The concept of e-invoicing is a major trick for India due to the several business transactions performed daily, with various non-standardized formats used in invoice generating. This concept may be new in the Indian market among Indian taxpayers but almost in 70 countries since last few decades, it has been accepted and adopted successfully. The new GST e-invoice system is designed to draft invoice receipts, which is an integral part of any business process, It is to inject input towards the removal of the tedious task of compiling invoices at the end of the return period, making the task for filing returns in a simple manner

Electronic invoicing can be considered as a good step in light of ‘Digital India Initiative. It is expected that GST e-invoice will curb tax evasion through fake invoices and also help in better tax compliance.

Implementation of GST E-Invoicing

The implementation of GST e- invoicing bills under the Goods and services tax Scheme was concluded by the 39th GST council meeting. The members of the meeting came up with a decision to start the usage of QR codes from 1st of October 2020 due to the outbreak of the novel covid-19 virus. However, in a recent press release issued by CBIC on dated 30 September 2020, CBIC has granted exemption to businesses by waiving the Penalty Due u/s 122 of the CGST Act, 2017 on e-invoices during October, if the companies issuing them receive the IRN within 30 days from the invoice date.

The integrated electronic format invoice is a type of documents, exchanged accordingly the goods and services in between the supplier and the buyer. It is a form of system where all the invoices (B2b) are decrypted electronically and certified by the concerned designated portal.

Read our article:A Coast-to-Coast Coverage of E-Invoicing in GST

Who is required to Generate GST E-Invoice?

GST electronic invoicing will provide several categories under which taxpayers will fill electronic invoice in accordance with the turnover and other criteria. CBIC had notified notification number 61/2020 CT; E-invoicing for businesses with turnover exceeding Rs. 500 crore, increase in mandatory electronic invoice issuance limit from the earlier limit of Rs 100 crore. Once registered, the taxpayer should generate an e-invoice even if the business is less than 500 crores in the subsequent year.

E-invoice can only be generated by suppliers. Transporters & recipients are not able to produce e-invoice. E-commerce operators are able to produce e-invoices on behalf of vendors on their platforms under Rule 48 (4) of the CGST Rules.

Who are not required to Generate GST E-Invoice?

Listed below persons are excluded from issuing e-invoice vide notification No. 13/2020-CT on dated 21st March 2020, which are as follows:-

- Insurance company

- NBFCs

- Financial Institution

- Banking company

- Supplier of passenger transportation services

This can be done with the aim of giving exemption to suppliers of categories where the volume of transactions is huge or unorganized sector, which can cause practical difficulty in issuing e-invoices.

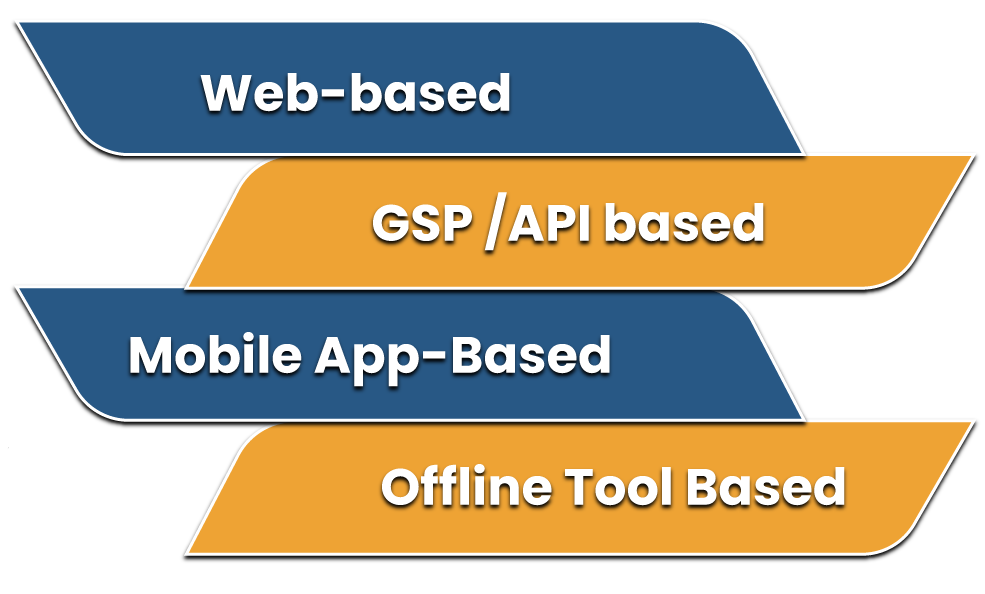

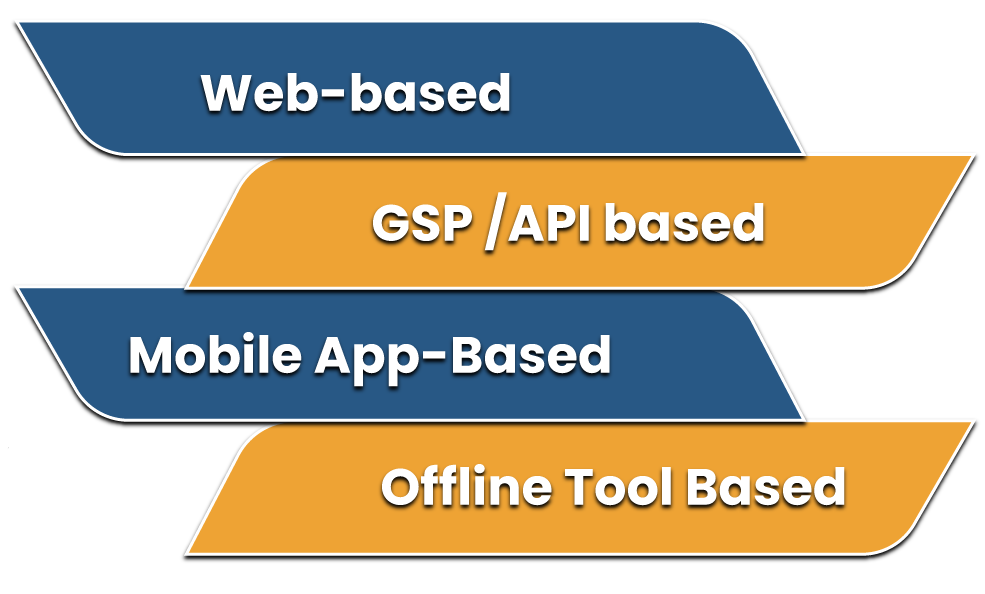

What are the Modes for Generating GST E-invoice?

The following are the modes for generating GST e-invoice, which are as follows:-

Web-based

Logging into the electronic invoice portal and manually entering the invoice data to generate the electronic invoice.

GSP /API based

Third-party software {Secure Folder, Excel Connector, Direct Database Access, Interface to access ERPs (Pull) and Click Button in ERP (Push)}

Mobile App-Based

Generating e-voice by using the mobile app.

Offline Tool Based

Generating e-invoice offline by using excel tool and data can be easily uploaded and exported to the IRP, so as to generate the IRN.

What are the Important Elements of GST E-Invoicing?

Electronic invoice scheme includes both mandatory and optional fields. Mandatory fields are those which must be mandatory for an invoice under the e-invoice standard. Optional areas are those which can be included as per business requirements.

The maximum number of items per line of e-invoice is 100. All mandatory fields have to be filled in for filing e-invoice on IRP. A mandatory field without value can be reported as NIL.

Basic Details

- Supplier’s information

- Recipient’s information

- Invoice item details

- Total documents

Stipulated Time Limit for the Generation of E-Invoice

The law does not specifically provided for any stipulated time frame within which it is necessary to generate an e-invoice.

Specified persons will have to generate electronic invoice before transportation of goods i.e. any invoice without IRN generation will have an invalid document in terms of Rule 48 (5) of the movement of goods.

In many countries, around 3 years of time was usually provided for the implementation of e-invoicing, after the final format or plan was made available in the public domain. However, in India, the final plan was provided only on dated 30 July 2020 and so taxpayers were given only 2 months in the between of an pandemic crisis for preparation and implementation.

Concluding Remark

This fact alone raises a big question on the readiness of taxpayers. It is initially expected to create an additional charge on taxpayers, but the real challenges will only come up at the execution on a real-time basis. Although, existing some of the clarifications from the end of government on the process and legal verification of e-invoice.

Electronic invoicing can ultimately help improve GST compliance and curb tax[1] evasion in the long run. The GST e-invoice system will help curb the actions of unscrupulous taxpayers and reduce the number of fraud cases as the tax authorities will have access to the data in real time. Kindly associate with the Corpbiz expert to know more about the GST e-invoicing compliance threshold limit increased from 1st October. Kindly associate with the Corpbiz expert to know more about the concept of GST e-invoice compliance threshold limit.

Read our article:CBIC orders Implementation of GST E-invoicing from January 1, 2021: Process & it’s Benefits