In financial terms, the buying of NBFC seldom refers to the acquisition of a corporate, whether by approval, wherein the seller is ready to give to complete possession of the asset to the buyer.

Overview on Buying and Selling of NBFCs

Whenever the seller transfers all the assets and liabilities to the buyer, the seller’s balance sheet exhibits no value whatsoever. Some corporates often come across exemplary success or unprecedented defeat after such hold and molds because the fundamental of buying and selling of NBFCs in India isn’t unique to the financial world.

Although the process of buying and selling NBFCs in India is similar to conventional banks, there might be some chances of uncertainty and prejudice. The RBI has proposed some provisions in the context of buying and selling of NBFCs in India. Considering the market dynamics, the buying of NBFCs seems a more practical and conducive option than setting up the new venture. The complete acquisition of existing NBFC would take only two months i.e., 60 days

Procedure for buying and selling of NBFCs

The buying and selling of NBFCs in India start with RBI’s approval under the given conditions, whose violation could lead to no results.

- Any buying and selling of NBFC in India may not ensure the complete alteration of the management.

- Any alteration in the shareholding that leads to 26% selling or buying of the paid-up equity capital of NBFCs increases over time.

- Any significant changes in the management in more than 30% of the directors of the NBFC.

Conditions that support non-approval of RBI

There are some events in which the approval from RBI[1] is not necessarily mandatory.

Those are as follows:-

- The altering of 26% company’s share capital comes out to be a result of a reduction in the capital or buyback of shares under the authorization of the court.

- Some significant alterations in the management (30% to be specific) due to rotation of the directors or changes in the independent Directors.

Checklist

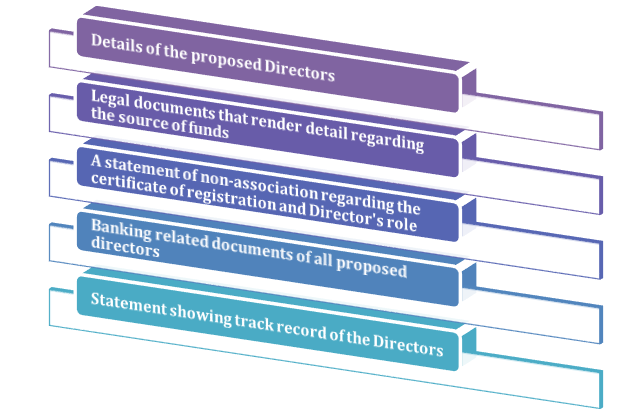

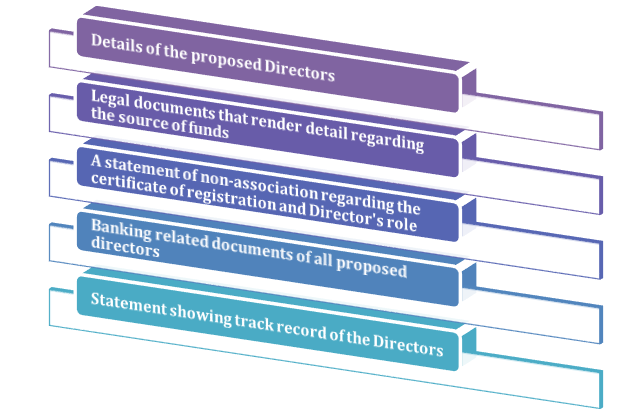

Documentation is crucial when it’s come to business deals, and NBFCs are no exception here. The inclusion of certain documents is mandatory in relation to the buying and selling of NBFCs in India. Documents are the only medium that justifies the purpose of the deal.

Later, the application is forwarded to RBI on the Company’s letterhead for the approval purpose accompanied by the following crucial documents.

Once these formalities are addressed, the application must be sent to the Regional Office of the Department of Non-Banking under whose jurisdiction the NBFC’s registered office is located.

The Reserve Bank might ask the applicant to clarify some doubts in the context of the submitted application. The applicant needs to be proactive in this aspect and must respond to such queries as quickly as possible to avert any delay that might hamper the processing of the application. The approval period of such an application demands around two to three months of time span. However, that depends on the nature of the case.

Read our article:A Complete Overview on Participation of NBFCs in Insurance Business

Prior Public Notice in case of amendment in management

The public notice shall indicate given details:

- The intention of the Company to sell its ownership or control.

- The detail of the balance sheet of the target NBFCs, which is intended to get sold out.

- The reasons stated by the Company that justifies the complete transfers of assets and liabilities.

Preparation of Share Purchase Agreement

The share purchase agreement is a legal document that is prepared and approved by the concerning party i:e buyer and seller regarding the seller’s company management, which is being handed over its control to the buyer. And in the event, if any, consideration is remaining, shall be addressed within 31 days of the public notice or as mutually agreed by concerning parties.

Handover of the entire assets of selling Company to the acquirer

In the buying and selling of NBFCs in India, this is the last destination of this tedious process where both parties agreed to the purchase agreement and sign it to close the deal. This sign act as a final stamp on the agreement where the assets of the transferor company will be discharged, and the liabilities will be paid off. The buyer will receive a bank balance in the Company’s name, whose estimation is based on net worth as on the date of acquisition.

Conclusion

The transparency, versatility, convenience, and performance are the few elements that make NBFCs a standout choice among organized banking. The way NBFCs confront financial issues of the concerning parties is more convincing than its counterparts, which in turn helped them to grow excellent reputation overtimes.

There is no denying the NBFCs are the only contenders in the finance sector, which show the real potential of lending money by averting the conventional barriers. It has provided a much-required rigidity to the country’s financial system by providing a hassle-free lending service to the help seeker at relaxed standards.

Since these institutions haven’t got the liberty of procuring public deposits that are repayable on demand, many eventually opt to sell out. The stringent RBI regulations are putting a lot of pressure on these institutions, which is the only reason for their unfortunate backout. Our CorpBiz group will be at your disposal if you want expert advice on any aspect of NBFC Registration. We will help you to ensure complete compliances concerning all the issues related with Buying and Selling of NBFCs in India based as per your desired activities, ensuring the fruitful and well-timed completion of your work.

Read our article: Types of NBFCs in India – An Overview