An NBFC must seek Certificate of NBFC Registration as per with the rules and regulations mentioned under Section 45-1A, RBI Act, 1934. In addition, it must be duly registered under the Companies Act, 2013. The RBI can grant or cancel the Certificate of Registration for an NBFC. However, it is an option to appeal against cancellation of NBFC registration.

Cancellation of NBFC Registration by RBI

If at any time, the RBI found that an NBFC is conducting the business in the manner NOT specified in the Act or not acting in favor of public interest, and then it can cancel the certificate of registration conferred to an NBFC. RBI must provide an opportunity to the concerned NBFC for clarification before the Cancellation of Registration. Only, when RBI feels a delay will result against public interest, then NBFC registration must not be cancelled instantaneously.

Reasons for Cancellation of NBFC Registration

- When an NBFC ceases to carry on the business of the non-banking financial institution in India

- In case if NBFC fails to comply with the registration conditions specified under the Act and an additional RBI specified conditions at the time of issue of a certificate of registration. Such as, if it fails to maintain the minimum paid-up capital requirement, which is not below INR 2 crore.

- In case NBFC fails to fulfill the specified conditions with respect to the affairs and capital of a Company.

- In case of non- compliance by NBFC with any direction issued by the RBI

- In case NBFC fails to maintain the books of accounts in accordance with the provisions of the RBI Act or directions issued for the same.

- In case NBFC accepts the deposit that has been prohibited by an order made by the RBI, or by an order has been in force.

- In case NBFC fails to submit any other relevant documents to the RBI for inspections.

Read our article:Prerequisites of NBFC Registration: A Comprehensive Overview

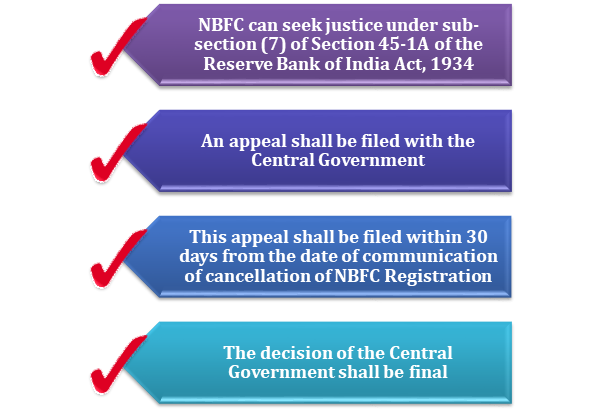

An appeal against cancellation of NBFC Registration

- On appeal against the cancellation of NBFC registration, the aggrieved company by the order issued by RBI can file an appeal within the period of 30 days from the date of the order of cancellation of the NBFC registration is communicated to the company.

- An appeal must be filed with Central Government, and the final decision must be made by the Central Government when an appeal has been referred to it or also in a case where no appeal can be preferred.

- The appeal can also be filed if there is a case of delay. It can be filed along with the Condonation of Delay Application within a reasonable time, along with proper justification.

Before cancellation an opportunity for being heard given by RBI.

Unless it is in the opinion that the delay in canceling the certificate of registration will prejudicial to the public interest or the non-banking financial company or the interest of the depositors, the RBI, before passing an order of cancellation, must provide an opportunity of being heard to the Company.

Where to file an appeal against cancellation of NBFC Registration is filed?

- An appeal can be filed before an Appellate Authority in the department of financial services, under Section 45-IA, sub-section (7) of the RBI Act, 1934.

- The time duration to file an appeal is within 30 days, starting from the date of receipt of cancellation order.

- Writ Petition filed under Article 226 before the High Court.

Compliance before filing an Appeal against cancellation of NBFC Registration

Following compliances followed before filing an Appeal against cancellation of NBFC Registration:

- Double-check your ROC (Registrar of Companies)

- Compliance Check your RBI (Reserve Bank of India[1]) Returns (NBS-9)

- Tax Audit Reports

- Quality test of the Assets and Liability

- Minimum NOF (Net Owned Fund) of Rs 2 crore

- Adequate reason for filing an appeal

Certificate of Registration is required for every NBFC

Every NBFC must obtain the certificate of registration from RBI before undertaking any business. Following conditions are required to be complied by each NBFC at the time of obtaining a certificate of registration:

- Company has to be registered as per the provisions of the Companies Act 2013

- A Company is required to undertake the financial activities mentioned in the provisions of the RBI Act, 1934.

- A company must get an NBFC registration certificate. If at any time, there is an increase in the business’s financial flow, such that it exceeds 50% of the company’s total capital asset.

- A minimum Paid-up capital fund of INR 2 Crore shall be held by the company.

- It must ensure that the company must be in a position to pay its present or future depositor’s claims. It has an adequate capital structure and earning prospects, and affairs of the company are not detrimental to the interest of its present or future depositors. The RBI may ask to inspect the books of account of the company.

RBI has cancelled a large number of NBFC License in 2016 in India

RBI has cancelled many NBFC’s certificates of registration, which were fraudulently impersonating as NBFC. Many entities were promising loans to the needy people at attractive rates and collecting money from them as processing charges for the loans/advances and vanish with the money so collected. In 2016, RBI had cancelled the certificate of registration, nearly 26 non-banking financial companies found in fraudulent activity.

Conclusion

(NBFCs) Non-Banking Financial Companies are the financial institutions which are an important and integral part of the Indian economy. NBFCs offer various services such as credit or loan, retirement plans, acquisition of shares/stocks, leasing, merger activities, etc. For any NBFC to function, it’s mandatory to seek a Certificate of Registration that must be issued by the RBI. At Corpbiz, we have experts which will help in NBFC registration and will guide you upon post NBFC compliances.

Read our article:NBFC Registration: Step by Step Procedure