Income tax audit report is an examination for an individual’s or organisation’s tax returns by agencies to verify that all the income, deduction and expenditure information that are filed correctly. The tax audits have been made mandatory by Income Tax Act. It also states that all taxpayers are required to get the accounts for their business or organisation audited according to the provision of the IT Act. Recently, there is an extension in Tax audit report due dates and income tax returns filing applicable for AY 2020-21 due to pandemic.

The Section 44AB of Income-tax Act, 1961 contains provisions for the tax audit of the entity. According to these provisions, tax audit report must be conducted by a Chartered Accountant who ensures that a taxpayer maintains proper books of account and complied with all provisions of the Income-tax Act.

Read our article:CBDT Amends the Tax Audit Report Form 3CD, ITR 6, Form No 10-IE and 10-IF

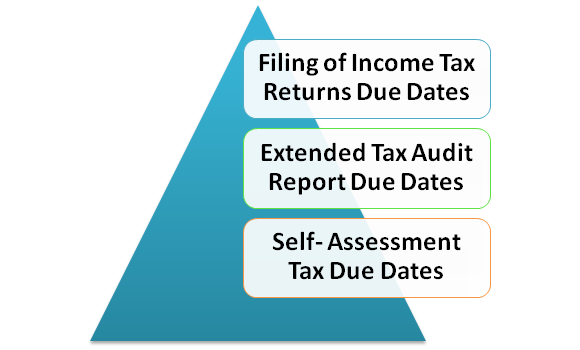

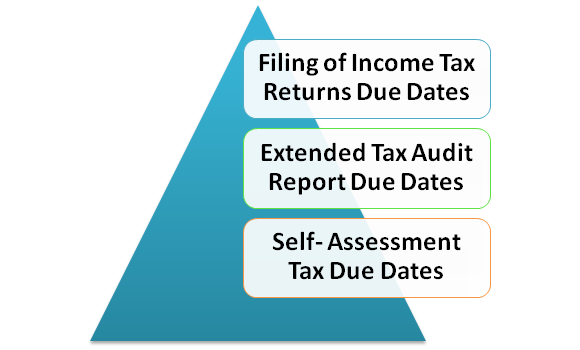

Filing of Income Tax Returns Due Dates

For providing more time to taxpayers it has been decided to further extend the due date for furnishing of Returns. Those underlines are as follows:-

- The due date for furnishing of the Income Tax Returns for the taxpayers who are required to get their accounts audited as per the Act was 31st October, 2020, which further has been extended to 31st January, 2021.

- The due date for furnishing of Income Tax Returns for taxpayers who are required to furnish report in respect of domestic and international transactions for which the due date was 30th November, 2020 has now been extended to 31st January, 2021.

- The due date for furnishing of Income Tax Returns for other taxpayers, for which the due date was 31st July, 2020 has now been extended to 31st December, 2020.

Extended Tax Audit Report Due Dates

The date for furnishing the audit reports including tax audit report and report in respect to international and domestic transaction has also been extended to 31st December, 2020.

Self- Assessment Tax Due Dates

For providing relief to small and middle class taxpayers, the due date for payment of self-assessment tax for the taxpayers whose self-assessment tax liability is up to Rs. 1 lakh has been extended as well.

- Accordingly, the payment of self-assessment tax for taxpayers who do not required to get their accounts audited due date was extended from 31st July, 2020 to 30th November, 2020, hereby further being extended to 31st January, 2021.

- And, for the auditable cases, the due date was extended from 31st October, 2020 to 30th November, 2020, hereby further being extended to 31st December, 2020.

Conclusion

The Government[1] has issued a Notification on 24th June, 2020 which has extended the due date for all Income Tax Returns for AY 2020-21 to 30th November, 2020. Hence, the returns of income that were required to be filed by 31st July, 2020 and 31st October, 2020 has been extended till 30th November, 2020. Also, the date for furnishing various audit reports including tax audit report under the Income-tax Act, 1961 has also been extended to 31st October, 2020.

Read our article:Submitting of Audit Report with Income Tax Return is not Compulsory – ITAT

PressRelease_Extension_of_due_date_of_furnishing_of_IITR_and_Audit_Reports_24_10_20-1