The Section 23 of CGST Act 2017 talks about the non-applicability of GST on the taxpayers. This blog would provide a briefing about the statutory provisions cited under the said Act.

Statutory Provision under Section 23(1) (a) of CGST Act

Any individual involved exclusively with the business of supplying goods and services or both that are exempted under this Act is not required to avail GST registration. Let’s understand the above section’s notion through an example: Let’s say Mr. X is a business owner who supplies essential oils and resinoids perfumery. As per the Section 23 (1) (a), he is not liable to get registered even if his yearly revenue exceeds the maximum threshold limit i.e., Rs 20 Lakhs.

Section 23 of the CGST Act provides the non-applicability of GST on exempt supplies even if the yearly revenue surpassed the limit of Rs 20 lakhs. On the contrary, Section 22 talks otherwise as it mandates to avail registration if the aggregate turnover in financial years surpasses Rs 20 Lakhs regardless of whether such turnover includes exempt supplies or not.

Analysis of Provision

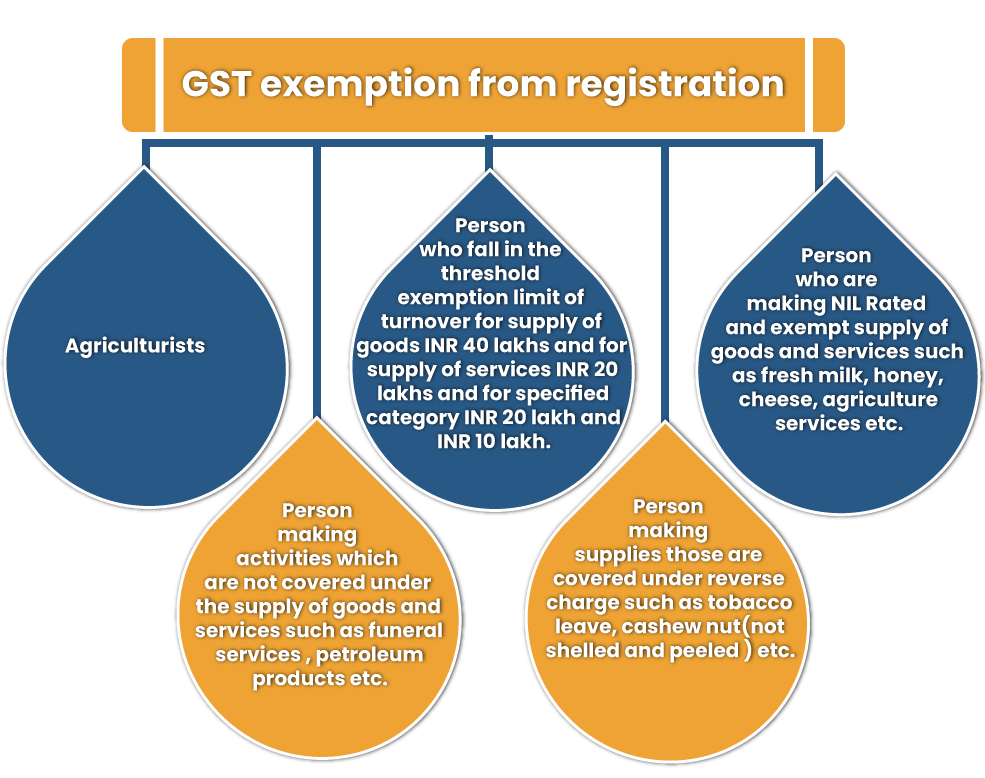

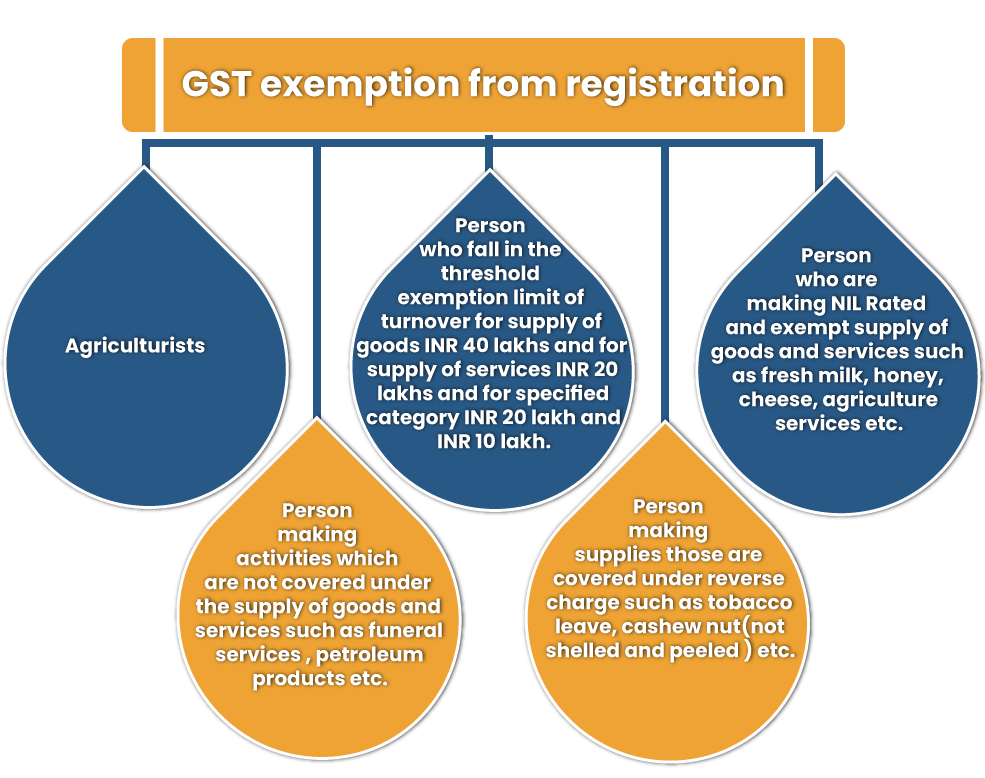

Following are the individuals who are not allowed to avail of GST registration under section 23 of the CGST Act, which are given below:-

- Agriculturist;

- Individual involved exclusively with the supply of exempted goods or services or both.

Henceforth, the aforesaid individuals don’t need to get registered under GST even if their annual income surpasses Rs 20 lakhs. Section 23 of the CGST Act overrides section 22 in this regard.

Read our article:Overall Concept of GST E-Invoice Compliance Threshold Limit

Who is Agriculturist as per Section 2(7) of CGST Act?

According to the said Act, agriculturist is referred to a person or HUF who is directly engaged with the farming activities and undertakes such tasks via

- Own labor, or

- Labour of family, or

- Servants on wages or supervision of any family member

Therefore, an agriculturist is not entitled to avail GST registration only to the extent of the supply of produce reaped through land cultivation. If an agriculture supplies product other than the product linked with land cultivation, he would not deem fit within the provision of section 22 and might have to avail registration w.r.t such supplies.

Why Nature of Activity Plays a Crucial Role in GST Applicability?

It is essential to consider the nature of activities performed by the agriculturist. If the process differs from the term “cultivation,” it would be treated outside the scope of this exclusion from registration. That means any further processing of the primary produce will continue not to avail this exclusion.

The activity of land cultivation does include pisciculture on inland water bodies or animal rearing. Technically, the produce from land is termed “cultivation of land”. For example, a harvesting paddy is a form of cultivation, but the production of wheat is not.

It’s worth noting that the exclusion from the requisite to get registered doesn’t lead to a tax collection on agri-produce. Section 9(3) of the CGST Act & Section and sections 5(3) of the IGST Act provides certain products (such as almond) on which tax is payable under reverse charge mechanism by the recipient of goods when such goods are purchased from an agriculturist.

Therefore, the exemption from GST registration depends on the status of the supplier rather than the commodity. Apparently, if the good’s supplier is not an agriculturist, he would have to register as per section 22 if his turnover crossed the ‘exemption threshold.’

Exclusively Involved with the Exempt Supplies

The term exclusive indicates involving only those supplies which are exempted. Henceforth, if a supplier is supplying taxable & exempted goods or services, this provision would not be applied and the supplier has to obtain registration under Section 22.

It objectively allows any individual whose entire supply contains supplies to be exempted from availing registration. The taxpayer should pay attention while validating the premise of the entire supply. The exempted supplies’ valuation should be done along with the taxable supplies to check if the annual turnover has surpassed the exemption threshold u/s 22 for attracting registration.

This leads to another query- whether registration is needed in case an individual is involved exclusively with supplying non-taxable goods or service and incurs some expenses cited in Section 9(3) for addressing tax liabilities under reverse charge basis. In view of Section 23 (2) of the CGST Act, India’s government[1], in association with the GST council, can roll out notifications for the grant of exemption to other categories of persons.

Notification Released By the CBIC for Grant of Exemption to Other Categories of Persons

The following notification has been made publicly available by the CBIC in the past few years regarding the grant of exemption to other categories of persons.

Notification No. 5/2017-CT Issued on 19-June-2017

Individuals who are making supplies of non-exempted goods or services or both, where the tax is applicable on the recipient of goods or service under RCM, are exempt from obtaining GST registration.

Notification No. 10/2017-IT issued on 13-Oct-2017

This notification is related to the interstate supply of non-exempted services- the GST registration does not apply to the class of supplier dealing with inter-state supplies of services whose total turnover falls under the range of Rs 20/10 lakhs.

Notification No. 65/2017-CT issued on 15-Nov-2017

This notification is for the taxpayer supplying service via an online operator. The notification provides that the taxpayer who supplies services via e-commerce operator is not liable to obtain GST registration if their aggregate turnover falls under the range of Rs 20 lakhs/annum (Rs 10 lakhs in other specified states).

Notification No. 3/2018-IT issued on 22-Oct-2018

This particular notification paid attention to the interstate supply of handicraft goods. As per the said notification, the supplier of the handicraft goods making inter-state supplied are excluded from the requirement of obtaining GST registration.

They are also not liable for general registration for conducting inter-state supply where they possess a fixed establishment. However, they are under the legal obligation to obtain Income Tax PAN and to generate e-way bill.

Notification No. 32/2017-CT issued on 15-Sep-2017

Through this notification, the government had mandated the generation of e-way even if the consignment’s value falls under Rs 50,000 if the supply of handicraft goods took place on an inter-state basis.

Notification No. 10/2019-IT issued on 07.March.2019

A taxpayer involved with the exclusive supply of goods & whose total annual turnover does not surpass Rs 40 lakh is not required to secure the GST registration.

Conclusion

Section 23 of the CGST Act has emerged as a savior for the greater percentage of individuals who reap income through immense hardship. This section aims to enable the struggling strata of society to flourish with a minimum of tax obligations that largely act as a major roadblock for their development.

Connect with CorpBiz professional to get additional and precise information on the Section 23 of the CGST Act. You can use different mode of communication to get in touch with our professional.

Read our article:An Comparison of Post-GST Implementation Scenario in India