GST Returns is obligatory compliance for every business registered under the GST regime. It is a document that contains the details of the income of the taxpayer, which further is used by tax authorities to calculate the tax liabilities. Let’s learn more about GST Returns, its applicability and the due dates to file them through this article.

What is GST Returns?

GST return is a document that contains all the details about your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

Who needs to file GST Returns?

Every business, registered under GST needs to file GST Returns within a prescribed time limit. Additionally, the frequency of filing these returns can be monthly, quarterly or annually. Also, late filing of any of the GST return can lead to unnecessary penalty and additional compliances[1].

Furthermore, as per the GST regime, a business generally needs to file two monthly returns, one annual return and a total of 26 returns in one year.

Different Types of GST Returns With Due Date for Filing Returns

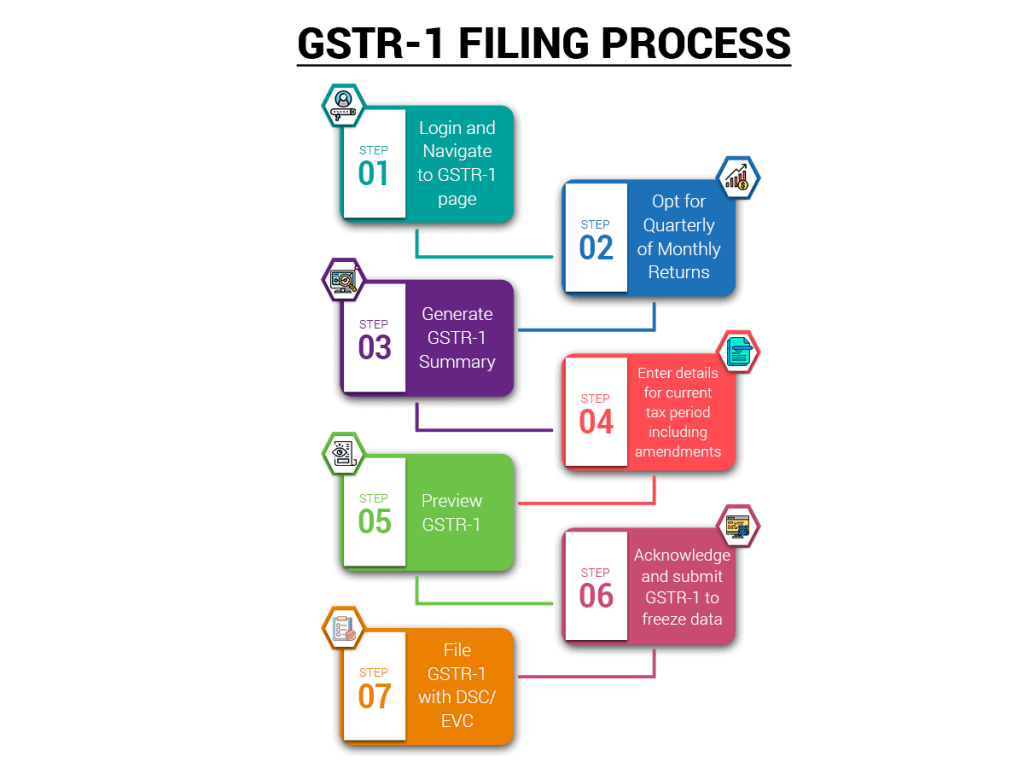

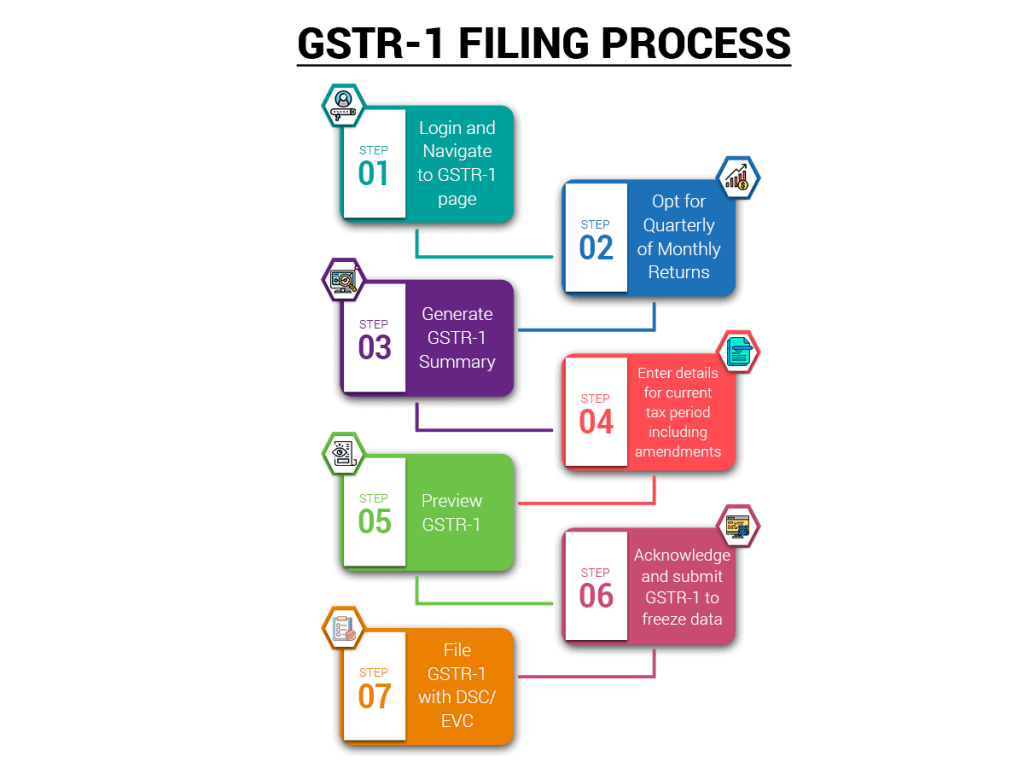

The given below list provides you with the details about the types of GST Returns, the due date to file them and the purpose of filing the return;

| Sr. no. | Type | Purpose/Remarks | Frequency | Due Date |

| 1. | GSTR 1 | Filed by– All taxpayers Information Furnished– Outward supplies of goods and services within the applicable tax period | Turnover< Rs. 1.5 crore- Quarterly Turnover> Rs. 1.5 crore-Monthly | 11th of succeeding month |

| 2. | GSTR 2 (Suspended) | Information Furnished- Detailsof inward supply of goods and services including those under reverse charge basis | Monthly | 15th of next month |

| GSTR 2A | Information Furnished- Details of all inward supplies of goods and services | Between 11th and 15th of the month | ||

| 3. | GSTR 3 (Suspended) | Information Furnished- Details provided in GSTR 1& 2 | Monthly | 20th of next month |

| 4. | GSTR 3B | Filed by- All regular taxpayers Information Furnished- Summary of GST liabilities for the applicability of tax period | Quarterly | 20th of next quarter |

| 5.. | CMP-08 | Purpose- To declare a summary of services liable to reverse charge mechanism | Monthly | 18th of next month |

| 6. | GSTR 5 | Filed by- Non-resident taxpayers when they do not want to claim Input Tax Credit (ITC) | Monthly | 20th of next month |

| 7. | GSTR 5A | Filed by- Service provider, providing Online Information and Database Access or Retrieval (OIDAR) outside India for their services to unregistered people in India | Monthly | 20th of next month |

| 8. | GSTR 6 | Filed by- Input service Distributors for distribution of ITC | Monthly | 13th of next month |

| 9. | GSTR 7 | To declare- TDS liability by the authoritydeducting tax at source | Monthly | 10th of next month |

| 10. | GSTR 8 | To declare– Tax collected at source (TCS) by e-commerce operators | Monthly | 10th of next month |

| 11. | GSTR 9 | Filed by- All normal taxpayers Information Furnished- Declaring details of the purchase, sales, input tax credit, refund claimed, demand created, etc. | Annually | 30th November 2019 for FY 2017-18 |

| 12. | GSTR 9A | Filed by- GST composition scheme taxpayers Information Furnished- Details of outward supply, inward supply, taxes paid, refund claimed, demand created, input tax credit and reversed due to opting out or opting into the composition scheme | Annually | 30th November 2019 for FY 2017-18 |

| 13. | GSTR 10 | Filed by- All taxpayers whose GST Registration has been cancelled/ surrendered To file- final GST returns | Once | Three months from the date/ order of cancellation (whichever is later) |

| 14. | GSTR 11 | Filed by– Unique Identity Number {UIN} holders Information Furnished– Supplied/received goods and services To Claim- GST Refund through RFD-10 | Quarterly | 28th of the next month in which refund statement was filed. Not mandatory for UIN holders who did not get any inward supplies during the quarter |

Read our article:How To Obtain GST Registration in India?

Details Required To File GST Return

The following details need to be furnished while filing GST Return;

- Details of Expenditure

- Total Purchase (Inter-State and Intra-State)

- Total Imports

- Sales Return

- Other purchases and expenditure

Details of Income

- Total Sales (Inter-State and Intra-State)

- Total exports

- Supplies on which no GST is paid

- Purchase Returns

- Other Income

Other Amount

- Audit and Assessment arrears

- Refunds

Profit and Loss Statement

- Gross Profit

- Profit after tax

- Net profit

Penalty for late filing of GST Return

In case if someone fails to file GST Returns within the specified time limit, he/she becomes liable for a penalty with includes interest rates on the basic amount and a late fee.

Furthermore, an interest of 18% p.a on the outstanding amount has to be paid by the defaulting taxpayer. Furthermore, the duration which is considered for payment is from the next day of the return filing to the date of the payment of such interest.

Also, a total fine of Rs. 200 per day, which includes Rs. 100 under CGST and Rs. 100 under SGST is imposed in case there is a delay in the submission of the fees. Furthermore, a maximum fine of Rs. 5000 is imposed on businesses that are registered under IGST.

Takeaway

Every business owner is liable to pay Goods and Services Tax Returns (GST Returns). Also, GST Return filing is mandatory for those who have nil returns in the preceding year. Henceforth, every taxpayer becomes liable for a punishment for not filing their GST Return, within a specified period.

Read our article:Pragmatic Impact of GST Rate on Indian Economy