Three years since the launch of the GST rule in 2017, the government for the first time has admitted that they have no money to pay the state government the share of GST incomes as was agreed by the GST law.

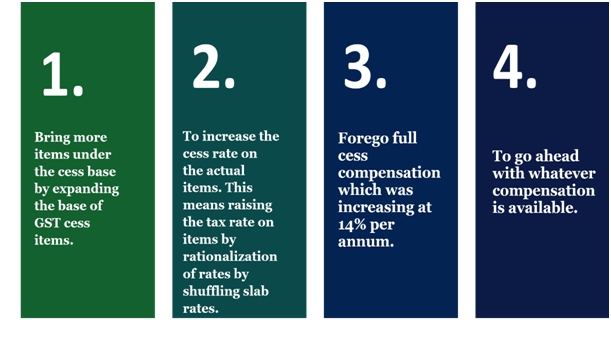

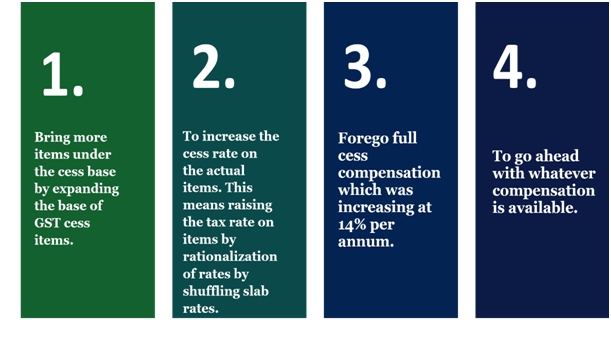

Meanwhile in August 2019, before the lockdown due to the pandemic, the economic state has been such that Goods and services tax collected is almost half of what is due to the states. The Solution includes raising taxes on some items or bringing exempted items under the tax net either one of them.

Union Finance Secretary Ajay Bhushan Pandey told the Parliamentary panel on finance ministry that “the central government is not in the position to pay the share of the states” according to the revenue share formula laid down by the GST Act.

Finance ministry’s source

The finance secretary has said that the GST Act[1] was built with requirements to rework the method for paying compensation to the state government if the revenue collection drips below a certain level, then the issue is under debate in the GST Council of India.

Amidst demand for compensation and dues among the states, a finance ministry release on Monday said that the central government had released Rs 13,806 crore of GST compensation about the Financial Year 2019-20.

The GST Council is the sole policy making body for the ‘One Tax’ regime, and was scheduled to held a meeting in July to debate a substitute formula of reimbursement for cash-strapped state. The meeting is yet to be held due to the pandemic.

Read our article:How to apply for GST registration certificate online?

How bad is the revenue position?

According to a circumstantial note prepared by the government in the current fiscal year 2020-21, the central government has released INR 15,340 crore to the states and Union Territories as GST compensation notwithstanding an almost irrelevant collection nearly due to relief provided in relation with filing of return and compensation of taxes owed to lockdown due by the outbreak of Covid-19.

In contrast, government foundations say that earlier in the previous Financial Year 2019-20, the central government released INR 1,20,498 crore GST compensation to states and union territory while it had collected about INR 95,000 crore in the form of compensation cess from the taxes.

The government had room as on March 31, 2019, with an amount of INR 47,271 crore of GST compensation cess together that had continued unused after the release of GST reimbursement to the states and Union Territory in the Financial Year 2017-18 and 2018-19 respectively.

In the circumstantial note, the government has admitted that much before the coronavirus-triggered economic slowdown, “Since the end of August 2019, and the central government started realizing the impending unwarranted position in paying GST reimbursement to the states and UTs as the reimbursement cess prerequisite was being double on the average monthly cess collection in India”.

The note says that on a regular, the monthly GST compensation cess prerequisite was to the tune of INR 14,000 crore while the cess gathering average was only in the range of INR 7,000 to INR 8,000 crore monthly.

According to finance ministry foundations, the monthly cess necessities were to increase over the years.

The GST Council, which is debating the way out, has little option but has its limitations. An increase in reimbursement cess on few items could only yield about INR 2000-3000 crore a year.

Point of conflict between Centre andStates

Government foundations has said that compensation from the monthly period of October-November, 2019, has been compensated for all states, and salary has not been paid to state for any period beyond that without any discrimination between states. Sources claimed that the calculation of compensation is done in a completely transparent manner and is shared with the states.

Conclusion

The central government additional rules that notwithstanding its attempt to keep the exercise see-through on non-discriminatory payment of GST compensation cess have become an arguable point of discussion among the Centre and states. GST law lies down that compensation for loss of revenue to states due to the outline of GST has to be compensated by taking in account the gap amongst the projected revenue and the GST revenue collected.

Read our article:Exemptions Under GST: Detailed Guide