India is the second-largest growing economy in the world with a huge population. The Private sector Banks and Government Banks cannot open their branches in the remote villages areas. Though the presence of India Banks is increasing, there is still limited reach to the remote regions of our country. In India, the Micro Finance Companies act as a cluster of banking services to meet the financial requirements of low-income people. These Companies are introduced for small-scale businesses that are not able to get loans from banks. The Micro Finance Companies provide financial services like credit, loan, insurance, money transfer, and savings. These financial institutions are a huge support to agricultural and rural development in India. In this article, we will discuss the process of Micro Finance Company Registration.

What is a Micro Finance Company?

The Micro Finance Company is also known as Micro Finance Institution. The Micro Finance Company is a type of company that provides financial services like credit, loan, savings, insurance, and money transfer to small enterprises and small businesses. These Companies offer microcredits to a special type of borrowers.

The Micro Finance Company is a non-deposit taking Non-Banking Financial Company (NBFC) (other than Section 8 Company registered under Companies Act, 2013), which performs banking at small scale as the other banks do. The existence of Micro Finance Company is at a very small scale as compared to NBFC. The Micro Finance Company provides lending of financial services to economically weaker sections of the society who do not have regular facilities of banking.

The individuals who have no access to capital, Micro Finance Company are the solutions for the individuals. The Micro Finance Company helps individuals to become stable financially and work for building a better lifestyle. The sectors who can opt the solution of Micro Finance Company to increase and improve production are as follows:

- Small-scale businesses

- Artisan Business

- Agricultural Activities

- Professional and Transport Trades

What are the objectives of Micro Finance Company?

The objectives of the Micro Finance Company are as follows:

- To offer banking services at small monetary amounts

- To increase in participation of women in generating sustainable livelihood

- To provide access to quality healthcare

- To make people with low-income self-sufficient

- For low-income people enrichment and increase in the mode of livelihood

- To offer financial and banking assistance to small-scale enterprises which cannot afford any collaterals

- To create an opportunity for self-employment for low-income people

- To provide financial and banking support to individuals who work in varying trades like fishing, carpentry, transportation, etc.

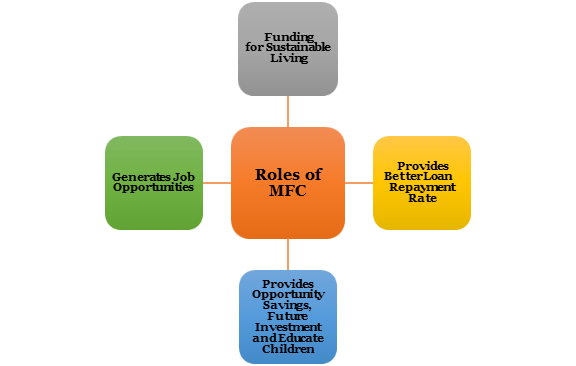

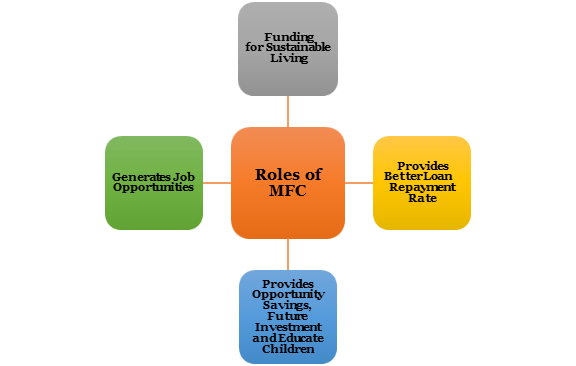

What is the role of Micro Finance Company ?

The role of Micro Finance Company are as follows:

Funding for Sustainable Living

- The Micro Finance Company creates opportunities for the underprivileged section of society to improve the living standards and become entrepreneurs. These Companies provide loans without any collaterals, which creates more flexible opportunities for initiating new business.

- The Micro Finance Company helps the following individuals to improve the standard of living:

- Villagers

- Indigent Women

- Low-income families

- Economically-weaker Population

- Small Entrepreneurs

Provides Better Loan Repayment Rate

- As compared to the traditional lenders, the interest rate of Micro Finance Company loans is lower. The default in payment of the loan by borrowers is a rare occurrence. Hence. To eliminate poverty, the loan provided by Micro Finance Company acts as a logical choice for many underprivileged people.

Provides Opportunity Savings, Future Investment and Educate Children

- The increase in poverty leads to eliminate the cost of education for many individuals. The loans provided by Micro Finance Company increase the stability of the livelihood of common people and also increases the savings of the individuals. Hence, through savings, individuals can create several opportunities for better education, health care, and future investments.

Generates Job Opportunities

- The Micro Finance Company provides lendings to individuals, which helps individuals to create businesses and which leads to the creation of job opportunities.

- The increase in labor increases the productivity and stability of income.

What are the basic requirements for Micro Finance Company Registration?

The basic requirements for Micro Finance Company Registration are as follows:

- The Micro Finance Company should maintain 85% of qualifying assets.

- The Reserve Bank of India (RBI) approval is mandatory for commencing of business affairs of Micro Finance Company

- The Micro Finance Company should maintain a minimum paid-up capital of 5 crore Rupees. In contrast, the Micro Finance Company in north-eastern states requires maintaining a minimum paid-up capital of 2 crore Rupees.

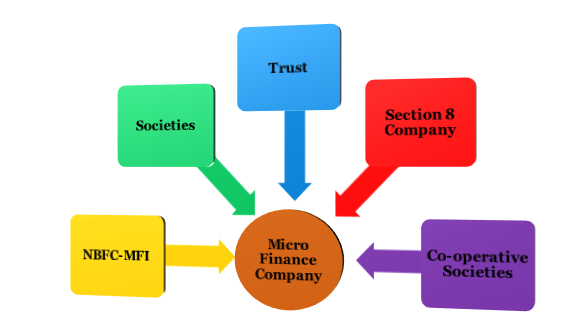

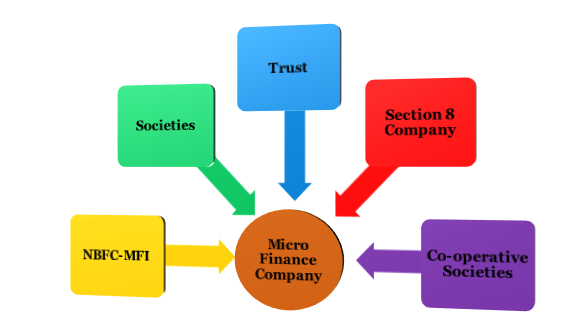

What are the different types of Legal Structure for Micro Finance Company Registration?

The different type of legal structure for Micro Finance Company Registration are as follows:

NBFC-MFI

- The Registration of NBFC-MFI is done as per Companies Act, 2013 with the RBI (Reserve Bank of India).

- The minimum capital required for Registration from RBI is 5 crore Rupees, but in the case of north-eastern states 2 crore Rupees is the minimum capital requirement.

- The NBFC-MFI is a non-deposit taking NBFC which have not less than 85% of its assets as qualifying assets.

Societies

- The Registration is done as per Society registration Act, 1860.

- There is no minimum requirement of paid-up capital under Societies.

- Societies are non-commercial organizations which are formed to promote objects like science, culture, art, religion, etc.

Trust

- The Registration is done as per the Indian Trust Act, 1882.

- There is no minimum requirement of paid-up capital under Trust.

Section 8 Company

- The Registration of Section 8 Company is sone under the Companies Act, 2013.

- The Registration of Section 8 company is very easy and does not require a minimum paid-up capital for Registration as Micro Finance Company.

- Section 8 Company is registered for not-for-profit or charitable purposes like art, commerce, science, sports, education, charity, religion, social welfare, environment protection, or any other subject. The profit or any other income is applied for promoting the main object of the company. The members of Section 8 company are not paid any dividend.

Co-operative Societies

- The Registration is done as per the Co-operative Societies Act, 2002.

- There is no requirement of minimum paid-up capital for Co-operative Societies.

- It is a voluntary association of individuals to meet the common social, economic and cultural needs and aspirations through a democratically and jointly owned enterprise.

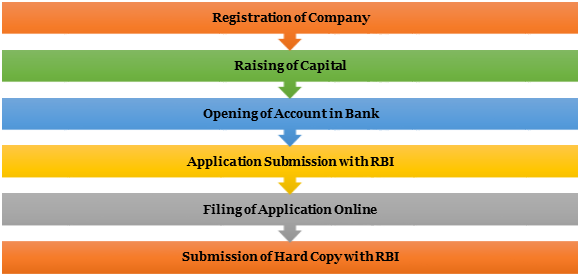

What is the process of Micro Finance Company Registration?

The process of Micro Finance Company registration is as follows:

Registration of Company

- The Registration of Company is done under the Companies Act, 2013. The company should be registered either as a Public Limited company or Private Limited Company. The initial capital requirement for Registration is 1,25,000 Rupees.

Raising of Capital

- The paid-up, as well as the authorized capital, is raised. The raising of capital to 5 crore Rupees or 2 crore Rupees is decided based on the case. The amount of capital raised should be done only through the Equity Share Capital. The capital cannot be raised through Preferential Share Capital. The possibility of raising capital from Preference Share Capital is ruled out from the step where the account is opened in Bank.

Opening of Account in Bank

- The amount received by the company after the Incorporation of Company should be deposited in the bank account as Fixed Deposit. Subsequently, the Bank provided a certificate of no lien to the applicant. The certificate of no lien should be attached to an application. After attaching the application with the no lien certificate, it should be submitted to the Reserve Bank of India (RBI).

Application Submission with RBI

- All the certified copies are submitted with reserve Bank of India (RBI) for carrying business operations of Micro Finance Company. The certified copies of the following documents are required:

- A true certified copy of Certificate of Incorporation of Company;

- A true certified copy of an extract of the main object clause in Memorandum of Association (MoA);

- A true certified copy of Fixed Deposit Receipt provided by Bank;

- A true certified copy of Bankers Certificate of no lien in relation to Net Owned Fund by the Company;

- A true certified copy Bankers Report.

Filing of Application Online

- An online application will be filed with Reserve Bank of India (RBI) for Micro Finance Company Registration. After the application for Registration is filed with RBI, the company will get a Company Application Reference Number (CARN).

Submission of Hard Copy with RBI

- After filing of application online, a hard copy of the application along with all the required documents should be submitted with the regional office of RBI (Reserve Bank of India).

- After receiving the hard copy of the application, the RBI will conduct Due diligence.

- Once RBI is satisfied, a certificate of commencement of business will be issued to the Micro Finance Company.

What are the documents required for Micro Finance Company Registration?

The necessary documents for Micro Finance Company Registration are as follows:

- A minimum of 2 people are needed for the Registration of Company;

- A latest passport size photographs of all Directors/Promoters;

- A copy of PAN of all Directors/Promoters;

- Digital Signature Certificate (DSC) of Directors;

- Directors Identification Number (DIN) of Directors;

- A copy of Identity Proof like Passport, Aadhaar Card, Voter ID;

- A copy of documents of property ownership;

- A copy of address proof like Electricity Bill, Bank Statement, Telephone Bill;

- A copy of Rent Agreement if the premises are on rent;

- A true certified copy of the certificate of Incorporation of Company;

- A true certified copy of Memorandum of Association (MoA) and Articles of Association (AoA);

- A copy of Banker’s Report

- A copy of Board Resolution regarding the proposed Micro Finance Company Registration;

- Report of Auditor declaring the minimum net capital owned by the applicant;

- A true certified and signed copy of the declaration of educational and professional qualifications of all proposed Directors of Micro Finance Company;

- A duly signed certificate from CA (Chartered Accountant) of Company regarding the detailed list of all the holding, group, subsidiary, associate Companies. The list should be attached to the particulars of all the investments made in other Non-Banking Financial Companies (NBFC’s).

- Any other documents as requested.

What are the advantages of Micro Finance Company?

The advantages of Micro Finance Company are as follows:

- The Micro Finance Company promote socio and economic growth of the economically weaker sections of the society.

- The Micro Finance Company helps in eliminating poverty from the society.

- The approval of RBI is not needed if the company is registered as a non-profit Company.

- There is no need for minimum capital requirements if the company is registered as a non-profit Company.

- The loan repayment rate is better than the traditional banks.

- The Micro Finance Company helps in meeting the basic credit needs of such a huge population. The different ranges of services provided by these companies are consumer loans, business loans, housing loans, working capital loans, emergency loans.

- The focus of Micro Finance Company is to build a financial system for the unemployed and poor people of the society.

- The main aim is to make permanent financial institutions for economically weaker sections of society and try to attract domestic deposits from people and then recycle them and provide as loans.

- The compliance with the RBI standards is mandatory even if the Micro Finance Company Registration is not required under the Reserve Bank of India (RBI).

- Section 8 Company requires no approval from RBI but will follow all the compliances of the Companies Act, 2013[1].

Conclusion

The Micro Finance Company acts as medium growth of financial Market. These Companies serve as the most important source of finance for the economically weaker sections of society. These companies provide financial services like loans, credit, insurance, etc., to the people living in remote areas of India. There is an increase in the number of such companies these days. The Micro Finance Company Registration process is time-taking and long-lasting. We at Corpbiz have experienced professionals to help you in enabling Micro Finance Company registration. Our team of professionals will guide you with the process of Registration. You just have to provide us with all the essential documents required for obtaining Micro Finance Company registration. Our professionals will assure successful and timely completion of your work. We aim to provide quality services to our clients to strengthen our bond with clients instead of focusing on monetary benefits.

Read our article: Types of NBFCs in India – An Overview