Section 122 of the Transfer of Property Act provides with a definition of gift as a transfer of existing movable and immovable property which is made voluntarily and without any consideration. Hence, gift deed is a legal document that contains the voluntary transfer of gift from the donor (property owner) to donee (gift receiver) without any consideration. Gifting of a house property is subject to certain income tax and stamp duty implication. In this article, we will discuss the important aspects of gifting of property in India and stamp duty provisions on gift deed.

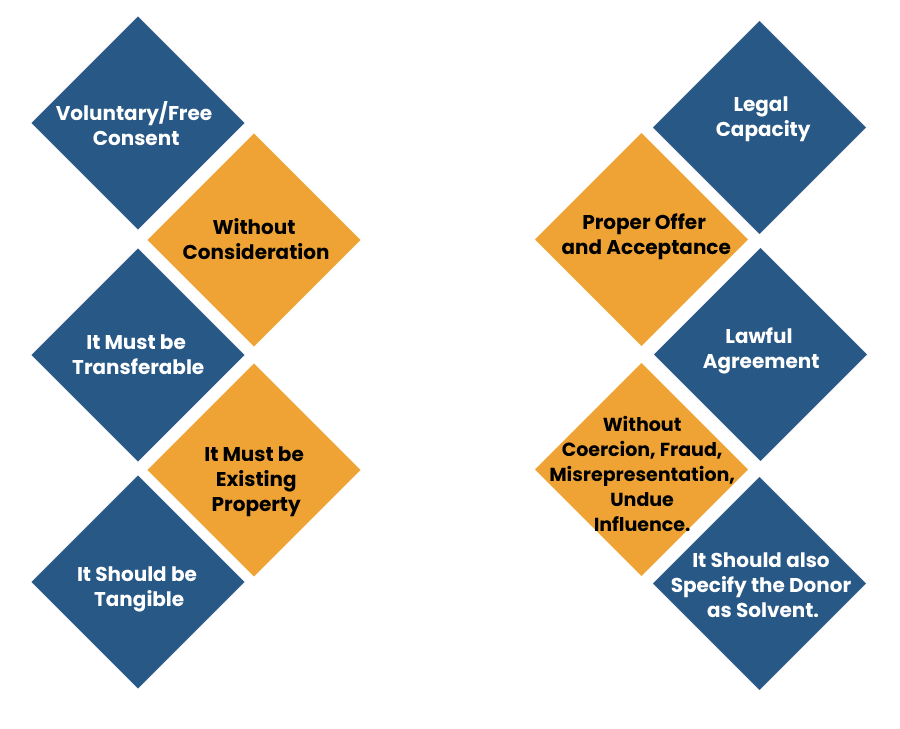

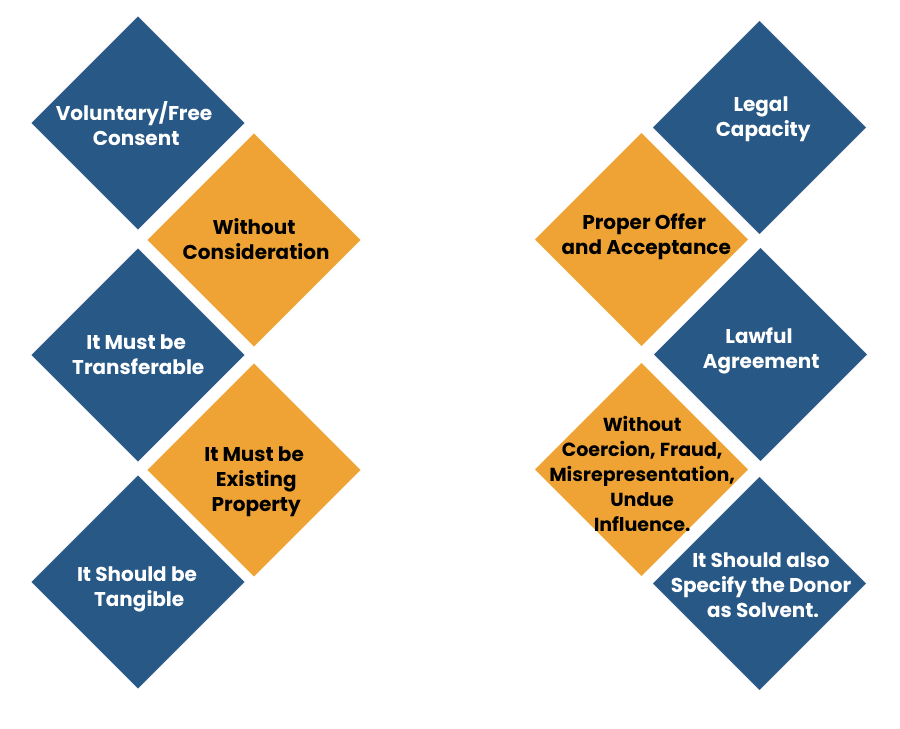

What are the Basic Essentials of Gift Deed?

The basic essentials which a gift deed must comply with to make it a valid transfer of gift:-

Legal Requirements to Comply for a Valid Gift Deed

According to the Transfer of Property Act, it is mandatory requirement that the gift of a transfer of house property has to be registered instrument, signed by the person gifting the property or on his behalf and it is ought to be attested by two witnesses.

- Section 17 of the Registration Act, 1908 makes it obligatory for the registration of the gift deed with the sub-registrar.

- The transfer of property is invalid if a gift deed is not registered.

- It is the duty of the registrar to ensure that proper stamp duty has been affixed on the gift deed or document at the time while it is given for registration.

- The amount of registration charges and the charges of stamp paid with regard to the gift deed are usually the same as in a regular sale. Nonetheless, in case the gift deed is transferred between some particularclose relatives then there are few states that provide concessions in the stamp duty.

For example, the state of Maharashtra has fixed a cap on the stamp charges that is paid on gifting agricultural property or the residential property to one’s children, spouse, grandchildren or wife of a son who has died, at the amount of Rs 200, irrespective of the property’s value.

Read our article:What is the Gift Deed and how it Works?

What are the Provisions of Stamp Duty?

Stamp duty is governed by The Indian Stamp Act, 1899. The incurred Stamp charges differs from state to state and it varies depending upon the property in consideration during the registration. It is collected and levied by the state government

Thus, a stamp charge refers to the tax that the government levies during the transaction of the property. It is a kind of physical stamp that is impressed on the gift deed or the legal document which ensures the transaction of property and confirms that the tax has been paid.

Mere physical possession of the property is not sufficient so it is important to have the legal evidence for the ownership of the property. Hence, it is mandatory to get the gift deed registered and comply with the stamp requirements to make a valid gift deed.

Stamp charge is the direct tax payable under section 3 of the Indian Stamp Act, 1899. It is payable on all financial transaction documents including promissory notes, bills of exchange, in addition to the property transactions.

Factors to Consider while Making Stamp Duty Payment

- Location- Stamp charges differ from state to state and the rates also differ in different areas. So, if the property is situated in a municipal area, the person will have to pay a higher rate than any property situated in a rural area.

- Full Payment – The payment given under Stamp Duty has to be the discharge of payment in full.

- Purpose- Stamp charges depends on the purpose for which it is used. Hence, the commercial buildings attract higher stamp fee in comparison with the residential buildings.

- Age of the Building- It is important to know the age of the building because the stamp rates are calculated depending on the percentage of the whole value of the property in the market. Hence, Old buildings have less stamp charges than the new buildings as the market value of the old building gets depreciated.

- Legal Document – The document on which the stamp rate is paid must be legitimate and should be admissible under the court of law to make it a valid gift deed.

- Ages of the Owner- Most of the state governments have subsidized the stamp charges for senior citizens. Hence, the owner’s age is important in deciding the charge.

- Gender of the owner- Women also gets the benefit of stamp duty concession if the property is in her name.

What is the Stamp Duty for Executing Gift Deed?

After the drafting of the gift deed it shall be printed on the stamp paper of the appropriate value and get registered at the registrar office the stamp charges varies from state to state which is given as below:-

| State | Stamp Duty |

| Delhi | 4% of the market value of property for Women6% of the market value of property for Man |

| Uttar Pradesh | 6% of the total value of the property for Women 7% of the total value of the property for Man |

| Karnataka | 5.6% of the land value- Transfer is to non-family members.For the family members- range from Rs.1000/- to 5000/- which depends upon the property location. |

| Maharashtra | 3% for the Family members 5% in the case of other Relatives Rs.200 in case if the residential property or the Agricultural land is gifted, |

| Gujarat | 4.9% of the total value of property in Market. |

| West Bengal | 0.5% for Family Members6% in any other case.1% of the surcharge above 40 lakh. |

| Tamil Nadu | 1% for Family Members and 7% for Other relatives |

| Punjab | None – where in case of blood relativeOthers- 6% of value of the property. |

| Rajasthan | 4% and 3% in case of SC/ST or BPL for Women5% for Man1% for the daughter or Wife 2.5% for close family members like son, daughter, father, mother, in-laws, grandson or granddaughter |

How to Pay Stamp Duty in India?

The given below are the three ways by which a stamp charges are paid to the respective state government:-

- Stamp Paper- The stamp charge must be executed on non-judicial stamp papers and is paid directly to the registered authority. Both the parties shall put in writing the terms of the agreement on the document or in case of a gift deed, the property that is being gifted and get it signed. It is then recorded by the stamp vendor regarding details about the transaction & the stamp purchaser and the same is mentioned at the back of stamp paper.

- Electronic Stamping- The Government[1] has introduced e-stamping with the objective to avoid fake stamp papers and to formulate easy stamping. E-stamping is a more suitable way to pay stamp duty as stamping is done online. For e-stamping, the SHCIL (Stock Holding Corporation of India Limited) website shall be visited.

- Franking-Franking is process in which the stamp duty is payable to the authorized banks having a franking centre. The documents are first prepared and then taken to the authorized bank which shall accept the stamp duty payment and then the bank shall stamp the paper to make it legal.

Conclusion

There are numerous legal rules and procedures that should be complied with for a valid discharge of gifting a property to any person. Thus, it is important to understand the legal implications of a gift deed. Therefore, the owner should mandatorily pay the stamp duty and complete all the specific procedure involved while making a gift of any property.

Read our article:Procedure for Gift deed registration: A Step By Step Guide