In the absence of GST registration, the supply of goods and services lures substantial penalties. Being registered under GST, means that you are eligible for collecting taxes from the customers. Thus, if you wish to avoid penalties, you need to get registered under GST as soon as possible. This blog will provide all the necessary information regarding GST registration process.

What scenarios lure the GST registration for the business owner?

The goods and services providers must avail GST registration and GSTIN if the following conditions are satisfied:

- The yearly income crossed the limit of Rs 40 lacs for the intrastate business.

- If the business location found to be in the list of special states such as J&K, HP, and Assam) and have a turnover above Rs. 20 Lakh annually.

- They are running an e-commerce business.

- They are involved in interstate business.

- They come under the canopy of reverse charge.

- They are following the tax provision under Section 9, sub-section (5)

- They are non-resident engaged in producing taxable supply

How to avail GST registration?

Here are the steps involved in GST registrations, which are as follows:-

- First of all, you need to fill out the GST REG-01 form. For that, you will need to furnish ample detail such as PAN information, Email ID, and phone number.

- After the PAN verification, you will need to verify the email and phone number via OTP.

- Spare the details regarding the application reference number [ARN] sent to your email and phone number once the verification process is complete.

- Put in your ARN number along with supporting docs where required.

- If you have some more info to add, fill out the GST REG-03 that generates automatically.

- After an in-depth examination of the information, a certificate of registration will be awarded to you within three days.

Read our article: Actionable Strategies to avoid GST Registration

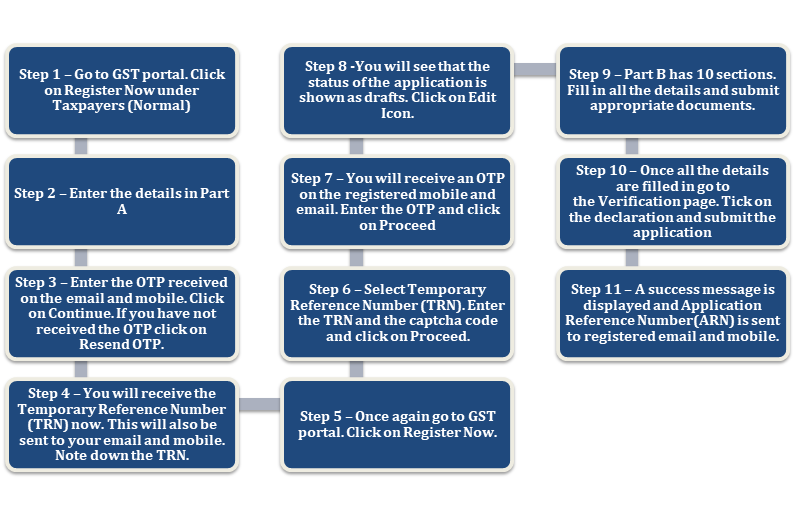

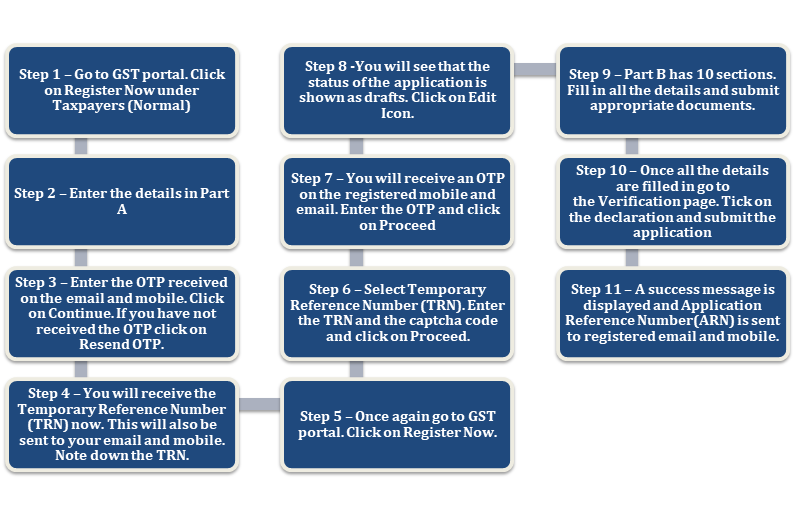

GST Registration Process for Normal Taxpayers

Here is a step-by-step guide on how to complete GST registration process online on the GST Portal:

List of the documents that support that GST registration

- Certificate of Incorporation

- Photograph of the Authorized signatory.

- Photo of the partner or the promoters.

- Address proof of the business such as utility bill or legal ownership document

- Resolution copy furnished by the relevant board members or letter of Authorization.

- Bank related evidence such as- a copy of passbook, canceled cheque, and bank statement.

What is the method to verify the GST registration status?

Here is how to verify GST registration statuses without logging in, which are as follows:-

- Head over to the URL- https://www.gst.gov.in via your web browser.

- Navigate to the menu bar and click the “Service” tab

- Next. Opt for the ‘Registration’ followed by ‘Track application status’ option

- A new window will pop up, asking you to Enter your ARN.

- As soon as you enter the ARN, click on the search option.

- Your application status will be rendered on your computer screen and also delivered to the email ID and phone number.

There is also an alternative method to serve this purpose. Here you need to open the same website and then log in to it. Next, select the ‘Registration’>‘Track application status.’ On the next page, all you need to provide your ARN and click on search will be rendered on your screen along with registered email id and phone number.

Important facts related to GST registration

- Every business that is reaping yearly turnover of more than 40 lacs must avail GST registration to avoid conflict with the law.

- If the business’s annual turnover is Rs 20 lacs or less, and it resides in the list of special states, the GST registration is mandatory. Here is the list of 11 special states-

- Arunachal Pradesh

- J&K

- Assam

- HP

- Sikkim

- Manipur

- Mizoram

- Tripura

- Nagaland

- Meghalaya

- Uttarakhand

- If you are the entity deals with inter-state supply, then, in that case, GST registration is compulsory.

- In case if you have a plethora of branches in the multiple states, then it’s not necessary to avail GST registration for all the branches. All you need to apply for the main branch and include the remaining ones as additional. However, this provision will not support the entities who are dealing with different business vehicles. Note that this provision is mentioned in Section 2(18) of the CGST Act, 2017

- GST provisions exclude any fees for the registration purpose.

- Any violation in terms of GST registration could lead to sustainable penalties such as Rs 10000 or 10% of the amount due. In case, if tax evasion is done on purpose, the penalty will be 100% of the owned taxes.

Conclusion

We recommend getting GST registration as soon as possible if you are supplying goods or services on an inter-state basis. Because bypassing such requirements would land you into the zone of discomfort, operation loss, and even substantial penalty. So, to avoid such conflict, make sure to get aid from professional who is accustomed to GST registration, and its traits. Please don’t hesitate to drop your invaluable insights in the comment box as we will try to respond to them promptly.

Read our article:GST Registration for E-commerce Operators under GST Regime