GST Registration is needed to be obtained by business owners who have a turnover more than Rs. 40 lakhs which was initially Rs. 20 lakhs. However, people saw a scope of loss at the initial stages of the introduction of the GST laws. The reason behind this was, earlier, in the pre GST laws, businesses having a turnover of Rs. 5 lakhs needed to obtain registration, so they opted to cancel their GST Registration. Also, there are other reasons for the cancellation of the registration under GST which are mentioned in this article.

What is meant by Cancellation of GST Registration?

Cancellation of GST means if an individual or entity wishes to stop the business or profession registered under GST and does not want to be a GST registered person. Also, if the taxpayer wants to discontinue the current business in any way, cancellation of GST Registration is required to be done.

Conclusively, after a GST Cancellation, the taxpayer will not be a GST Registered person or entity anymore and he will not have to pay or collect the Goods and Service tax.

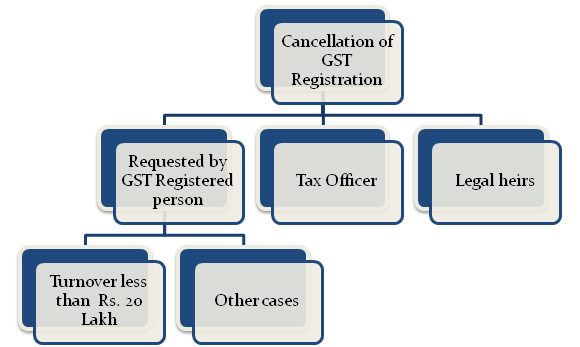

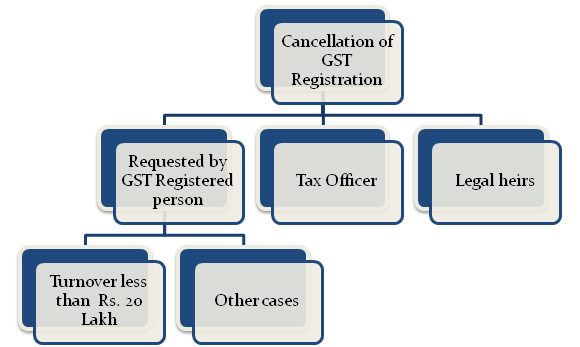

Who can Cancel GST Registration?

GST Registration can be canceled by either of the below-mentioned persons-

Furthermore, the process for the cancellation of GST Registration is different if it is requested by the taxpayers themselves.

- If the turnover is less than 20 lakhs,

- Other cases

What can be the Consequences of the Cancellation of GST Registration?

GST Registration under certain business is mandatory, in case of failure or cancellation of GST, it will amount to an offense under GST and heavy penalties will apply. Additionally, Cancellation of Registration does not affect the liability of the taxpayer to pay-

- Tax[1],

- Interest,

- Penalties or any other dues whether specified before or after the GST Cancellation.

Under What Circumstances the Taxpayer can opt for GST Cancellation?

- Discontinuance of Business.

- Transfer of business, amalgamation, demerger, or otherwise disposed of.In the above cases, the transferee company or the new company has to get GST registered.

- Change in the constitution of business.

- Exemption from GST Registration.

- Not Conducting the business from the declared place of business.

Read our article:Step by step guide on how to check GST Registration Status

Under what Circumstances the Tax Officer can cancel the GST registration?

The taxpayer can cancel the GST registration if he founds that-

- The Taxpayer does not carry out any business from the stated place of business or,

- Violates the provisions by Issuing invoice or bill without supply of goods/services or,

- Violates the anti-profiteering provisions.

Recent update -With effect from 1st January 2021

- Utilization of Input tax credit from electronic credit ledger to discharge more than 99% of the tax liability for specified taxpayers violating Rule 86B – with the total taxable value of supplies exceeding Rs.50 lakh in the month, with some exceptions.

- A taxpayer who cannot file GSTR-1 due to GSTR-3B not being filed for more than two consecutive months (one quarter for those who opt into the QRMP scheme)

- If the taxpayer avails ITC in violation of the provisions of section 16 of the Act or the rules.

Other updates as on 22 December 2020

- The scope for GST registration cancellation under the CGST Rule 21 at the discretion of the tax officer has been increased.

- If there are major difference between the GSTR-3B with the GSTR-1 and GSTR-2B,Suspension of GST may get attracted under CGST Rule 21A

What are the forms for Cancellation of GST Registration?

All taxpayers who cannot follow the above-mentioned criteria must apply for GST cancellation in FORM GST REG 16. The taxpayer and the legal heirs of the deceased taxpayer will follow a similar process as mentioned below.

- Application for GST cancellation has to be made in FORM GST REG 16 along with the requisite information-

- Particulars of inputs, semi-finished, finished goods held in stock on the date on which application for GST Cancellation is applied by the taxpayer.

- Liability thereon.

- Particulars of the payment

- The tax officer has to issue an order for GST cancellation in FORM GST REG-19 within 30 days from the date of application.

Effectiveness of GST Cancellation– The GST cancellation will be effective from a date specified by the officer and he will notify the taxable personof the same.

What is the Procedure for Cancellation of GST Registration?

The process of cancellation of the GST Registration differs from case to case. Below mentioned is the procedure for GST Cancellation Online:-

For Good and services tax Registration the taxpayer needsto applyin Form GST REG- 16. Also, the legal heirs of the deceased taxpayers need to follow the same procedure to cancel the registration under GST.

Furthermore, the following details must be included in the Form GST REG 16-

- Details of inputs, semi-finished, finished goods held in stock on the date on which cancellation of registration is applied.

- Liability thereon

- Details of the payment.

The proper officer has to issue an order for cancellation in FORM GST REG-19 within 30 days from the date of application. The cancellation needs to be effectual from a date determined by the officer, and he will have to notify the taxable person.

What is the Procedure to Re-apply for GST Registration?

The procedure to apply for reapplying for the GST is as follows;-

- In case the proper officer has reasons to cancel the registration of a person then he will send a show-cause notice to such person in FORM GST REG-17.

- The registered person must reply in FORM GST REG–18 within 7 days from the date of the receipt of notice stating the reasons why his registration should not be canceled.

- If the tax officer finds the reply to be satisfactory, the tax officer will drop the proceedings and pass an order in the FORM GST REG –20.

- Furthermore, if the registration is liable to be canceled, the proper officer will issue an order in FORM GST REG-19. Such an order will be sent within 30 days from the date of reply to the show cause.

What is a Revocation of Cancellation of GST Registration?

Revocation of cancellation means the process of taking back the decision of canceling Goods and services tax Registration, and it means that the registration is still valid. In other words, revocation refers to the official cancellation of a decision or promise.

Applicability of Revocation

You can only apply for revocation of the cancellation of Goods and Service Tax in case the registration has been canceled by the Tax Officer. Such a person can apply for revocation within thirty days from the date of order of such cancellation.

The procedure to apply for revocation is as follows;

- The registered person, whose registration is canceled by the tax officer can apply for revocation of cancellation, in GST REG-21 FORM, if his registration has been canceled Suo moto by the designated officer.

- Such taxpayers must apply within 30 days from the date of service of the cancellation order at the Common Portal.

- If the tax officer is satisfied, he can revoke the cancellation of registration by passing an order in the Form GST REG-22 within 30 days from the date of receipt of such application. Furthermore, the reasons for the revocation of cancellation of registration must be provided in writing.

- The tax officer can reject the application for revocation by an order in FORM GST REG-05 and communicate the same to the applicant.

- Furthermore, before rejecting, the designated officer must issue a show-cause notice in FORM GST REG–23 for the applicant to prove why the registration should not be rejected. Furthermore, the applicant must reply in FORM GST REG-24 within 7 working days from the date of the service of notice.

- Such an officer will decide within 30 days from the date of receipt of clarification from the applicant in FORM GST REG-24.

What are Initiatives taken by the Authority for GST Registration as a COVID-19-Relief Measure?

As per the update, date 25th June 2020, the taxpayers whose GST Registration has been canceled by the authority till June 2020 can apply for revocation of GST. The expiry of 30 days limit will be later of-

- Date of service of the said cancellation order by the authority or,

- 31st August 2020

However, the extension is a 1-time facility to ease those taxpayers who want to continue the existing business.

Conclusion

Goods and Service Tax Registration is mandatory for business owners having a turnover of more than Rs. 40 lakhs per annum. However, people having a turnover of less than that does not need to obtain registration under GST.

On the other hand, people can cancel their registration under GST if they wish or in case their business is going to be discontinued due to any reason. If in case you are confused about the cancellation of GST , feel free to consult Corpbiz. We provide proper assistance on GST registration and related services.

Read our article:GST Returns: Applicability, Due Date and Penalties