It’s a well-known fact that RBI has rendered their permission to NBFCs to diversify its footprint in the insurance business. NBFCs gain this authorization under the light of their success in the Indian financial markets that they have reaped over the years. However, NBFCs haven’t got permission to operate in an independent framework yet. Instead, they must follow the predetermined RBI’s guidelines to conduct their operation in the insurance sector. The advent of NBFCs helps Insurance companies stabilize their capital and meet ancillary requirements under the IRDAI provisions. In this blog, we will shed some light on the Participation of NBFCs in Insurance Business.

Participation of NBFCs in Insurance Business: Prerequisites

NBFCs or any other private lender companies aren’t authorized to work outside the regime of authorities. Having said that, there is mandatory approval that NBFCs required to obtain from the RBI & Regulatory, and Development Authority of India (IRDAI[1]), to operate seamlessly in the insurance business.

Insurance Agency Business

RBI approved NBFCs may enter insurance agency businesses based on a fee and risk participation, which deals with the following conditions.

- No RBIs approval is required here.

- In such a case, NBFCs require mandatory approval from IRDAI to act as a `composite corporate agent’ with insurance companies.

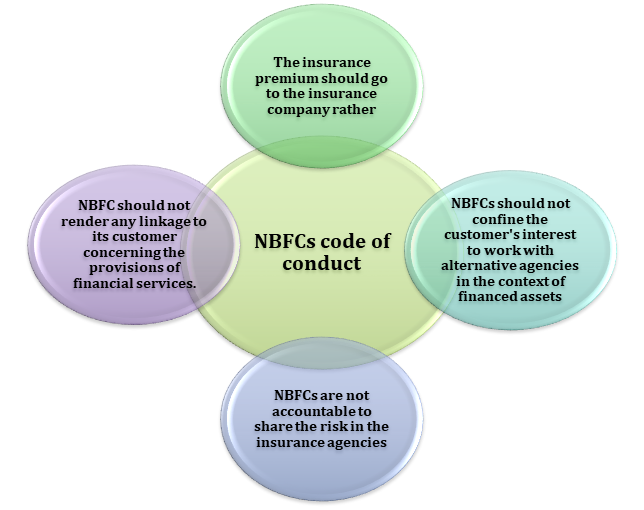

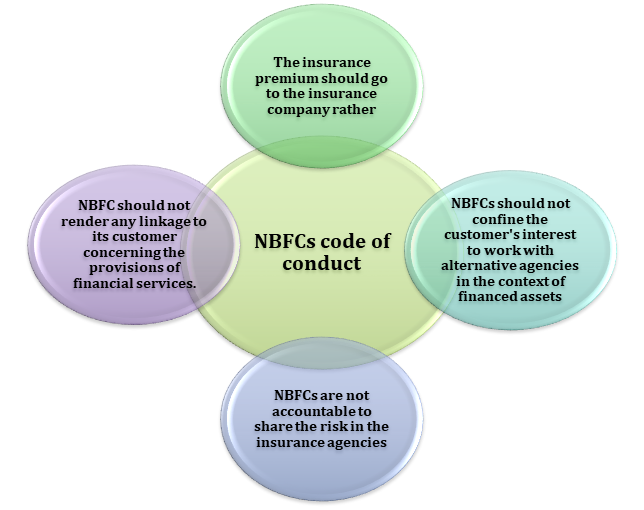

- The NBFCs should not confine the customer’s interest to work with alternative agencies in the context of financed assets.

- Since the acceptance of the insurance products is made voluntarily, it should be duly mentioned in the NBFCs publicity material.

- NBFC should not render any linkage to its customer concerning the provisions of financial services.

- The insurance premium should go to the insurance company rather than NBFC.

- NBFCs are not accountable to share the risk in the insurance agencies.

Insurance Joint Ventures

- NBFCs which met all the required provisions and aim to establish a joint venture with equity contribution based on risk participation must avail RBI approvals to ensure the continuation. Similarly, this same condition is also applied to NBFCs who seek significant investment in the insurance company.

- In Joint Venture, the NBFC has an authority to hold up 50% paid-up capital (in the form of equity shares) of the insurance firm.

- A subsidiary branch of NBFC or another company engaged in the same area of interest is not permitted to take any involvement in the insurance company on a risk basis.

Eligibility Criteria

- NBFC must have at least Rs. 500 crore of Owned Fund under its possession.

- NBFC, who holds public deposits, cannot pursue/enter the insurance business unless its CRAR (Capital to Risk Assets Ratio) is higher than 15%. Similarly, the conventional NBFCs who have no possession of the public deposit should maintain their CRAR higher than 12%.

- The limit for non-performing assets in the NBFC is not more than 5% of the total outstanding assets, such as leased/hire purchases and loans.

- NBFC should not be under the influence of financial loss, at least for the last three years.

- The subsidiaries of the concerned NBFC must have an exemplary track record of rendering services.

- The computation of NBFCs net owned funds seek some investments which come under the provision of Reserve Bank of India.

- Servicing public deposits and Regulatory compliance, if held.

Read our article: Types of NBFCs in India – An Overview

What If NBFC fails to meet the eligibility criteria?

RBI approved NBFCs, which are not entitled to become a part of a joint venture, can make 10% of the owned fund of Rs 50 investment, whichever is lower, in the insurance company. Such funding ought to be accepted as an investment that is free from contingent liability for the NBFC.

Eligible criteria regarding such NBFC

- The NBFC, which possesses public deposits and involved in services like equipment leasing/hire purchase, must have a CRAR of at least 12%. On the contrary, the NBFC, which deals with loan/credit service, should have a CRAR of 15%.

- Maximum net NPA in such cases should be 5 percent of total outstanding assets and loans.

Acceptance of Deposits

The provisions on Acceptance of Public Deposits regarding NBFC allow the exemption on the deposit from the director’s relative. However, that funding cannot be routed directly to the NBFC until an application is submitted from a depositor end. NBFCs are under the provision of authorities to provide substantial details of every incoming deposit to maintain transparency.

However, the above provision shall be treated violated if the relationship between directors and depositors found to be compromised on the date of acceptance of such notice.

Other Provisions of Insurance Companies:

When the foreign partner accounted for 26% of the contribution regarding equity approved by the Foreign Investment Promotion Board/Regulatory and Development Authority, in that event, multiple NBFC becomes eligible for the participation in the equity of the insurance joint venture.

The eligible criteria, in this case, will be presumed violated if the participants cannot bear the insurance risk. In the case of multiple companies (identical to NBFC) wants to acquire some stake in the insurance company, the contribution in the same group by all firm will be counted for a limit of 50% which will be allocated for NBFC in a joint venture.

Conclusion

The participation of NBFCs in Insurance Business has opened up endless possibilities for insurance companies. NBFC could help insurance companies to operate with more agility and meet their ancillary requirements. The NBFCs and the identical companies that seek swift initiation of insurance business either by independent undertaking or joint venture needs to follow to RBI and IRDAI guidelines carefully.

Corporate seeking additional business opportunities can opt for NBFC registration. It is one of the promising business realms at this point in time. However, getting into such business won’t be an easy task. The company has to avail NBFC registration from RBI to get started with such business.

Read our article: Prerequisites of NBFC Registration: A Comprehensive Overview