Transferring your assets to your friend or family member is now a lot easier than you think, particularly after the advent of the gift deed. The transferring of the property in India is executed by way of a gift deed. Individuals must register the gift deed even though the gifting process is free from monetary transactions. The registration will legalize the entire process. Oftentimes individuals try to relate the gift deed with a Will. However, a Will is executed after the demise of the property owner. Meanwhile, a gift deed is executed under the supervision of the owner. In this will unfold the Procedure for Gift deed registration by breaking it down to step by step guide.

What do you mean by Gift Deed?

A gift deed is a legal document availed after sanctioning the transfer of a property to the beneficiary. Section 122 of the Transfer of Property Act, 1882[1], renders the legal right to the individuals for transferring their property to the beneficiary of their liking via gift deed. Just like a sale deed, a gift deed encloses the details regarding the property, the donor, and the donee. The gift deed doesn’t deal with the financial transactions as it only transfers ownership to the beneficiary.

Illustration of the Provision

The Section 17 of the Registration Act of 1908 states that, individuals must validate gift deed through registration with sub-registrar. Furthermore, section 123 of the Act indicates that an unregistered gift deed shall be deemed invalid.

Apart from that, the registered gift deed holder shall be liable to apply for the property’s mutation. The mutation process is an essential part of the property sector, which advocates the transferability of the utility connections in favor of the beneficiary. The beneficiary must tender to a registered gift deed to further transfer the property.

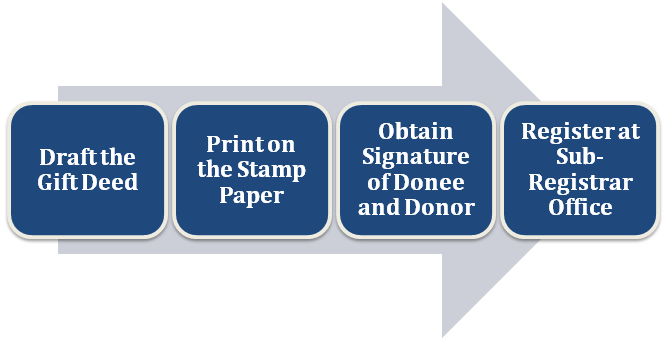

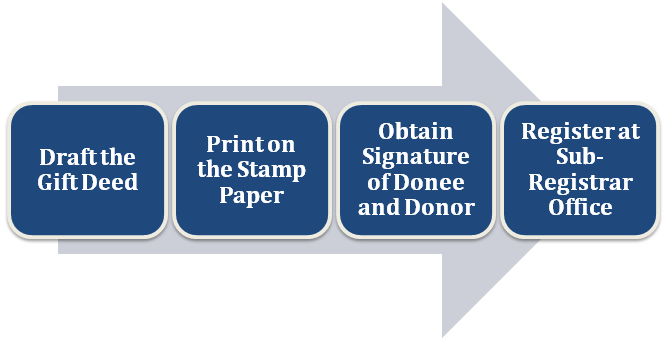

Procedure for Gift Deed Registration

Following are instructions to register the gift deed:-

- A certified professional will evaluate the property related to the gift deed.

- A gift deed will be signed by the donor and the donee in the presence of two witnesses.

- Approach to the nearest sub-registrar to submit the signed documents.

- Hire a lawyer for the calculation of the registration charges*, including stamp duty. You need to Pay the prescribed fees.

- Attest the deed

Charges for the Gift deed registration*

- For gift deed registration, you will have to pay the stamp duty and registration fee.

- In India, the state government determined the cost of gift deed registration like that of a sale deed. Prior to calculating the registration fee, a value determines the worth of the gifted property based on the market value.

The following table illustrates the cost of gift deed registration in major cities in India.

| New Delhi | 1% of the property’s market value + Rs 100 for pasting |

| Banglore | 1% of the property’s market value + Rs 500 + Rs 1500 for filing and postage fees. |

| Mumbai | Rs 200 for donee having family and Rs 30,000 or 1% of the property’s market value for non-family member donee. |

| Chennai | 1% of the property’s market value |

How Gifting Process work In India?

In India, the gifting process is categorized into three parts. We will address these parts individually to make things easier for you.

Drafting a gift deed

Drafting a gift deed is the first step toward to the gifting process. A lawyer’s involvement is quite vital here as he/she will be responsible for drafting the gift deed. The draft typically encloses the particular regarding the donee and the asset that is proposed to be transferred. It should be noted that financial transactions should not be carried out via gift deed.

Acceptance of the Property

As per the applicable law, the donee is required to accept asset/property from the donor during his/her lifetime. In case if donee won’t take the property from the donor, then the gift deed will become ineffective and turn out invalid.

Registration

As per section 123 of the transfer of property act, an unregistered gift deed cannot be deemed as a valid document in any case whatsoever. It’s a compulsion to include two witnesses to attest to the gifting process.

What can be gifted?

A gift must exhibit the following properties:

- The gift deed must indicate the existing movable and immovable property.

- Gift deed must be tangible and transferable in nature.

Advantages of Gift Deed over a Will

The following section depicts the advantages of a gift deed over a will. Those are as follows:-

- A gift deed is executed once the beneficiary and the donor agree to transfer; meanwhile, a Will is implemented after the property owner’s demise.

- A will allow the owner to take legal action in the matter of dispute, whereas a registered gift deed is free from litigation.

- The property transfer under gift deed doesn’t attract any tax liabilities.

Disadvantages

The given list illustrates the cons of a gift deed over a Will. Those are as follows:-

- After execution, a gift deed cannot be canceled, but a will is alterable in nature, and it can be modified as many times as possible as long as the owner is alive.

- Gift deed attracts additional costs in terms of stamp duty. The duty differs from state to state.

Conclusion

Keep in mind that gift deed is not for the minors. As per the bylaws, the minors cannot enter into the contract; henceforth, they cannot transfer a property to another person. However, the same law has a different proposition for donee in this context. If a donee is a minor, then his/her guardian on his behalf can accept the gift. The guardian will continue to follow the Procedure for Gift deed registration and adhering sole responsibilities being the owner of the property until the donee becomes an adult.

Read our article:Relinquishment Deed: Key Elements and Registration Process