There are legitimate ways to save your tax under Income Tax Act, 1961. Income Tax liability on an income is calculated by adding income from all sources in the total gross then taking all deductions and other tax-exempted allowances (HRA, LTA mutual funds, insurance premiums, NPS, medical insurance etc.) that a person can claim will be subtracted from the total amount.

The net result is taxable income. It is the resulting taxable income figure level which will decide whether you can avail the 100% tax rebate given to that earning up to Rs 5 lakh taxable income.

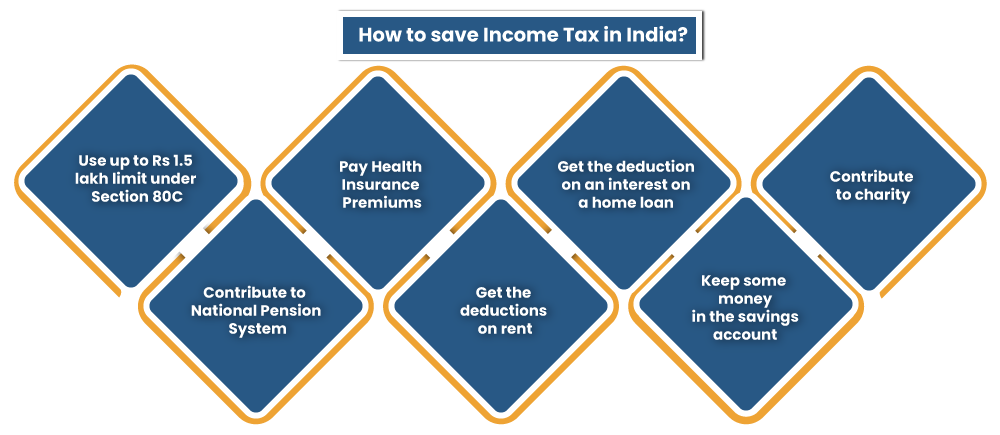

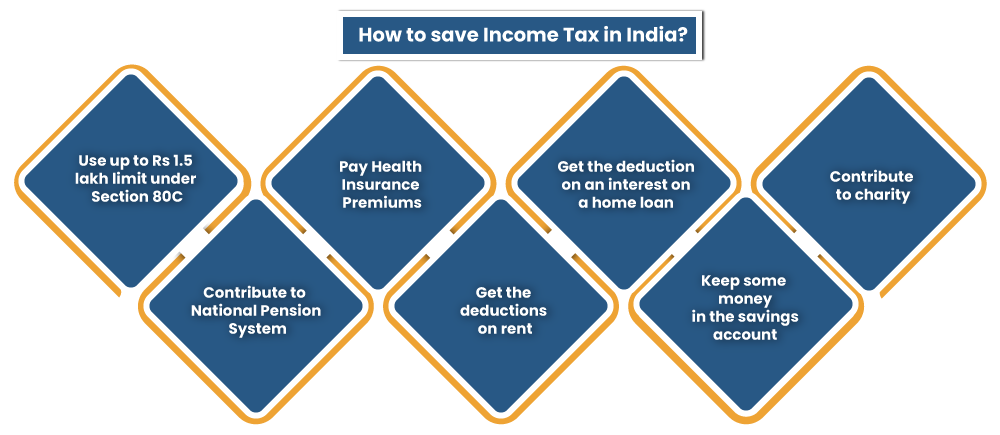

How to save Income Tax in India?

Use up to Rs 1.5 lakh Limit under Section 80C

The investments/deductions are all subject to a cap of Rs 1.5 lakh can be saved from income tax liability. In other words, they are investments, and any one type of investment will reduce the room for anoth.

Tax-Saver FDs

One can get a tax deduction of up to Rs 1.5 lakh under 5-year tax-saver FDs. It carries a fixed rate of interest currently between 7-8%. The interest on FDs is taxable.

PPF (Public Provident Fund)

The PPF (Public Provident Fund) is a government established savings scheme for a period of 15 years available at most banks and post offices in India. Its rate changes every quarter however the interest on PPF is tax-free.

ELSS Funds

These are a type of mutual funds which invest the minimum of 80% of the assets in equity. They can have a lock-in of 3 years. The returns on ELSS funds are also subject to Long Term Capital Gains Tax (LTCG) at 10%, and an exemption limit of Rs 1 lakh.

NSC (National Saving Certificate)

The (NSC) National Savings Certificate has the tenure of 5 years and the fixed rate of interest. The rate is presently is 8%, where an interest on NSC is automatically counted towards Rs 1.5 lakh 80C limit and also tax-deductible if no other investments are using up to that limit.

Life Insurance Premiums

The premiums for different types of insurance policies, including ULIPs, the term insurance and endowment policies can be tax-deductible up to Rs 1.5 lakh. However, the insurance cover has to be at least ten times of the annual premium.

National Pension System (NPS)

The NPS deduction is available under Section 80CCD up to Rs 1.5 lakh for the contributions to NPS. It is over and above of Rs 50,000 deduction available under Section 80CCD (1B)

Home Loan Repayment

The repayment of a principal amount on the home loan is tax-deductible up to Rs.1.5 lakh p.a., it can be saved from income tax liability

Payment of tuition fees

The payment of tuition fees for the children is tax-deductible up to Rs. 1.5 lakh p.a., it can be saved from income tax liability

EPF

Under the EPF Act[1], 12% of the salary of employees in the organized sector is deducted towards the Employees Provident Fund. The deduction counts towards Rs 1.5 lakh limit under Section 80C.

Senior Citizens Savings Scheme

The contribution to SCSS is tax-deductible up to Rs 1.5 lakh. The SCSS has a period of 5 years and is available to those above the age of 60. Presently, the rate for SCSS is higher than the existing FD rates (it is also taxable).

Sukanya Samriddhi Yojana

The parents of the girl child below the age of 10 years can get the deduction. The scheme has a period of 21 years or until the girl marries after turning to the age of 18years. It has an interest above prevailing rates, and the interest in this is tax-free.

Contribute to National Pension System

The deduction under Section 80CCD (1B) is up to Rs 50,000, and it is only available for contributions to NPS. The NPS allows us to invest in equity and in debt pension funds to build a retirement corpus. One can withdraw it at age of 60years.

Pay Health Insurance Premiums

The deduction upto Rs 25,000 is for health insurance premiums under Section 80D. For senior citizens, the limit is increased upto Rs 50,000. Any person contributing to health insurance for himself and senior citizen parents can avail a combined deduction up to Rs 75,000 p.a.

Get the Deduction on a Rent

One can claim tax deduction on the rent, i.e. (HRA) House Rent Allowance. In this, there is no upper limit; however, there are a certain set of rules that cap a maximum HRA deduction. If you do not have HRA but pay rent, then you can claim a deduction under Section 80GG up to Rs 60,000 p.a.

Get the Deduction on an Interest on a Home Loan

If one has a home loan, an interest payable on it is tax-deductible under Section 24 of Income Tax Act up to Rs 2 lakh p.a. If one gives out a house on rent, then there is no upper limit. However, a total loss that can be claimed on a broader head of income from house property is capped at Rs 2 lakh.

Keep some Money in the Savings Account

It is probably an easiest deduction under Income Tax Act that individuals can claim. An interest in savings accounts is also tax-free up to Rs 10,000 per year under Section 80TTA. It has a limit of 50,000 for senior citizens for both FD and savings account interest under Section 80TTB.

Contribute to Charity

One can get a tax deduction on the charitable donations. There is no upper limit but different rules restrict the tax deduction amount available on charitable contributions. For most donations to NGOs, the limit is 50% of a donated amount and up to 10% of adjusted total income. NGOs under this section are required to have the 80G certificate so that one can able to claim the deduction.

Few other Tax Saving Options in India

Some other pointers should be kept in mind while looking for tax saving methods, such as:-

- Under Section 80E, one can forego any tax payment on an interest component of education loans. Such benefits are only applicable for first 8 years of loan repayment.

- Expenditure incurred by the individuals for medical treatment is exempted from any tax calculations under Section 80DDB. The medical bills of up to ₹40,000 for treatment of specific diseases can be submitted to receive tax waivers. The senior & super senior get extended benefit up to ₹1 Lakh. Nonetheless, treatment charges only cover neurological diseases, AIDS, malignant cancer, renal failure, or haematological diseases.

- If host is a dependent family member who has the permanent disability, then can claim a tax exemption on all expenses borne for funding the livelihood of that person under Section 80DD. Also, tax exemption can be claimed for disabled members of a HUF.

- One can claim up to Rs 75,000 to finance the expenses of individuals having 40% or higher disability. However, the exempted amount goes up to ₹1,25,000 for people who suffer from 80% or higher disability.

- The proper documents required to be submitted for medical treatment costs, with the proof of disability in Section 2(i) of the Persons of Disabilities Act of 1955.

- If are disabled, one can avail tax waivers of the same accord under Section 80U respectively.

Conclusion

All the points will substantially reduce the total taxable income for a stipulated financial year. It helps to know more about the various government-mandated provisions. Make sure submit your income tax return form and Form 16 provided by the employer to get subsequent proceeds.

Read our article: DHC has Allowed GSP Power System to file Revised Returns under DVAT