NBFC is an organization that provides banking and financial services and it is governed Reserve Bank of India within the framework of the Reserve Bank of India Act, 1934 “Chapter III-B” and the instructions issued by it. In this write up we will look into the Regulations governing NBFCs in India.

What is Non-Banking Financial Corporation?

NBFCs are organizations registered under the Companies Act. These entities are bound to avail license from the RBI to conduct financial services in India. Non-Banking Financial Services perform various tasks such as accepting the deposit, rendering financial credit at a reasonable interest rate and play a significant role in routing the compromised financial resources toward wealth creation.

Read our article:Procedure for Appeal against Cancellation of NBFC Registration by RBI

Regulations governing NBFCs in India

While NBFCs have been providing several financial services to the needy ones, discrepancies in their system also have been identified. Presently, all NBFCs expect Housing finance company works under the canopy of the Reserve Bank of India. After the advent of the RBI (Amendment) act 1997, all NFBCs with net owned funds of Rs 2 Cr. and above have to avail statutory approval from the RBI. Housing finance companies in India are regulated by the National Housing Bank.

Regulations governing NBFCs in India are as follow:-

- The minimum net worth funds (NOF) of two crore is required to be maintain by companies who are willing to registered NBFC in India

- NBFCs ought to maintain ten percent of their deposit as liquid assets.

- NBFCs are not permitted to accept deposits which are repayable on demand.

- They are not allowed to cap the interest rate higher than ceiling rate mentioned by the Reserve bank of India.

- Offering gift or additional benefits to the depositors is not allowed.

- Reserve Bank of India shall not provide any assurance to the repayment of deposit made by the NBFC.

- They have to build a reservoir of the fund and transfer up to extend not less than 20% of their net deposit.

- RBI rules their functionalities regarding issues of disclosures, credit, prudential norms investments, etc.

- NBFCs depositors are eligible to avail of the nomination facility.

- NBFCs, particularly the unincorporated ones, are not eligible to accept deposits from the public.

- NBFC has to maintain a minimum capital adequacy norm of eight percent.

- NBFCs are liable to avail minimum credit rating from credit rating agencies.

- NBFCs are bound to maintain a certain threshold of liquidity buffers related to the liquid asset to address the short-term liabilities. This will empower them to counteract the liquidity crisis with a minimum of hassle.

- The Reserve Bank of India as per RBI Act 1934[1], reserve the right to register, issue directions, lay down policy, inspect, and conduct scrutiny over NBFCs.

- The Reserve Bank of India has the authority to penalize the NBFCs for infringing the compliances of RBI Act or the directions issues by RBI under the RBI Act.

- The penal action could lead the RBI to cancel the Certificate of Registration granted to the NBFC.

- It is illegal to pursue business without the approval from the Reserve Bank of India. Failing to this provision can endanger the existence of the concerned entities as RBI can enforce them to confront severe penalties.

- Every NBFC holding an asset value of Rs. 50 crore or more shall be entitled to constitute an audit committee in accordance with the last audited balance sheet. The committee must comprise of at least three members from the BOD.

- All the NBFCs are entitled to prepare their balance sheet along with P&L account on 31st March of every year.

- The board of directors of every NBFC that is willing to confer call loans must frame the policy for the same in the first place.

- NBFC must prepare Suspicious Transaction Report (STRs) in case if they have reason to believe that the specific transaction adheres to criminal activity regardless of the transaction amount.

Liquidity Coverage Ratio

Liquidity Coverage Ratio, aka LCR, is the proportion of liquid assets held by the NBFCs to address short-term liabilities. RBI also laid down certain conditions for non-deposit taking and deposit-taking NBFCs regarding the Liquidity Coverage Ratio which will come into effect from December 2020. These conditions are as follows.

- If the asset size of non-deposit taking NBFCs falls in the bandwidth of Rs 5,000 crore to Rs 10,000 crore then, in that case, they have to maintain 30% of liquid assets as LCR.

- RBI requires deposit-taking NBFCs to maintain a certain level of liquidity as a buffer asset to overcome the liquidity crisis

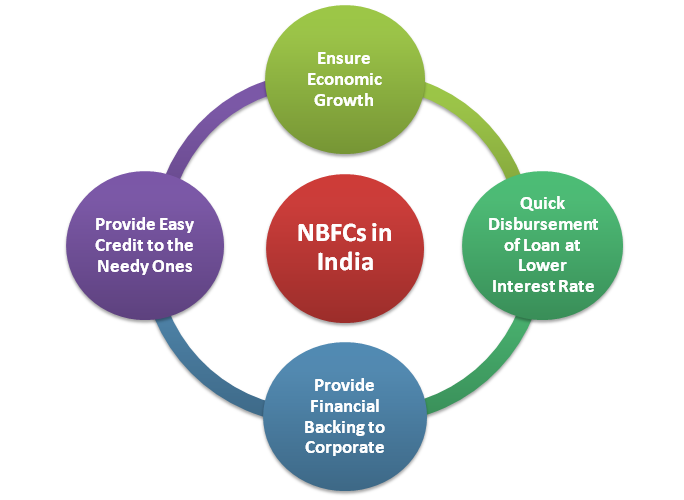

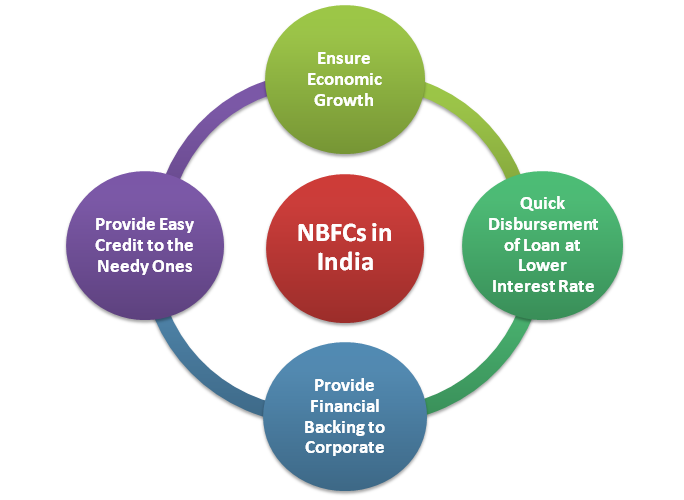

Reasons why RBI and other Regulatory Authorities allow NBFC to perform Financial Services

- NBFC can contribute to the growth of sectors like infrastructures and transport.

- These institutions could help in escalating employment across India.

- NBFI can trigger economic development.

- NBFI could render easy financial credit to the economically weaker sections of society.

Conclusion

To conclude, NBFCs are playing a vital role in strengthening the economic infrastructure of the country. Since NBFCs are bound to adhere to RBI’s compliances, they are not permitted to provide any services that go beyond the scope of bylaws. Sometimes such restrictions won’t allow the NBFC to operate freely, so governing authorities every now and then alter the relevant provision to strike the right balance between ease of working and risks.

As the economy develops, the need for financial credit is bound to escalate and NBFCs have the potential to push the growth of the Indian economy. Profitability is something that remains the top priority of every business venture but that’s not the case NBFCs.

Read our article:When to Surrender NBFC Registration and its effects