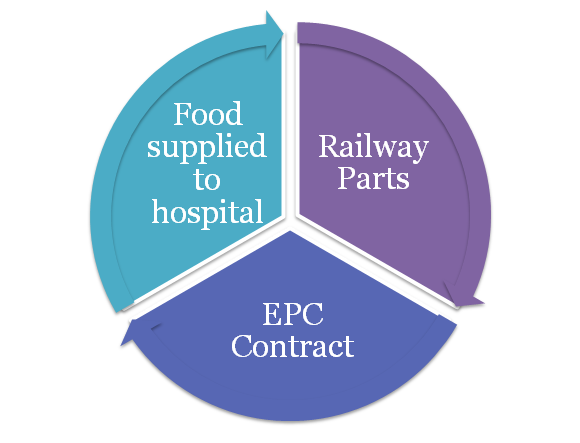

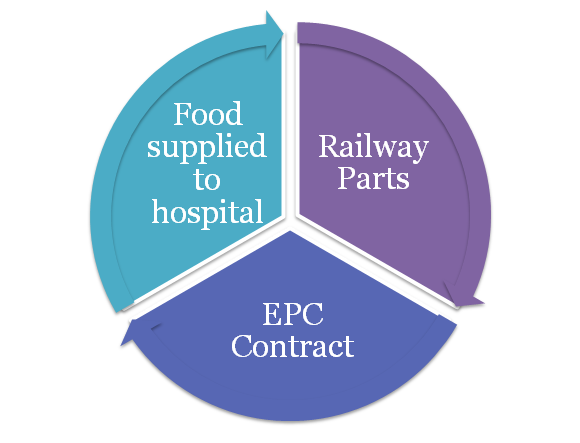

12% of GST applicable on manufacturing and supplying of different parts of Railway that includes knuckle, toggle, lock etc. as per the rulings stated by the Karnataka Authority of Advance Ruling. Applicability of GST on EPC Contract is 18% concerning the power distribution to the government entity as ruled by the Telangana Authority of Advance Ruling. 5% of Good and services tax is applicable on food that is supplied to the Government Hospitals, Private Hospitals as well as Autonomous Bodies on outsourcing basis as held by the Telangana Authority of Advance Ruling.

Applicability Of GST on Manufacture And Supply Of Railway Parts

M/s Pragati Steel Casting Pvt. Ltd. , manufacturers of various steel castings, automobile parts, valves etc. supply the parts to M/s Sanrok Enterprises, Faridabad, who supply the same to the Indian Railways on the classification of said goods under HSN 8607 and on discharging the GST on 5%. The specifications and drawings are as per the ruling stated by the Authority of Advance Ruling(AAR), Karnataka that 12% GST would be applicable in order to manufacture and supply Railway parts that include knuckle, toggle, lock, yoke, etc.

Hence the applicant i.e. M/s Pragati Steel Casting Pvt. Ltd. filed an application seeking the classification of the aforementioned parts and the rate of GST applicable thereon as the impugned goods are liable to be classified under HSN 7325 and the GST rate that is applicable here is 18%.

Whether Railway parts like Couplers, knuckle, locks etc. be classified under HSN 8607 or under HSN 7325?

The application seeking advance ruling regarding the classification of certain Railway parts under HSN 8607 or HSN 7325 as other cast articles of Iron or Steel was considered by the Authority consisting of members Dr. Ravi Prasad M.P. and Mashoodur Rehman Farooqui. It was held that the applicable rates of GST on the impugned goods is 5% in accordance to the entry number 241 of the Schedule I to the notification No. 1/2017, till October 29, 2019, which has now been replaced by the entry number 205 G of Schedule II. Hence the rate of GST has now been increased to 12% with no refund of the unutilized input tax credit.

Read our article:Latest: Government unable to pay state’s GST compensation share

Applicability of GST on EPC Contract with Respect to Power Distribution and Transmission to Government

M/s. Vishwanath Projects Ltd. is providing services of supply, erection. Testing and Commissioning of 51 Nos 33/11kV Substations with Associated Lines to M/s. Odisha Power Transmission Corporation Limited, Janpath, Bhubaneshwar (OPTCAL).

The AAR earlier ruled that 18% of GST is applicable on EPC contracts with respect to power distribution to the government entity. According to the applicant, the power distribution companies are treated as government entities and the GST rate is 12%.

Whether EPC contract with respect to power distribution falls under the category of “Government Entity”?

The application seeking advanced ruling as to whether EPC contract with respect to power distribution falls under the category of government entity. As per GST notification number 1/2018 Central Tax on which the rate of GST is applicable. It was considered by the authority consisting of Additional Commissioner Of State Tax Officer J. Laxminarayana and the Joint Commissioner of Central Tax Officer, B. Raghukiran.

It was held that the services rendered to M/s OPTCL falls under-serviced providers to a government entity and hence the rate of Tax is 18% for the services referred by the applicant. It was also found by the authority that the contractee is not rendering any non-commercial services for the purpose of commerce and they get reimbursed for their activity on behalf of the customers from the State Government[1] which cannot be called as non-commercial. Since their work is used for commercial purposes the benefit of 12% tax rate is not available to the applicant.

Applicability of GST on Food Supplied to Hospitals

M/s Navneet Kumar Talla is involved with supplying food to M&G Cancer Hospital, Hyderabad on an outsourcing basis to the patients of the hospital. The AAR, Telangana has ruled that 5% GST would be applicable to food that is supplied to hospitals inclusive of Government hospitals. Private hospitals and autonomous bodies on outsourcing basis with a condition of non-availability of an input tax credit.

Whether food supplied to certain hospitals is chargeable for GST?

The application seeking advanced ruling that whether the food supplied to the hospitals be it governmental, private and autonomous bodies on outsourcing basis are chargeable for GST or not. It was considered by the authority consisting of Additional Commissioner of State Tax, J. Laxminarayana, and the Joint Commissioner of Central Tax, B. Raghukiran. It was ruled that 5% of GST would be held chargeable for food supplied to Government Hospitals, private hospitals and Autonomous bodies on outsourcing basis, the GST is chargeable. The food that is supplied to the hospitals by the applicant depends on the time period and would be a subject to tax as per the provisions of notification numbers 11/2017. It was further held that the GST must be paid 5% from July 27, 2018 onwards.

Conclusion

The AAR held that applicability of GST in different situation will be conditional by nature. The food that is supplied to the hospitals by the applicant depends on the time period and would be a subject to tax as per the provisions of notification numbers 11/2017. It was further held that the GST must be paid 5% from July 27, 2018 onwards. It was held that the applicable rates of GST on the impugned goods is 5% in accordance to the entry number 241 of the Schedule I to the notification No. 1/2017, till October 29. “The AAR earlier ruled that 18% of GST is applicable on EPC contracts with respect to power distribution to the government entity.”

Our CorpBiz group will be at your disposal if you seek skilled advice on any aspect GST registration along with it’s complete compliance. We will help you ensure full compliance concerning all the requirements based on your anticipated activities of your company, ensuring the productive and well-timed completion of your expectation.

Read our article:GST online Registration Process: A Complete Guide