under different heads. An explanation (statement) of assets and liabilities may or may not get prepared.

- Accrual basis of accounting

- It is the method of recording transactions by which revenues, costs, assets, and liabilities get shown in the accounts in the period in which they accrue. The ‘accrual basis of accounting’ includes considerations associating to deferral, allocations, depreciation, and amortization. This basis gets assigned to as ‘Mercantile Basis of Accounting.’

- Accrual basis of accounting attempts to record the financial effects of the transactions. It affects other events of an enterprise in the period in which they occur rather than recording them in the period(s) in which cash is collected or paid by the Microfinance.

- Accrual is a technical basis of accounting and has conceptual superiority over the ‘cash basis of accounting.’ Accordingly, it gets recommended that all non-profit Microfinance should maintain books of account on an accrual basis for all elements of financial statements.

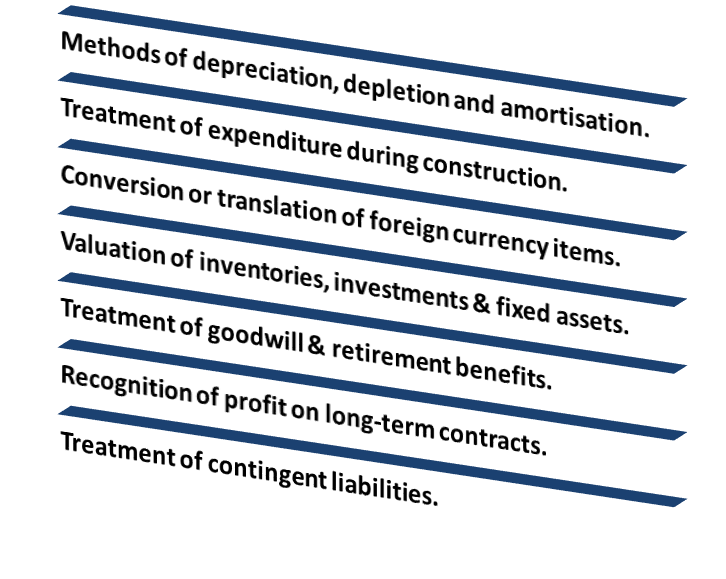

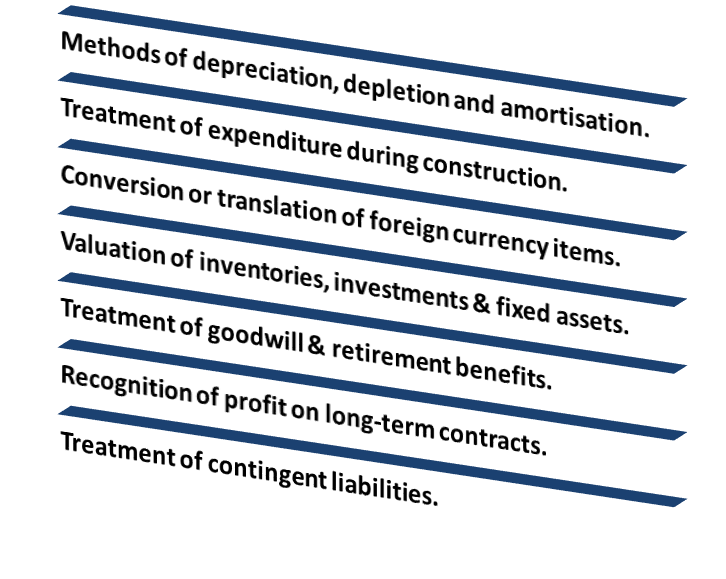

Some examples of the areas in which different accounting policies may be adopted by different enterprises are as follows:-

Note: –The list of examples is not intended to be exhaustive.

What are the Salient Features and Principle requirements for accounting treatment of charitable society or NGO under Microfinance (loans)? Briefed

Valuation of Inventories: – It applies to the assessment of all inventories except work-in-progress arising under construction contracts including directly related service contracts

- Cash Flow Statement: – Information about the cash flows of an enterprise is useful in providing users of financial statements. It works with a basis to assess the ability of the enterprise to generate cash and cash equivalents and the needs of the enterprise to utilize those cash flows.

- Contingency occurring after the Balance Sheet Date: – It deals with the treatment in the financial statements of emergencies and events occurring after the balance sheet.

- Net Profit or Loss for the Period: – It deals with disclosure in the profit and loss account of (a) significant items arising in the course of ordinary activities of the enterprise; (b) extraordinary items; (c) prior period items; (d) changes in accounting estimates; and (e) changes in accounting policies.

- Depreciation Accounting:-The depreciable amount of a depreciable asset should get allocated on a systematic. It should base on each accounting period during the useful life of the asset.

- Construction of Contracts: – The objective of this Standard is to prescribe the accounting treatment of revenue and costs associated with construction contracts.

- Revenue Recognition: – Revenue from sale of goods should be recognized when all the following conditions get fulfilled:

- The seller of the goods has to provide by transferring to the buyer property for a price. All notable risks and rewards of ownership have moved to the buyer, and the seller retains no effective control of the goods to a degree usually associated with ownership;

- No uncertainty should exist concerning the amount of the consideration that will derive from the sale of the goods; and

- It is not to be a single reason to expect the ultimate collection of the consideration.

- Accounting for Fixed Assets: – A fixed asset defines as “an asset held to get used to produce or provide goods or services and not held for sale in the normal course of business.”

- Changes in Foreign Exchange Rates: – An enterprise should apply it in accounting for transactions in foreign currencies and in translating the financial statements of international operations.

- Accounting for Government Grants: – Government grants are “assistance by government in cash or kind to an enterprise for past or future compliance with certain conditions.”

- Accounting for Investments: – Investments are “assets held by an enterprise for earning income by way of dividends, interest, and rentals, for capital appreciation, etc.

- Accounting for Amalgamations: – It deals with the treatment of reserve or goodwill. The Standard is directed principally to companies, although some of its requirements also apply to financial statements of other enterprises.

- Borrowing Costs: – Borrowing costs get defined as “interest and other costs incurred by an enterprise in connection with the borrowing of funds.” Thus, apart from interest, borrowing costs would also include the following:

- Commitment charges on bank borrowings and other short term and long-term borrowings;

- Amortisation of discounts or premiums concerning the borrowings;

- Amortisation of ancillary costs accrued in linking with the arrangement of such borrowings;

- Finance charges in terms of assets acquired under finance leases or other similar arrangements; and

- Segment Reporting:-It establishes principles for reporting financial information, about the different types of products and services an enterprise produces (business segments) and different geographical areas in which it operates (geographical segments).

- Consolidated Financial Statements: – The Standard applies to the preparation and presentation of consolidated financial statements for a group of enterprises under the control of a parent and the accounting for investments in subsidiaries in the separate financial statements of a parent.

- Accounting for Taxes on Income: – It applies to accounting for taxes on income, including the determination of the amount of the expense. It also determines saving related to taxes on income in respect of an accounting period and the disclosure of such an amount in the financial statements.

- Interim Financial Reporting: – This Standard prescribes the minimum content of a temporary financial report and prescribes the principles for recognition and measurement in complete financial statements for an ‘interim period.’

Conclusion

The Trust/Society as an ingredient of social capital helps microfinance institutions to accomplish their aim of improving the poor and/or develop autonomous institutions by intending market failures. With this, we sought to give a sketch of the Account Treatments that describes results in the attainment of MFI’s. Herewith, we at Corpbiz have experienced professionals to help you with the process of Registering as well as accounting Micro Financed Trust/institutions, guaranteeing the successful and timely fulfillment of your work.

Read our article:Trust is allowed for registration U/s 12AA even if it’s activity has not commenced yet: ITAT 2020