A gift deed is an agreement to legally transfer the property (movable or immovable) and it is executed between the donor and donee. Though gift deed replicates the sale agreement to a greater extent, it cannot be executed in the presence of any consideration whatsoever. As the name suggests, the gift deed is strictly based on the volunteer transfer of the property and it doesn’t lure any monetary arrangement. To execute a gift deed, there are certain things that an individual need to follow before legally transferring the asset/property to their beloved ones. In this article, you will learn what the gift deed is and how it works in the real world.

For a Gift Deed to be Valid

What is the Gift deed?

Transferring property in India is a matter of legal affairs. In these matters, anyone who intends to transfer the ownership of the property to another person needs to execute a legal contract that encloses comprehensive detail of the property, applicable clause, and involved parties. Under section 122 of the Transfer of Property Act, 1882, the gift deed can be executed by the donor for transferring the immovable property in the favor of the recipient.

Gift deed is more or less identical to the sale deed but it is free from sale consideration. As per section 17 of the Registration Act 1908, anyone who wishes to voluntarily transfer the property to the done must register gift deed with the sub-registrar, or else the transfer will be invalid. As soon as the gift deed is executed by the registrar, it cannot be revoked by the involved parties.

The Gift Deed Encloses the Following Clauses

A typical gift deed is incorporated with the given clauses. Those are as follows:-

Consideration Clause

It shall be executed in the absence of any consideration whatsoever or else it would be deemed as a sale.

Possession of Property

The donor must be the absolute owner of the property. Without legal ownership of a property, the gift deed cannot be executed. It should be an existing property.

Free will

The presence of coercion or fear shall void the agreement.

Detailed information about the property

The gift deed must enclose brief information about the property available to the concerned parties of the transaction.

About Donor and donee

Gift deed must manifest the relation between the donee and donor as it allows the parties to avail of a concession on stamp duty, particularly in the case of blood relationships.

Rights and Liabilities

Gift deed must incorporate with the rights of the donor and donee.

Delivery

The delivery clause typically includes the information about the mode, method, and delivery date of the property.

Revocation Clause

Modification of the gift deed is certainly impossible especially if it doesn’t enclose any revocation clause. Though it is not mandatory, such a clause can help overcome future complications.

List of Documents required

- An original as well as the duplicate copy of the certificate is compulsory for the registration.

- 2 passport size photographs of witnesses, donor, and the donee.

- Photo identification proof for all the involved parties such as voter’s ID and passport.

- Copies of incorporation certificate if the donor and the donee are not an individual.

- Proof of the land register card to show that the property is not acquired by the government.

- Copy of municipal tax bill to indicate the construction or built date of the land.

- PAN card of the involved parties.

- Signatures and passport size photos of all the parties.

Particulars Included in the Gift Deed Executed for Immovable Property

- Donor’s declaration regarding the transfer of the ownership of the property.

- Name and address of the witnesses along with their signatures.

- Description of the property including the address where it exists

- Estimate the value of the property

- Name and address of the donee along with their signatures.

- Name and signature of the donor.

Particulars Included in the Gift Deed Executed for Movable Property

- Donor’s declaration regarding the transfer of the ownership of the movable property.

- Name and address of the donor along with their signatures.

- Description of the movable property

- Bank detail plus address if gifting is done via cheque

- Income tax number, if applicable.

- Owner’s declaration regarding the revocation, if applicable.

- Name and address of the recipients along with their signatures.

Stamp duty for executing gift deed

After the drafting of the gift deed it shall be printed on the stamp paper of the appropriate value and get registered at the registrar office the stamp duty varies from state to state which is given as below:

| State | Stamp Duty |

| Delhi | Women-4% of the market value of property. Man-6% of the market value of property. |

| Uttar Pradesh | 6% for Women of the total value of the property. 7% for Man of the total value of the property |

| Karnataka | Transfer is to non-family members; it is 5.6% of the land value. In case of family members, it can range from Rs.1000/- to 5000/- depending upon the property location. |

| Maharashtra | Family members – 3% In the case of other Relatives – 5% If Agricultural land or residential property is gifted, then it is Rs.200 |

| Gujarat | 4.9% of the total Market value of property. |

| West Bengal | Family Members-0.5% In other cases-6%. 1% surcharge above 40lac. |

| Tamil Nadu | Family Members-1% and Other relatives-7% |

| Punjab | In case of blood relative-None Else 6% of property value. |

| Rajasthan | Women-4% and 3% in case of SC/ST or BPL Man-5% Wife or daughter-1% In case close family members like son, daughter, in-laws, father, mother, grandson or granddaughter-2.5% |

Tax exemption for gift of property

The general rule is that gifts have to be declared in the Income Tax Returns (ITR). Thus, in case of immovable property gift if its stamp duty value goes beyond Rs 50,000 and the property is received without necessary consideration then the person will have to pay tax.

But the exception is that if the property has been received from any of the given below list, then the donee will not be taxed:

- If the gift is received from relatives from a member or by an individual from a HUF.

- If the gift is received by way of inheritance or under a will.

- If the gift is received with the view in regard to the death of the payer or donor.

- Where the gift is received on the marriage ceremony of the individual.

- If the gift is received from an institution or trust registered under Section 12AA.

- Where the gift is received from the local authority (as given in Explanation to Section 10(20) of Income Tax Act).

- If received from any university, fund, educational and medical institution, foundation, any trust, hospital or other institution referred in the Section 10(23C).

Can a gift deed be revoked?

After the property has been gifted it cannot be revoked easily. However, as per the provision of Section 126 of the Transfer of Property Act, 1882, revocation of a gift may be permissible under the given below circumstances:

- The donor or done may agree upon the happening of specified event the gift deed shall be revocable but it shall not be on the will of donor.

- If the gift deed was made due to coercion or fraud.

- If it is found that the gift deed was made on grounds that were immoral or illegitimate.

In these cases, even on the death of the donor his legal heir can proceed with the revocation of gift deed.

Key Points

- It cannot be canceled once it is registered in the office of sub-registrar.

- Anybody can go through the record of the transfer of property available at the concerned Sub-Registrar office. The inspection would allow the individual to get ascertain the legal status of the property for which the concerned parties want to execute the gift deed.

- If the person wants to buy to property, they can inspect the available record for the same in the sub-registrar office to verify the legal status.

- The immovable property does not attract sales tax. But an applicant needs to pay the registration fee and stamp duty as per the provisions given in the Indian Registration Act 1908 and the Indian Stamp Act 1899 respectively.

- The movable property attracts both states as well as central sales tax as per the provision mention under the General Sales Tax Act and the Central Sales Tax Act, 1956[1].

Gift deed versus will

| Gift deed | Will |

| Gift takes effect during the lifetime of the donor. | Will takes effect only after the death of the testator. |

| Gift cannot be revoked/ Gift can be revoked only under specified circumstances. | A Will can be revoked several times. |

| Registration of Gift is mandatory under Section 123 of Transfer of Property Act, 1882 and Section 17 of the Registration Act, 1908. | It is not compulsory to register a will. |

| Charges include stamp duty and registration charges. | A will is reasonably cheaper. |

| Gift falls under the Income Tax. | A will is governed by the Law of Succession |

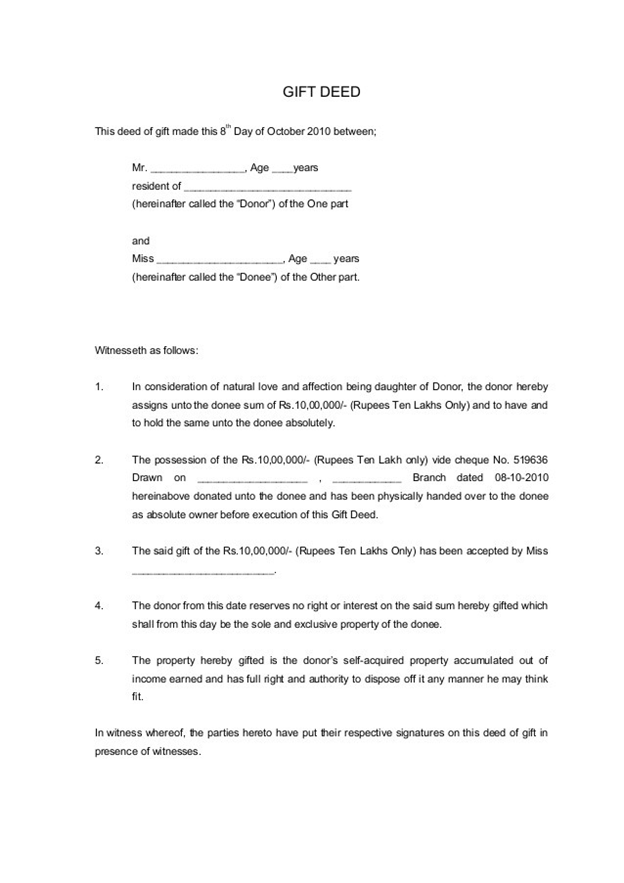

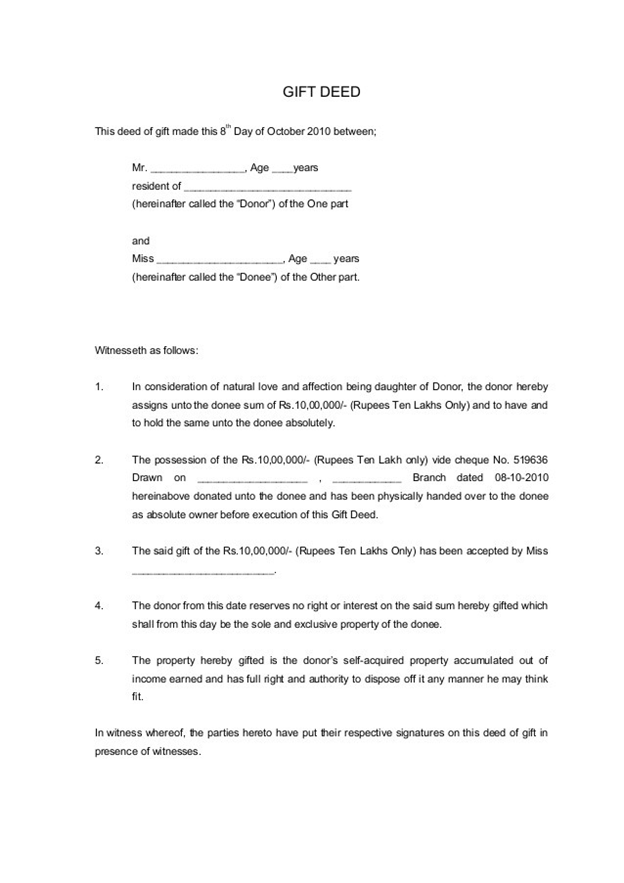

Sample Format of Gift Deed

A gift deed should be drafted properly and must include the details on place and date on which it is to be executed. The related information and complete details concerning the donor and the done and about the property that is gifted. There must be two witnesses and their signatures.

Subsequently, on the basis of the value as decided by the state government, the gift deed shall be printed on stamp paper after the payment of the requisite amount and the deed shall be registered at the registrar’s office. The sample of the gift deed is given below:

Conclusion

Among all other methods of registering the property’s transfer, It’s certainly the most profitable option. Since it’s mostly utilized for the voluntary transfer of the immovable property, it neither attracts state sales tax nor the central sales tax. CorpBiz’s professional can help you obtain such a registration in no times through deliberative and holistic approach. CorpBiz is a renowned name in the field in the licensing, governmental registration, and several other financial services.

Read our article:Procedure for Gift deed registration: A Step By Step Guide