A gift deed is referred to as a statutory document that encloses the act of transferring the property to the beneficiary from an owner in the form of a gift. The gift deed is executed between the donor (owner of the property) and the donee (beneficiary).

Precisely, it’s not important to execute a gift deed for transferring assets in the form gift; it does act a valid proof that might handy in the future to overcome the legal dispute. A typical gift deed encloses the declaration that property, be it movable or immovable, has been given to the beneficiary in the form of a gift. In this article, we will look into the core aspect of this topic and also explore the document needed for making a gift deed.

Who can be a donor/donee in a Gift Deed?

A donor is a person who transfers of immovable property. Any person with the best of health and mind can enter into an agreement can be a donor. As per bylaws, a minor is not legally permitted to enter into a contract.

A donee is an individual who receives a gift from the donor. A minor can be donee if the gift is accepted by the parent/Legal guardian on behalf of the donee.

Read our article:List of Advantages of Gift Deed Registration That You Must Know

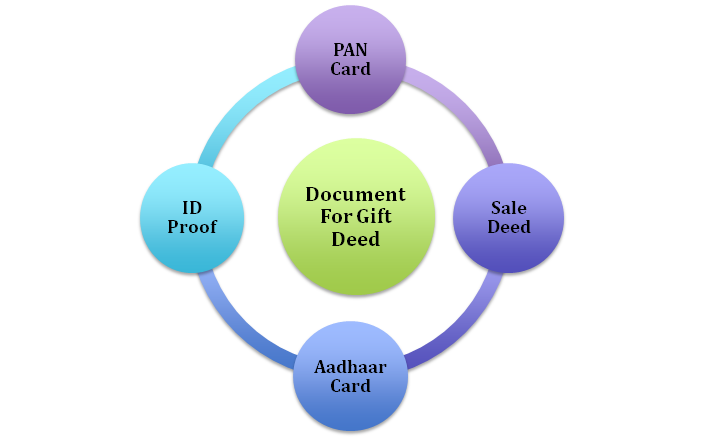

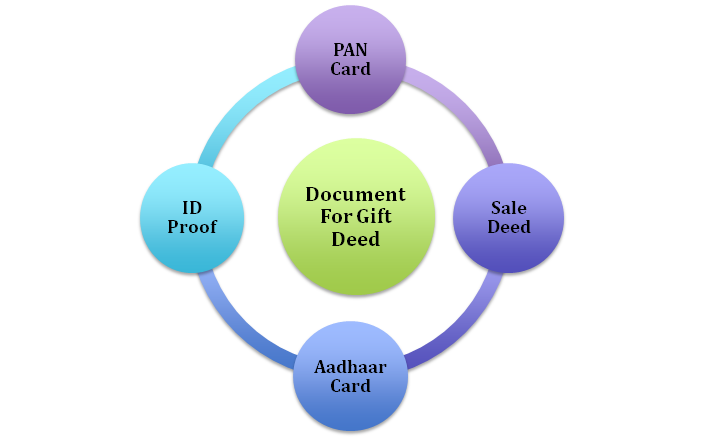

Document Needed for Making a Gift Deed

The applicant needs to fulfill certain legal formalities to complete the registration process, such as it must possess the signature of the donor and two witnesses. The presence of the donor and receiver is imperative in the registrar’s office at the time of registration. Also, the stamp duty and the registration payment must be made to register a Gift Deed. The following are the documents needed for gift deed registration.

- PAN card

- Identification proof driver’s license, passport, etc.

- Aadhaar card

- Sale deed stating the detail regarding the ownership of the donor over the property.

So these are the document needed for making a gift deed. However, the list could be exhaustive, as you may have to present different documents depending on the scenarios.

The Registration Process of the Gift Deed

The following section unfolds the steps required for registering a gift deed.

Drafting a gift deed

As gifting is conducted through voluntary action, the gift must contain the intent behind the gifting process, and it should clearly indicate that it has been executed without any force or coercion. It’s important to note that the gift deed should declare that the donor is not bankrupt.

Acceptance of gift

In the next step, the donee would accept the gift by the donee. The act of receiving the gift will be recorded in the gift deed along with the donee’s signature. Another vital fact to this step is that the gifting process cannot happen in the absence of the donor i.e. the donor’s presence is extremely imperative to validate the existence of the gift deed.

Registration of Gift Deed

Gifts that consolidate the immovable property must be registered to the Transfer of Property Act. In immovable property, the donor cannot transfer the title to the donee unless the gift deed is registered. As far as the stamp duty is concerned, it is payable, depending on the value of the gift. The valuation experts are the one who is responsible for the exact valuation of the immovable property.

Essential Points Regarding Gift Deed

- Depending on the state’s statuary law and how the deed is prepared, the stamp duty might be deducted if the owner is transferring the property to the trust. However, if the donor has decided to gift the asset to NGO, then he/she doesn’t have to pay the stamp duty. It’s worth noting that all the NGOs are allowed to accept the gift of immovable assets.

- In spite of gifting your properties, you might not wish to parts way with it at any instance in your lifetime. To ensure this situation, the transfer must take place via a will and not a gift deed. While creating the will, you have the chance to make the changes in it. That sort of liberty is not available in a gift deed.

- As per section 126 of the Transfer of Property Act, 1982, the revocation of a gift deed is impossible until and unless the donor specifies the same in the registered contract.

- If you are transferring the asset (estimated value of over Rs 50,000) to a non-relative, the donee will have to address the tax liabilities during that financial year.

- The donee and the donor will be not liable to pay taxes on the gift deed that has been executed. However, the donor still has to pay stamp duty on the transaction to legalize the gifting process.

- As per the property transfer law, after a property transfer upon a new person via the gifting process, the recipient/donee will be liable to pay the pending dues.

Key takeaways

- The entry of the minor in the gift deed is strictly prohibited as per the bylaws. However, it can be done if the gift is accepted by the parent/Legal guardian[1] on behalf of the donee.

- Once registered, the gift deed cannot be canceled in any situation whatsoever.

- A gift made to relatives is exempted from the income tax in the hand of the donee.

Conclusion

Executing a gift deed is probably the best proposition for someone looking to save taxes on the property’s transfer. It also helps the individual to legalize the whole process of property transfers. Gift deed acts as proof in the court proceeding, eventually helping concerned parties to resolve the legal disputes. In the term of law, the gift deed is a legal instrument that can be used to transfer the movable and immovable asset of an individual to the donee. All in all, gift deed offers tons of legal benefits over a will when it comes to tax exemptions and seamless transfer of property.

Read our article:Procedure for Gift deed registration: A Step By Step Guide