The Government of India has announced the Faceless Penalty Scheme, 2021 by the vide Notification No. 02 /2021 which will digitize the issuance of penalty on assessees under the faceless tax regime. It has become effective from 13th January 2021.

The Faceless Penalty scheme, 2021 specifies the establishment of the National Faceless Penalty Center, Regional Penalty Center, Penalty Unit and Review Unit for execution of penalty proceedings, such as when a penalty order is properly issued and before an assessee is issued on undergoes review.

Scope of the Faceless Penalty Scheme

The penalty under this scheme will be levied in respect of such territorial area, or class of persons or persons, or class of income or cases or class of cases, or class of penalties or penalties which may be specified by the Board.

Highlights of the Faceless Penalty Scheme, 2021

Below listed are the features of Faceless Penalty Scheme, 2021, which are as follows:-

National / Regional Penalty Centre

For the purposes of this Scheme, the CBDT will set up a National Faceless Penalty Centre, Regional Faceless Penalty Centres to facilitate the conduct of faceless penalty proceedings and vested with the jurisdiction to levied fines as per the provisions of the scheme.

Setting up of Penalty Units

- Penal units will be set up by the CBDT to draft punitive orders, which contains the identification of points or issues to levied penalties under the Income Tax Act

- It is for seeking information or clarification on the points or issues identified, it gives an opportunity to listen to the assessee or any other person, analysis of material submitted by the assessee or any other person, such as may be important for other works.

Penalty Review Units

Penalty review units shall also be setup to perform the functions of review of draft penalty order.

- Whether relevant real evidence has been brought on record or not,

- Whether the similar to points of fact and law have been duly registered in the draft order or not,

- Whether the matter on which penalty is to be imposed have been mentioned in the draft order or not ,

- Whether the precedents have been considered and dealt with in the draft order or not,

- To review arithmetical correctness of computation of penalty, if any, and such other functions as may be needed for the reasons of review.

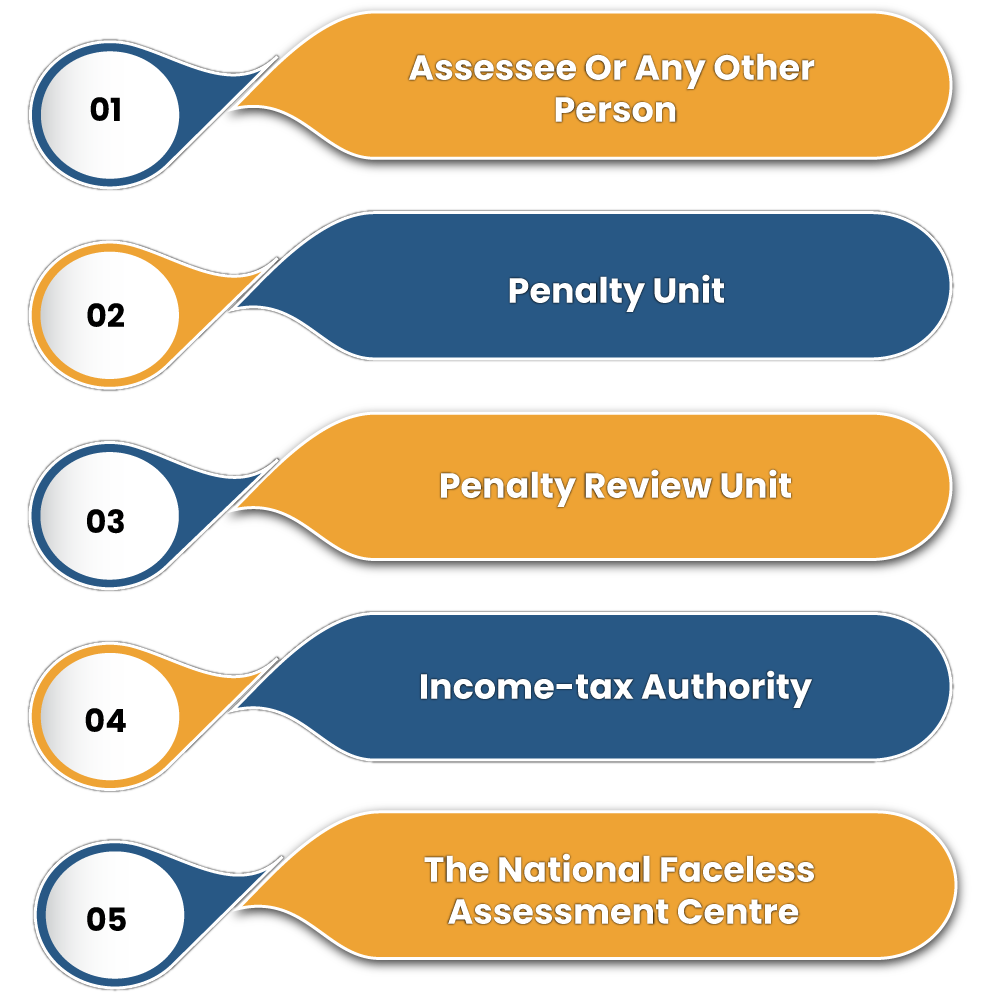

Authorities under Penalty Unit & Penalty Review

The penalty review unit and the penalty unit will have the below listed authorities, namely:–

- Joint Commissioner or Additional Director or Joint Director or Additional Commissioner

- Income-tax Officer or Deputy Commissioner or Assistant Commissioner or Deputy Director or Assistant Director

- Ministerial staff or Other income-tax authority, consultant or executive, as may be considered important

Procedure in Penalty under Faceless Penalty Scheme, 2021

- Tax authority or the National Faceless Assessment Centre can initiate penalty proceedings and issue a show-cause notice for imposition of penalty; or

- National Faceless Penalty Center can assign case to a specific penal unit in one of the regional faceless penalty centers through an automated allocation system if any reference has been received,

- It is recommended to the penal unit to initiate punitive proceedings against such a unit,

- After examining the piece of evidence, the penal unit can decide the case,

- When the case has been decided by the penal unit, the penal unit can initiate the sentencing proceedings.

- The penal unit will summon the assessee or any other person and prepare a draft notice.

Rectification Proceedings under Faceless Penalty Scheme, 2021

- With respect to any order passed by the National Faceless Appeal Center may rectify any mistake apparent from the record, and may amend the mistake by passing an order in writing.

- Subject to other provisions of the scheme, an application to rectify the mistake may be filed with the National Facial Penalty Center by shown below.

Appellate Proceedings under Faceless Penalty Scheme, 2021

- An appeal against the penalty order made by the National Faceless Penalty Center under this scheme shall lie on the Income Tax Officer of the jurisdiction of the Commissioner (Appeals) or as the jurisdiction before the National General Appeal Center, as the case may be;

- In any communication to the National Faceless Penalty Center, any reference to the Commissioner (Appeals) may mean such jurisdiction as the Commissioner (Appeals) or the National Faceless Appeal Center.

Exchange of Communication Exclusively by Electronic Mode

- It has been provided that for the purposes of the Scheme all communications between the National Faceless Penalty Centre and the assessee or any other person.

- As the case may be, or his authorized representative, shall be exchanged exclusively by electronic mode;

- All internal communications between the National Faceless Penalty Center, National Faceless Assessment Center, Regional Faceless Penalty Center, any Income Tax-tax authority, penal unit or penal review unit will be exchanged exclusively by electronic mode.

Delivery of Electronic Record

- An electronic record shall be authenticated by a digital signature certificate to fulfill the purpose of this scheme, if it is necessary under the rules for the assessee to return his income under a digital signature and in any other case a digital signature will be done by a verification code.

- Under this scheme every notice or order or any other electronic communication shall be conveyed to the assessee through a registered account or by keeping a certified copy to the registered email address or its authorized representative.

No Personal Appearance

- Under the Faceless Penalty Scheme, 2021 assessee will not be needed to appear before the Income Tax Officer either in person or through an authorized representative in respect of any action under this scheme at the National Faceless Penalty Center or Regional Faceless Penalty Center or Penalty Unit or Penalty Review Unit.

- The assessee’s authorized representative may request for a personal hearing, so as to make his oral presentation or present his case before the penalty unit under the provisions of scheme.

Concluding Remark

The Faceless Penalty Scheme, 2021 has given the direction to the process of taking punitive action in a virtual manner without any physical interaction between the tax payer and the Income Tax Department[1]. The said scheme aligns with the Faceless Assessment Scheme and the Faceless Appeal Scheme.

The Faceless Penalty Scheme, 2021 leverages on the development of technology and aims to meet the Honourable Prime Minister’s vision for improving transparency, efficiency and accountability in tax administration. Kindly associate with the Corpbiz expert to know more about the notification releases by CBDT on Faceless Penalty Scheme, 2021.

Read our article: Necessary Orders Passed By Income Tax Appellate Tribunal (ITAT) that You Must Know!

notification_no_3_2021