A sin tax is a kind of sales tax or excise tax imposed on the products that are harmful to society. Basically, it is imposed to discourage consumers from using harmful goods or services that are claim as undesirable or detrimental to society. A sin tax is witnessed with two objectives. Firstly, to make the undesirable goods so expensive that rational consumers would force to take their feet back and give up on the bad habit. Secondly, to make the producing industry pay a higher tax so that it can be used to fund another welfare spending.

Sin taxes have become a global trend. Talking about India the GST regime, cigarettes, pan masala, and liquor have attracted high taxes. Hence, in other countries also like the UK, Sweden, and Canada[1] also impose this Tax on the series of products and services from tobacco and alcohol to lotteries and gambling and fuel.

Sin Tax History

In 1776, Adam Smith wrote that taxes on cigarettes, rum, and sugar are genuine and appropriate. Even if commodities are not essential for life but still their consumption rate is high. However, the Federal government began taxing tobacco during the civil war. In the 1920s cigarette taxes became widespread as advertising double the number of smokers.

In India, over Rs, 19,000 crores have been collected as the central tax on tobacco till the January in the financial year 2016-17 while the figure for 2014-15 and 2015-16 stood at Rs 22,174 crores and Rs 19,997 crores respectively.

What is Sin Tax?

‘Sin’ taxes are the taxes levied so as to demoralise the consumers from using any harmful goods or doing any services that are considered as unfavourable and detrimental to the interest of the society.

There are two objectives of the Sin Taxes and those are:

- To make these undesirable and harmful goods like tobacco costly by imposing sin tax that any rational customer would be under constrain to give up the habit as it would be difficult to afford the same.

- To make the business industry that is producing or manufacturing these products to pay higher tax, which shall be utilised in funding other welfare expenditure or social programs like raising awareness on the consequences of smoking.

Sin Taxes are now a worldwide movement. In India, cigarettes, liquor and pan masala have constantly been charged with high taxes evenon being under a non-GST regime.

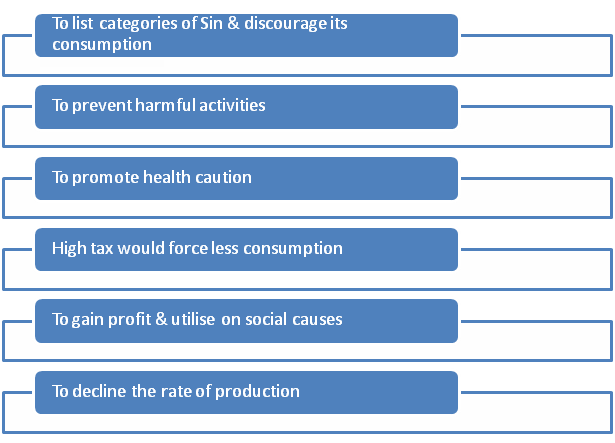

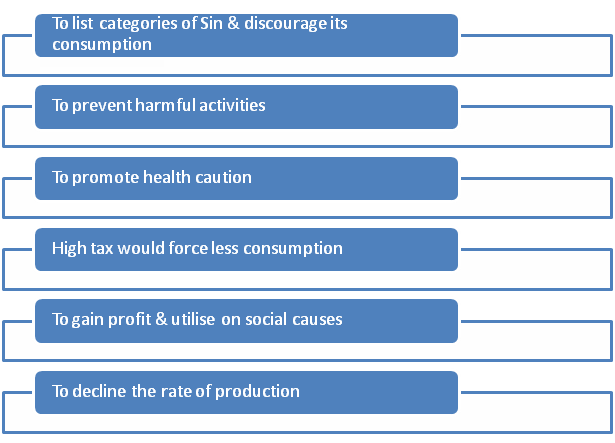

Purpose behind imposing Sin Tax

Few of the purposes which the Government has in mind for imposing sin tax are given below:

Sin Tax under GST

Pan Masala, tobacco, and aerated drinks along with the luxury vehicles are some example of Sin products that come under the highest tax slab rate of GST. This Tax percentage is 28% charged on the sin products under the GST act imposed by the GST Council. It is a treasure to the Government because they are earning maximum revenue from these sin products. Furthermore, chewing gums, chocolates, custard powder, students’ colors, paints, varnishes, a wafer coated with chocolate perfumes, beauty products, sunscreen, shampoo, hair dyes, aftershave lotions, and deodorants are also imposed under the highest tax slab rate under GST.

Why Sin Tax is important?

As we discussed earlier, a Sin tax is on the sin products and sin products are the products that harm the society at large. The excessive consumption of tobacco, alcohol or empty calories heightens health risk such as cancer, heart conditions and obesity is quite well- documented by now. In other countries, after the imposition of tax actual consumption of these products have certainly fallen. But on the other hands, in India, it means to be a bonanza for the state.

Read our article:GST Returns: Applicability, Due Date and Penalties

Where does all Sin Tax money go?

So, the treatment of sin tax is like the other taxes. The money comes from this tax goes to the pocket of the government in term of tax. Later the money is used for public safety and health campaign, treatment of medical people, etc.

Sin tax pros and cons

There are many arguments in favour of sin taxes like they discourage unhealthy behaviours or society pays their cost.

Pros

This tax helps in reducing the consumption of substances which are creating health issues. Sin tax is more feasible option to increase the Governments’ revenue. It helps the government to pay the cost of treating the public health consequences of smoking, gambling, and drinking. But, it is harsh truth government don’t use that tax on health care as they obliged to do. Sin tax on a cigarette is also known as a Pigouvian tax.

A sin tax is political more viable than raising the income or sales tax.

Cons

It is regressive as they impose a harsher burden on the poor than the rich. Like in the poor family a good amount of income is used to pay the shelter, food, and transportation. Any new tax decreases their ability to afford these basics.

On the other hand, the wealthy can easily afford the basics. These kinds of taxes decrease the ability to invest in stocks, add to retirement savings or purchase of the luxury item. Also, the imposition of sin tax may result in increase in illegal activities like smuggling and black markets. Thus, there is no guarantee that imposing sin taxes can actually decline the intake of harmful substances as consumed by the people who are habitual or addictive to such products.

Criticisms against sin tax

There are many critics against the sin tax who say that sin taxes give the Government pointless moral authority to dictate citizens on what to do and what not. According to their opinion sin taxes cannot necessarily reduce the harmful product purchase and customers who are addicted to the practice may still continue buying.

Therefore, the Government is unnecessary increasing the sin tax. Sin taxes are frequently referred to as “regressive” as they are always discriminating against the lower classes. These poor and underprivileged people are forced to pay a bigger share of their income as tax.

Conclusion

Excess consumption of harmful and detrimental products like tobacco, alcohol increases the health risk. There are reports on sudden high rise in rate of heart attacks, obesity and cancer.

Sin tax has affected the ordinary tax payer because they are more sinner than they are actually sinning. Thus, the studies have revealed that sin taxes have been victorious in dropping the consumption of such harmful products and the Government has gained enough capital from the excess tax which is also used for running the welfare and social cause against the use of harmful products.

Read our article:Cancellation of GST Registration in India: Full guide