Provisional attachment of property under GST is mainly concerned with the protection of the interests of the revenue. All the legal proceedings under several tax laws (Also comprising goods and service tax) might require a substantial amount of time. Delay could take place in the earning of revenue by the government due to the state of pending or awaiting settlement of all the proceedings.

Before the proceedings come to an end, the taxpayer can take a step ahead and transfer his property to another person. The government can utilize its power of provisional attachment of property under GST (Properties of the taxpayer) for protecting the interests of the revenue in the period of pending or awaiting settlement of any of the proceedings.

Meaning of Provisional Attachment of Property under GST- As per Section 83 of the GST Act, 2017

Knowing the meaning of provisional attachment of property under GST is essential before moving ahead on Section 83 of CGST Act. The person cannot make the transfer of his property to any other person in case if the government attaches the property of that person. However, if somehow he does manage to make the transfer of his attached property, then such a kind of transfer won’t get recognized by law, and also, the transfer would get assumed as void. Although the bank account would get attached, transfer of funds to other accounts won’t get allowed.

Systematic Exposition of Section 83 of the CGST Act

An order concerning attachment of property including taxpayers’ bank accounts for protection of the interests of the revenue would get passed from the Commissioner end at the time of pendency of some specified proceedings under CGST Act, 2017[1].

In case if no action is taken, such order would likely remain in effect till one year time. The concerned Transport Authority, Revenue Authority, or any related authority would put an impediment on the said property after receiving a copy of the order passed by Commissioner. Without getting instructions from the Commissioner, there is no provision for removal of the impediment.

State of Affairs in Which Section 83 can be put into effect

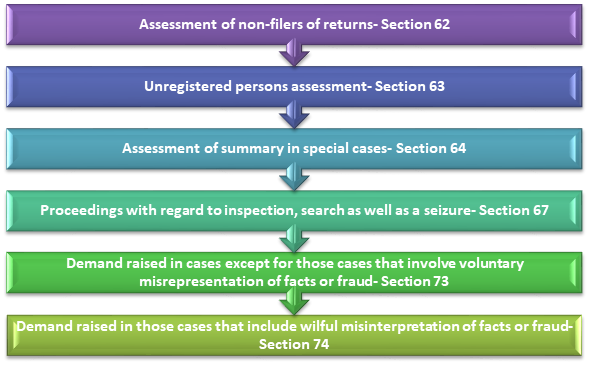

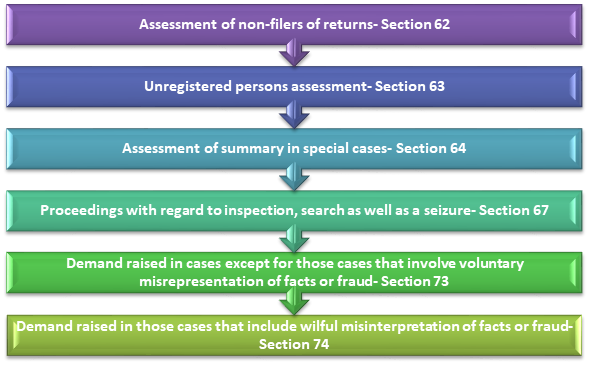

At the time of the pendency of the proceedings given below, Section 83 could get invoked-

- No provision with respect to attaching the property of such taxpayer is applicable in any different case.

- In the same way, for proceedings that are closed, Section 79 of the CGST Act concerned with the recovery of taxes gets captivated for provisional attachment of property under GST by the goods and service tax Officer.

- It is applicable with respect to those cases in which the proceedings are over, and the taxpayer would get certified as a defaulter.

- Therefore, provisional attachment of property under GST (Section 83) is applicable in those limited cases when there are certain pending proceedings before the tax authorities.

Read our article: Composition Scheme under GST- The Next Big Thing

What moves the taxpayer would make?

- After the demand notice would get issued under Section 63, 73, or 74, the Commissioner can use his authority to issue DRC-22 at any point in time.

- In DRC-22, the Commissioner would pass an order that will include the details related to the attached property in case if he wants to go for provisional attachment of property under GST, also including bank account.

- In the same manner, notice for attachment would get made after the assessment orders would get issued under Section 62 or Section 64.

- Upon receipt of the order in DRC-22, the taxpayer has got the right to file an objection in the disfavor of it, asserting that such a kind of property won’t be liable to attachment.

- In the time limit of seven days of the property attachment, the objection should get filed. Then, there would be a layer of confinement for the Commissioner to provide a chance of being heard to the taxpayer.

- Furthermore, he would pass an order in DRC-23 to set free the attached property from his shackles if in case he found the response of the taxpayer satisfactory.

- The taxpayer would either go for settling the applicable tax dues or pay the market price as a consideration for the property, among both whichever is lower if in case the characteristics of the attached property are precarious or liable to perish.

- The Commissioner would pass an order in DRC-23 in order to release such property at the time of settlement.

- The Commissioner would exercise his power of disposing of the property, and also he may take the appropriate action against the taxpayer dues in case if the taxpayer does not set his mind to either pay the property market price or take another step of settling the appropriate tax dues.

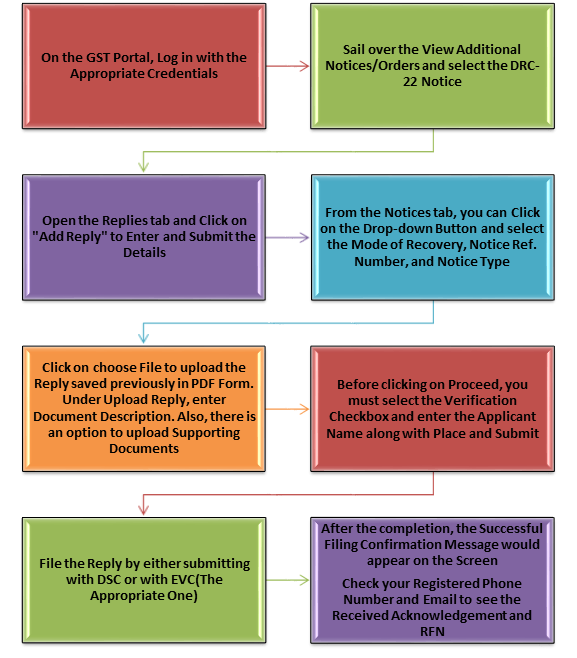

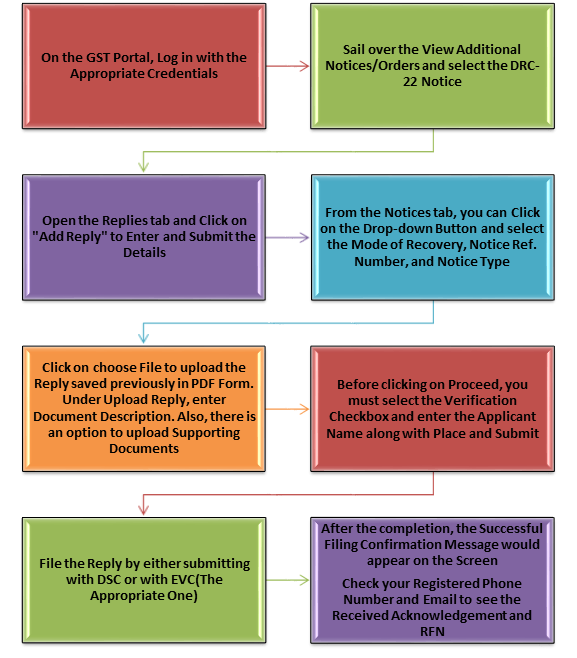

Stepwise Guide to File a Reply to Notice in DRC-22

Put the reply to the notice typed out as well as saved in a PDF formatted file as a necessary condition. Nothing is defined about the specific format. Nevertheless, it should get ensured that the file size won’t be more than 5 MB.

Given below are the stepwise guide to reply to a notice in DRC-22 form on the goods and service tax portal-

Take Away

In brief, Provisional attachment of property under GST (Section 83) is related to the protection of the interests of the revenue. At Corpbiz, Our GST experts will be at your disposal in case you are looking for expert suggestions on the matters concerning the Provisional Attachment of Property under GST.

Read our article:Inspection under GST: A Concise Study