Before addressing the applicability of GST on legal services in India, let’s begin with the basic understanding of GST for a better perspective towards the whole concept.

Goods and service tax is a comprehensive, multi-stage, value-added indirect tax imposed on the supply of taxable goods and services. The purpose of the presentation of goods and service tax into the Indian economy was to supersede multiple levies and act as a substitute for indirect taxes with a unified tax. After the goods and service tax got implemented and came into operations, it has abolished the cascading effect on tax.

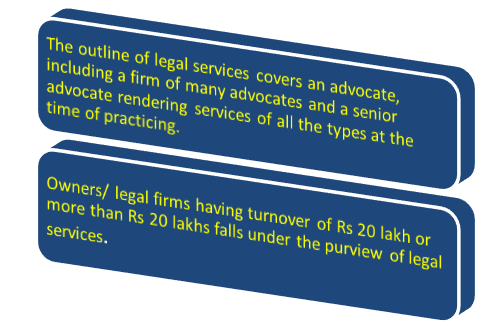

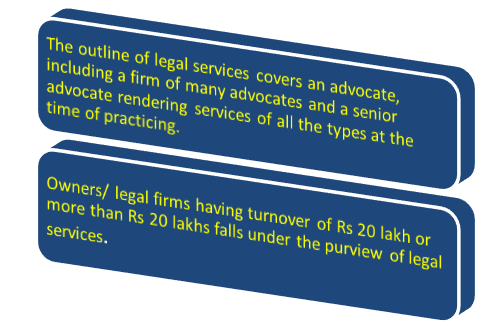

In the Goods and Service Tax regime, legal services refer to any service provided with respect to consultancy, advice as well as assistance in any category of law, in any way comprises representational services prior to any tribunal, court or authority. The impact of GST is not limited to the business owners and regular taxpayers, but the impact of GST on legal services in India and the entire legal community is visible, covering the broader legal aspects.

There was an assumption regarding the legal community that legal firms and lawyers were not part of the GST framework. However, now things are unclouded that Central Goods and Services Act encompasses advocates and services rendered by law firms, legal advisors along with services that advocates provide.

Yes, you got it right. The goods and service tax is leviable on legal services as well as accounting services. The GST rate applicable is 18%. In the Pre-GST period, the statutory tax rate for most of the goods was 26.5%. After the implementation of GST, the indirect taxation system has witnessed many changes. Given below is the diagrammatic explanation of legal services.

GST on Legal Services and Lawyers in India: Applicability Part

GST on legal services and advocates are chargeable under various prescribed conditions. The efficient implementation of goods and service tax on the 1st of July, 2017 has served the purpose of replacing the service tax system and different forms of indirect taxes. However, the order of legal services taxation remains the same as it was earlier. There is no applicability of reverse charge or forward charge for law firms as well as lawyers. As per the following conditions, GST on legal services and advocates would get charged.

- GST is chargeable on the legal services that a senior advocate would provide to a legal firm or some other individual advocate.

- GST is chargeable on the legal services rendered by any advocate practicing on an individual basis or senior advocates or a firm of advocates to a business corporation with a yearly turnover up to Rs 20 lakhs.

The enactment of CGST 2017, along with goods and service tax legislation, has been consolidating various levies into one single unified tax.

Article 279A of the Indian constitution states that the rate of goods and service tax on legal fees in response to legal services coupled with the exemptions of the earlier tax regime got settled by the Goods and Service Tax Council.

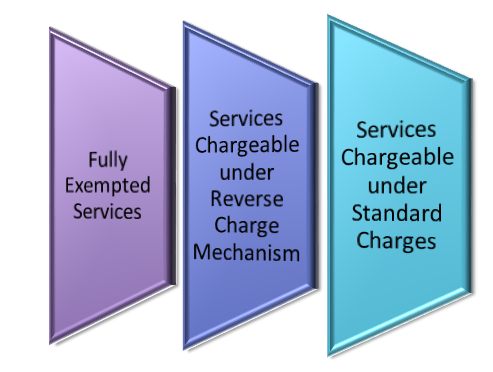

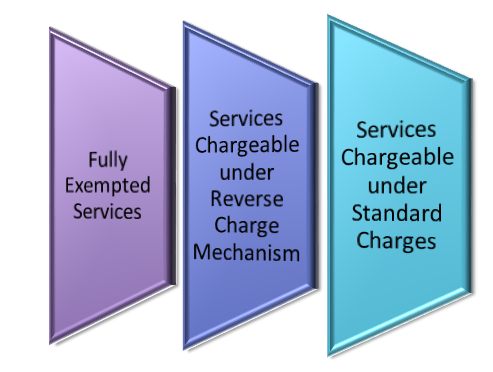

Classification of GST on Legal Services in India

Fully Exempted Services

As per the Notification No.9, Integrated Tax Rate dated 28th of June, 2017; the following services got exempted-

- Legal services provided by a partnership firm consisting of advocates or an individual lawyer advocating any individual alongside businesses.

- Legal services provided by a partnership firm having advocates or an individual lawyer advocating senior advocates, individual advocates, or a firm of advocates.

- Legal services rendered by a partnership firm having advocates or an individual lawyer advocating a business institution having an aggregate turnover of not less than Rs 20 lakh and Rs 10 lakh in various hill states or states that belong to the special category in the previous financial year.

- Legal services that a senior advocate provides to a business establishment having an annual turnover not exceeding Rs 20 lakhs and in case of special category states or hill states not exceeding Rs 10 lakh in the last year of financing.

- Legal services rendered by a senior advocate to any individual person besides a business entity.

Services Chargeable under Normal Charge

- Under the standard charge, the taxpaying liability is entirely on the firm of advocates or the advocate.

- Services granted by an individual advocate or a partnership firm of advocates to a business entity with the turnover exceeding Rs 20 lakhs or Rs 10 lakhs outside the taxable territory is neither a part of reverse charge mechanism or nor under the exemption, the following points get heeded-

According to Section 7 of IGST Act, 2017, this comes under the ambit of inter-state service, and tax must get paid after getting the registration. As the export of service open to qualifying conditions, this taxable service can be eligible. This is for those entities which went through the registration process outside the geographical boundaries of India.

As mentioned in Section 2(6) of the IGST Act, The following conditions must get fulfilled in order to qualify as export of services-

- The supplier needs to be in India

- The recipient must be outside the boundaries of India

- Place of supply should be outside India

- Recipient and supplier are not a distinct person

- Payment should get received in convertible foreign exchange

- Registration in Case of Export of Services

If a person involved in interstate services having a turnover not more than Rs 20 lakhs or Rs 10 lakhs within a financial year, then there is no requirement to obtain registration. This exemption is needless because of the following reasons-

- Since only a person who is registered can claim a refund, exporters of services can’t even go on claiming a refund as per Section 16 of the IGST Act.

- In this exemption, a turnover limit is granted.

Read our article: A Complete Outlook on Job Work under GST Regime

Services Chargeable under Reverse Charge Mechanism

- Services that an individual advocate (Comprising a legal firm or a senior advocate rendering legal services, either in a direct way or an indirect way) grants to a business entity settled in the taxable territory.

- Under RCM, the entire responsibility to pay tax lies on the shoulder of the recipient of the services and not on the supplier.

GST Registration for Law Firms and Lawyers

- As per the GST law, an individual involved in the inter-state taxable supply of services should get GST registration.

- There is no significant requirement for GST registration for those persons who are engrossed in making taxable supplies. This is a case of applicability of RCM, and thus, the recipient of goods and services will be liable to pay the tax.

- GST on RCM won’t be applicable in the case of recipient sited abroad. After acquiring GST registration for lawyers in India, there will be a liability concerning the release of GST, determining the eligibility for the benefits of exports, which would then come under the LLP or the concerned lawyer or a law firm as well.

- Supplies made by the unregistered law firms or lawyers will be chargeable to GST. These supplies are inter-state supplies.

Legal Requirements to Acquire GST Registration to pay GST on Legal Services in India

- Section 22 of the CGST Act- Obtaining GST registration is mandatory for a person who is involved in inter-state services supplies.

- GST registration is mandatory for a person involved in the supply of services with a turnover of more than Rs 20 lakhs.- Section 22 of CGST Act

- As per the notification no. (5-CT) dated 19-06-2017, persons occupied in supplying inter-state services are exempted from acquiring GST registration wherein the entire tax would get paid under reverse charge mechanism.

- There is no major requirement to get GST registration for any person involved solely in supplying services entirely exempt from tax.

Reverse Charge on the Recipient of Service

It is the liability of a business entity, which is the recipient of legal service, to pay tax under RCM. In the shadow of reverse charge mechanism under GST, the liability to pay service tax is in cases where legal services received are from an Arbitral Tribunal, Individual Advocate, A firm of Advocates, and A Senior Advocate.

Bottom Line

The structure of GST on legal services in India is just like the service tax regime. Applicability of GST on legal services has passed through various changes from time to time. The latest provisions suggest that lawyers won’t be paying professional taxes anymore as everything has got clustered into a single unit. Talking about the current scenario, the applicability of goods and service tax is on law firms or advocate fees as well. At Corpbiz, legal experts would guide you with respect to GST on legal services. We are India’s leading platform for legal solutions.

Read our article:GST on Food Services and Food Items: All that you need to Know