As India has celebrated the 72nd Republic Day, it is also a preparation for another important milestone. Great hopes had been placed on the Goods and Services Tax (GST) after the pandemic effect of Covid 19, where after the GST implementation has provided freedom to Indian citizens from the tyranny of multiple levies and tax rates. This tax combined almost all state and central indirect taxes into a single category, creating a single market in the country.

The Practice of GST at International Level

- The main objective of implementing the GST regime in France was to prevent tax evasion which was prevalent in the country due to high tax rates.

- The European Union adopted a system to replace the turnover tax with the aim of generating revenue on goods of general consumption.

- The GST was implemented as a federal tax which was collected by the Centre and distributed to the states in Australia.

- In China, the tax system only applies to the provision of goods, repair, replacement and processing services.

- Countries like Singapore and New Zealand tax charges almost everything at the same rate.

- Indonesia has five positive rates, one zero rate and more than 30 categories of discounts.

How Indian GST Implementation Differs from other Countries?

The structure of tax in India is different from other countries because it is payable at the end of consumption. Typically, tax is collected on value-added goods and services at each point of the supply chain.

Being a union of states, India follows a dual tax structure i.e. separate tax schemes for the centre and states and the same will be applicable for GST governance. Also, while rates in other countries are around 15% to 20%, India’s rates are approx 5% to 28% lower than other countries.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty

Lessons of GST Implementation from Other Countries

Listed below is GST implementation lesson, India learnt from other countries for:-

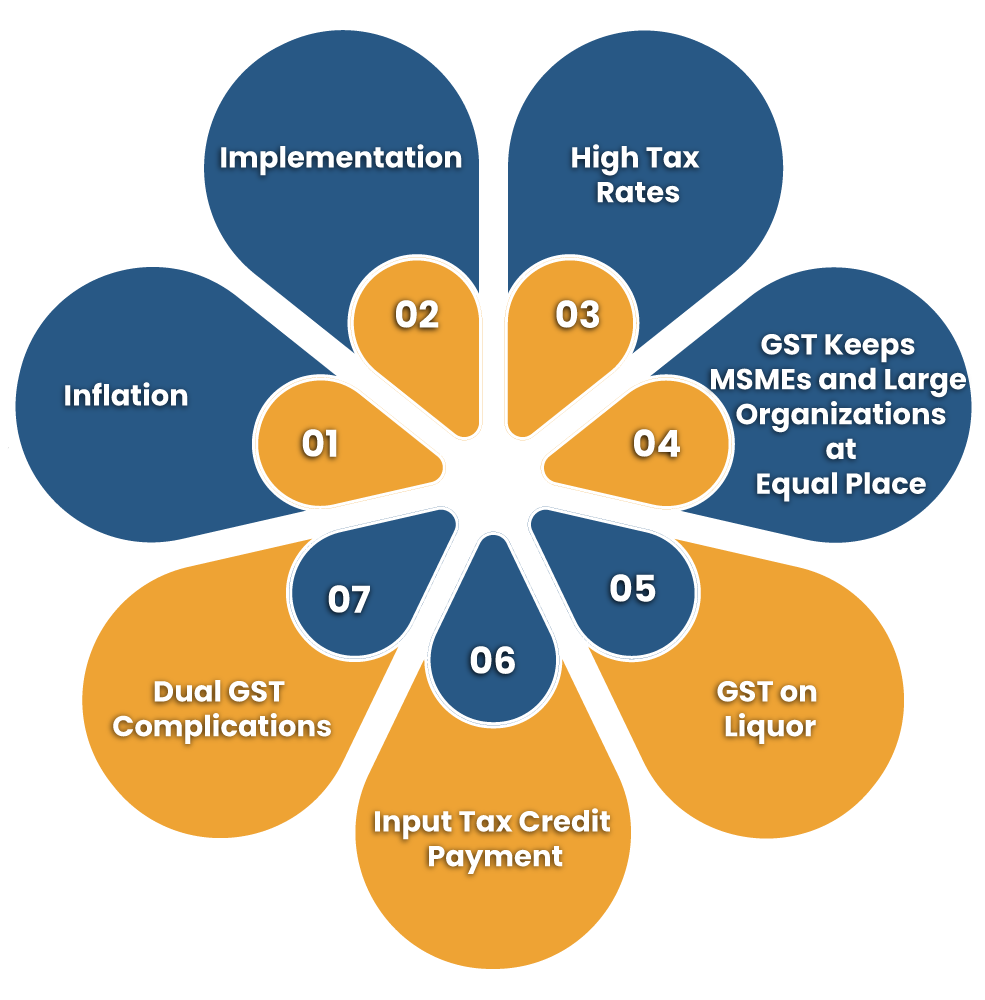

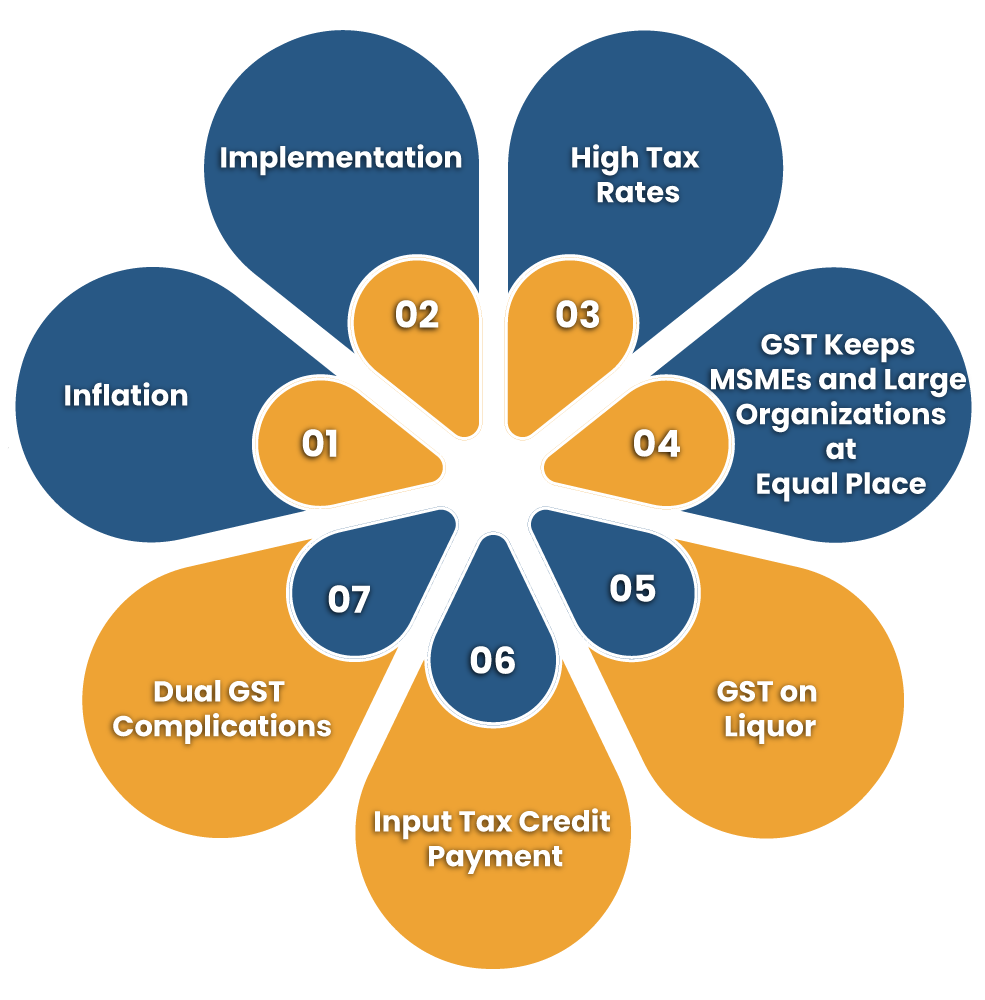

Inflation

New regime of tax (GST) has brought with it great concern in terms of its implementation. Even in the between of all the unpredictability & challenges, there is a belief that in the long term it will promote higher GDP growth and profit as a wider tax base.

As per GST tax rates, about 50% of goods fall under the 18% tax rate. In the earlier indirect tax regime, for many items, excise and state VAT and all other taxes increased by more than 25%. Therefore, many of the prices of manufactured goods should fall under GST.

Under GST for all goods and services, manufacturers can ITC. This means that at the time of paying the tax on the output, manufacturers can reduce the taxes they have already paid on the input.

In the earlier regime, many taxes such as CST, entry tax, octroi and many cesses were not feasible. This resulted in a wider impact of taxes. Removing the cascading effect under GST should also help in reducing prices.

GST Implementation

Another lesson learned from Malaysia is that businesses need to start with the implementation process to be GST-ready. It is necessary for businesses to undergo radical changes to adapt to the complex GST regime.

High Tax Rates

GST rates are typically between 16% & 20 % worldwide. Lower rates can help reduce tax evasion rates in the economy in the long term.

GST Implementations Considers MSMEs and Large Organizations Equally

The Indian GST considers MSMEs and large organizations equivalent & has a very low (Rs 20 lakh) exemption limit without any tax discrimination. But the large corporations have the resources to invest, change their systems and get ready for GST, this will be challenging for MSMEs provided the limited resources.

It also must be remembered that Malaysia suffered comprehensive unrest and street protests by small and medium businesses in Kuala Lumpur for a few months after implementation even though they enjoyed simpler systemic requirements and much higher exemption limits than India.

GST on Liquor

Liquor is being kept outside GST for human consumption, with each state free to set its own rates. These regions account for about 40% of the state’s revenue. However, post-GST, they are taxed at 18%

Input Tax Credit Payment

GST implementation of Malaysia revealed that timely payment of ITC refund is mandatory. Until the necessary technology infrastructure is established, it can take months to return tax credits, which can lead to cash flow problems for all links in the supply chain.

The ITC will be available in India only if the supplier has filed his GST return. If the supplier delays or files an incorrect return it will delay the input credit & blocks the funds. Thus organizations will need more working capital resulting in increased costs.

Dual GST Complications

Most countries have implemented the model GST, which has all indirect taxes under one. India has implemented dual GST with separate central and state component.

Concluding Remark

The administration of the dual GST model is the biggest challenge facing India. India should follow both in applying the law in developing countries and successful administrative strategies of developed countries like Singapore. Proper audit planning (to reduce the difference between the taxpayer’s reported and actual statutory tax liability) is needed to cover various economic activities and a large diversity of taxpayers, as done by Singapore and Malaysia.

However, India[1] follows the electronic e-filling and invoice matching system, which made it difficult to avoid taxes. However, the collusion of business partners in the distribution chain can lead to tax evasion. Regular audits are necessary for the implementation of India’s GST. In addition, adequate training is required for both taxpayers and promoters.

The government should ensure that they have a sufficient number of experienced tax agents to handle the grievances of the taxpayer and the exporters and other taxpayers should be well prepared for timely refunds so that they do not face cash flow problems. Kindly associate with the Corpbiz expert to know more about the post GST implementation

Read our article:CBIC: Extension of deadline for GST Return Filing FY 2019-20