Small finance banks primarily set up to support the under-privileged section of the economy, which often fails to avail of the benefit of major banks. Such banks emerge as an excellent platform for those lacking in financial prowess and don’t have access to major banks. These commercial houses primarily support small scale enterprises, small farmers, small businesses, or low-income households. This blog will address the key area of concern w.r.t Small Finance Bank license.

Small finance banks come under the Company Act 2013 and meet the compliances similar to a public limited company. Such banks are licensed under the banking regulation act 1949, section 22. Also, it works under the framework of the RBI Act 1943 regulation. These banks have been established to support the weaker part of the economy belong to rural and semi-urban areas.

Small finance banks give opportunities for using the current and saving accounts to their depositors. They also support them by providing services w.r.t refinancing, commercial papers, and fixed deposits. Coming to the interest rate, SFCs offer a 6-7% and a 9% rate of interest on saving and fixed accounts, respectively.

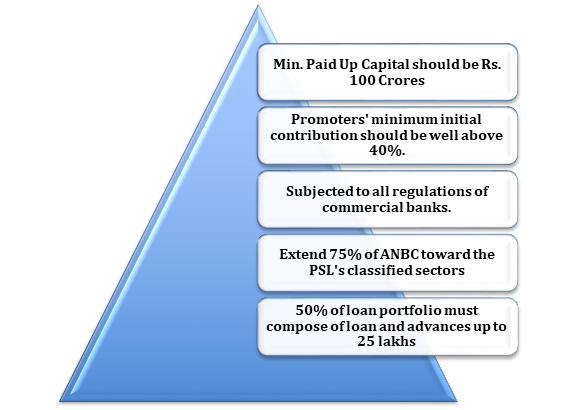

Small finance banks provide two types of loans i:e group & individual loans. Anyone can avail of group loans on joint liability. If one of the group members encounters some issue regarding the loan repayment, the whole group is accountable for completing the loan tenure. Prior approval from RBI is mandatory if a financial firm willing to be part of this business and want to open a new branch. An adjusted net bank credit of small finance bank is subjected to a mandatory 75% extension to classified sectors under the PSL by the RBI.

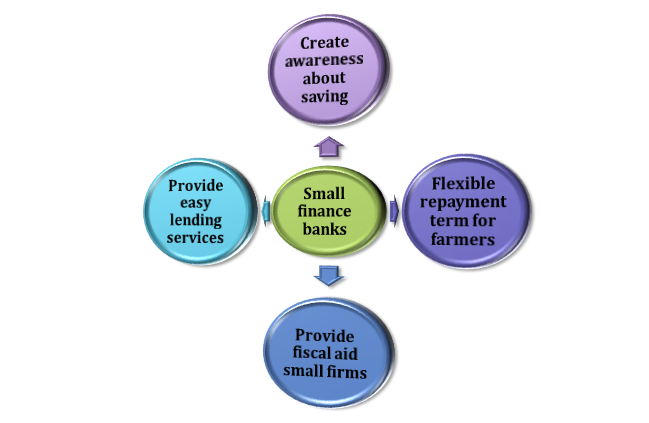

The objective of small finance banks

- Its primary objective is to provide an institutional mechanism w.r.t saving promotion among the underprivileged section of the society.

- It helps to provide financial help to small business units; small farmers, small industries, and other unorganized sectors.

Rules for Small Finance banks

- Small finance banks cannot violate the working framework of the conventional banking system. They must act as guiding light for underprivileged society lacking in financial support.

- They must perform primary tasks like lending and deposit for money to backward sections.

- It has to render excellent banking services to raise awareness about savings among the backward section of society.

- Since such banks are deemed as a public limited company, their promotion might pursue via individuals, trust, corporate, or societies.

- These banks shall not violate the provision of the RBI Act 1934 and the Banking Regulation Act 1949[1].

- Small Finance Banks, under no circumstances, raised funds from the Reserve Bank of India, unlike their primary counterparts.

Critical challenges encountered by Small Finance Bank

- It is hard for such banks to keep up with the evolving technology that supports seamless and swift transactions benefiting both customers and banks in several ways.

- Previously, Small finance banks work like Microfinance institutions that don’t deal with deposits very often.

- Small Finance Bank needs more significant investment to enable deposits via ATM and partnering with banks.

- Capital adequacy ratio (CRR) and (SLR) will be elements from a management viewpoint, which will impact the overall earnings until SFBs procure a huge depositor base.

Read our article: Buying and Selling of NBFCs in India: A Complete overview

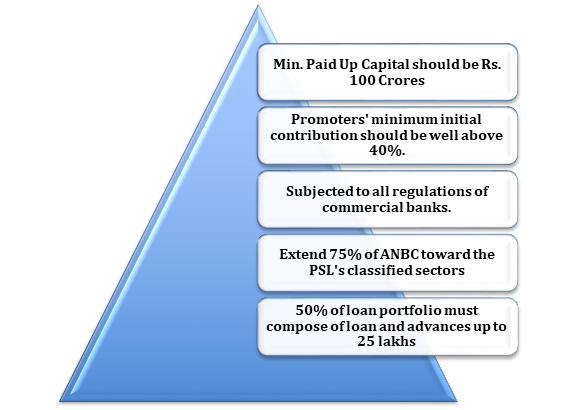

Eligibility Criteria for Small Finance Bank license

Small Finance Bank license: Important Points to Remember

- Small finance banks are a major source of credit to small and micro-enterprise and under-banked regions in the country. This is why RBI enforced the provision to control such banks’ activities in the private sector.

- Payment banks emerge as a new way of banking conceptualized by RBI. These banks have the authority to accept a restricted deposit, currently limited to ₹100,000/customer. Unlike conventional banks, these banks are entitled to issue credit cards and loans.

- Although these banks have working protocols identical to conventional banks, they work on a limited scale. For instance, SFCs don’t enforce any limit on deposit per account. Meanwhile, payment banks offer a limit of Rs 1 lakh. Similarly, SBCs are capable of lending financial products, whereas payment does have such liberty at their disposal.

- Currently, 21 Private sector banks are working in India, out of which 13 banks were already in existence before 1969 are still working as an independent entity.

Prudential norms: Small Finance Bank license viewpoint

- The newly set up SFCs should have conformity with relevant RBI’s provisions and a robust risk management framework.

- The SFCs must follow all rules and regulations in the context of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- No forbearance would be permitted to such banks w.r.t statutory provisions.

- SFCs must allocate 40 percent of its ANBC to sub-sectors under PSL, as per PSL provisions.

- The first balance sheet as on March 31st, post-initiation of SBCs operation, would establish the foundation for the first PSL target.

- The SFCs are not authorized to sell out PSL certificates to the concerned party, especially between the start of the business and the date of first balance sheet.

- The maximum loan size is limited to 10% and 15% of capital funds w.r.t a single and group obligor.

- To ensure the extension of the loan period for small borrowers, the SBCs loan portfolio should represent the loans and advances of up to Rs.25 lakh.

Conclusion

To sum up, small finance banks play a vital role in filling up the financial holes created in the backward society overtimes. Through easy lending and deposit schemes, these banks play a crucial role in raising awareness about monetary saving and credit among the underprivileged section of the society. Easy access, hassle-free loan, and quick deposit are the few things that make SBCs as a standout choice among the organized banks.

Despite the identical working protocols, SBCs differ from conventional banks in many ways. Our CorpBiz group will be at your disposal if you want expert advice on any aspect of NBFC Registration. We will help you to ensure complete compliances concerning all the issues related to Small Finance Bank license, their objectives, Rules and Key Challenges in India based per your desired activities, ensuring the fruitful and well-timed completion of your work.

Read our article: A Complete Overview on Participation of NBFCs in Insurance Business