In the past, in the absence of a reliable verification method, the Income Tax Department approved deductions under Section 80G of the Income Tax Act based solely on taxpayer claims or donation receipts. To solve this, the NGOs that have NGO registrations that receive gifts are now required to provide a donation certificate to contributors and file a yearly statement of donations, similar to the TDS Reconciliation System (TRACES), with the Income Tax Department. However, on March 26, 2021, the Central Board of Direct Taxes (CBDT) introduced 10BD and 10BE forms via notification no. 19/2021 to further improve accuracy and openness. The purpose of these forms is to make it easier to precisely reconcile donated funds and claimed deductions. We shall present a thorough rundown of Form 10BD in this article.

Prerequisites for Filing out Form 10BD

The prerequisites are as follows –

- The applicant should be registered at the e-filing portal.

- The applicant should have a valid username and a strong password for the portal.

- The PAN status of the taxpayer should be active.

- The applicant taxpayer should have a valid DSC if they want to validate through it.

- The DSC should already be registered with the portal and should not be expired.

Basic Requirements for Filing Form 10BD

10BD form is essential to ensure clarity and transparency in claiming benefits of deductions by non-profit organizations. The basic requirements for filing out Form 10BD are as follows –

- ID of the donor donating to the organization

- A statement number of the donation

- Address of the Donor

- Passport/ PAN/ Aadhar/ Driving License/ Voter ID of the donor

- Income Tax Act Section code (Section 35(1)(iii), Section 35(1)(ii), Section 35(1)(iia))

- Mode of payment

- The type of donation made

- Amount of Donation

Applicability of Form 10BD

Form 10BD is applicable for institutions that take donations from the public to carry forward their object of a noble cause. It ensures that the entity doesn’t have to worry about finances to promote its charitable work. The institutions that fall under the ambit of the 10BD form include schools, colleges, universities, churches, research institutes, trusts, NGOs, and similar others. These funds should cover the following sections of the Income Tax Act of 1961 –

1. Section 35 (1A) (i)

2. Section 80G (5) (viii)

Legal Penalties for Non-Filing of Form 10BD

As per the recently inserted Section 234G, the reporting entity must file Form 10BD for all the donations that it has received under Section 80G; failure to do so would result in a fine of Rs. 200/-per day of such delay. The late costs listed above cannot exceed the gift amount for which there was a 10BD form filing delay. Not filing such a statement would result in a penalty under Section 271K of the Income Tax Act, which can be as much as Rs. 1,00,000 in addition to a minimum of Rs. 10,000. This penalty is in addition to the late fee for submitting a statement of donation in 10BD form.

Procedure for Filing Form 10BD Online

The applicant has to mandatorily file a 10BD form to avoid legal consequences and penalties. You can fill out the form through the official income tax department website. The person authorized should sign the form before submitting it to the authorities. The procedure for filing out this form is given below –

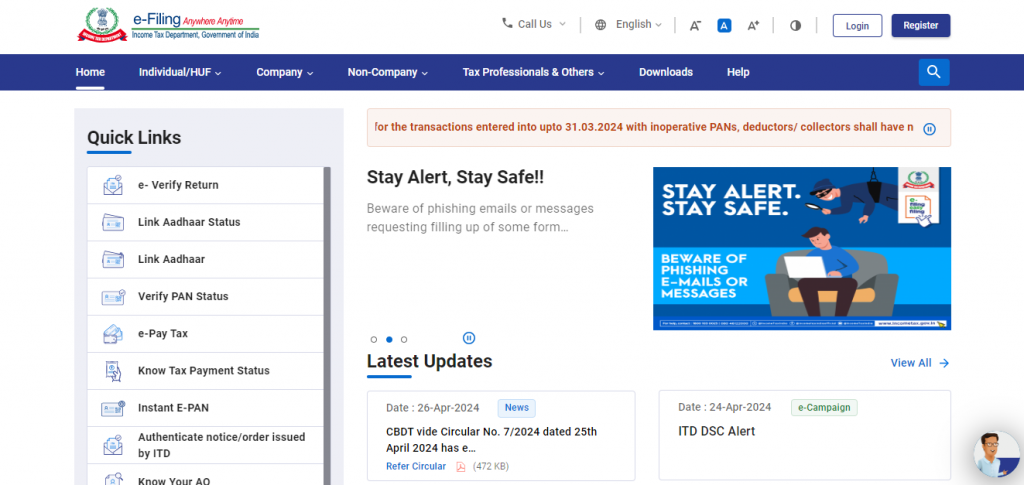

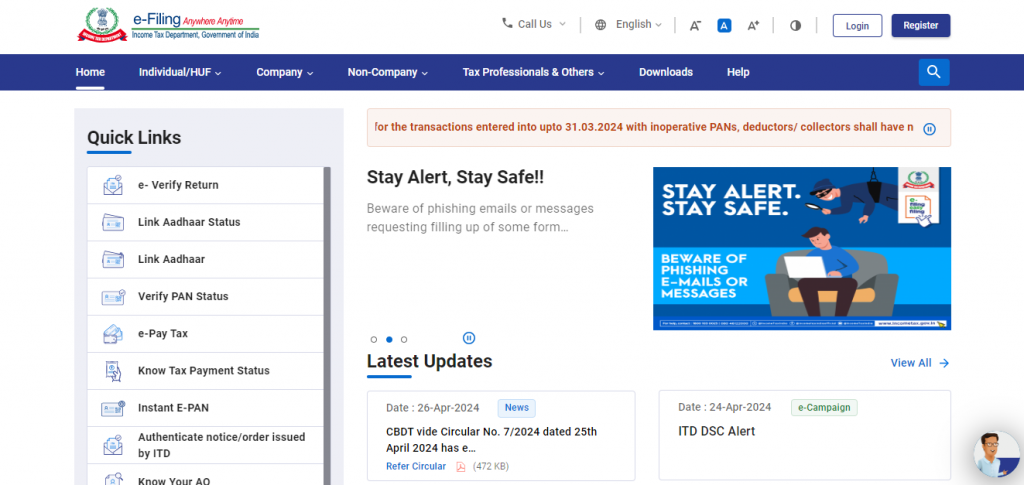

- You have to first go to the official website of the Income Tax Department and then log in through your details.

- Click on Form 10BD by going to the e-file section and then to Income Tax Forms.

- You then have to select the financial year for which you have to fill out the form and then click on continue.

- You should select the ‘Provide Details’ option to complete the form. You can fill out the 10BD form through the dashboard that appears.

- 10BD form is mainly divided into three parts where you have to provide details like ‘Basic Information’, ‘Donor’s and Donations details’, and ‘Verification of such donation’. These details need to be provided correctly and without any changes made.

- The first section where personal information has to be filled is automatically filled once you open that section. You can click ‘Confirm’ and then move to the other section.

- You must then fill out the other parts of the form with the correct details.

- To provide the obligatory fields, the applicant has to download a template of Excel. A CSV file will get downloaded then.

- When this CSV file is filled, you need to upload it to the portal.

- Preview all the details you entered by clicking on the ‘Verification’ tab.

- If all the details entered are correct, then select ‘Proceed to Verify’.

- Click on ‘yes’ to submit the form after verifying all the details entered in it.

In case you have made errors while filling out the form, you can very easily make amends in the form. When these institutions have filled out this form, they need to issue a donation certificate in favor of the donor through Form 10BE. Now, they are eligible to claim deductions as per section 80G or 35 of the Income Tax Act of 1961.

Due Date for Filing Form 10BD

The due date for filing the 10BD form is May 31 of every year, immediately after the end of the financial year. Institutions must file this form to claim deductions under sections 80G and 35. Failing to do so will attract legal recourse, penalties, and fines. The government made it mandatory to fill out the form in the recent amendment to the Income Tax Act.

To Wrap Up

The Finance Act 2021 has undergone a recent revision that has increased the importance of Form 10BD. It is a significant step in improving the transparency of donation reporting systems. For income tax purposes, charity organizations must fully understand the nuances of the 10BD form and the online filing methods. This form plays a crucial part in making sure that donations are reported accurately and responsibly, following the changing regulatory landscape. To ensure compliance with the updated regulations and maintain the integrity of their financial reporting procedures for charitable contributions, organizations need to get familiar with the 10BD form.

Corpbiz can help you fill out the form and claim deductions under section 80G of the act by following all the prerequisites. The expert guidance available at our organization cannot be underestimated since they carry a total of 40 years of industry experience. We can help your organization claim tax benefits at a reasonable cost and in a quick time.

Frequently Asked Questions

Why was Form 10BD introduced?

In the earlier days, there was no record of donations received, and these institutions used that fraudulently and claimed more deductions than they were eligible for. The 10BD form was introduced to ensure clarity and transparency in claiming deduction benefits by non-profit organizations.

What is the minimum amount of donation received to fill out Form 10BD?

There is no minimum donation limit for the 10BD form as per the act, and no threshold limit applies to the number of donations received. Hence, all the donations received have to be filled out.

When can charitable institutions claim deductions?

When these institutions have filled out the 10BD form, they need to issue a donation certificate in favor of the donor through Form 10BE. Now, they are eligible to claim deductions as per section 80G or 35 of the Income Tax Act of 1961.

Who is required to fill out Form 10BD?

10BD form is applicable for institutions that take donations from the public to carry forward their object of a noble cause, ensuring that they don’t have to worry about the finances to promote their charitable work. The institutions that fall under the ambit of the 10BD form include schools, colleges, universities, churches, research institutes, trusts, NGOs, and similar others.

Is it mandatory to file Form 10BD?

Yes, it is mandatory to file a 10BD form with the income tax department. However, if any charitable institution hasn’t received any donations from the public in that year, there is no need to file a 10BD form.

Can a trust file Form 10BD, having only provisional approval u/s 80G?

Having a regular or provisional approval under sections 80G or 35 doesn’t make any difference, and they can file a 10BD form. The status of approval is irrelevant and the organization has to file a 10BD form if it has received a donation mandatorily.