The Goods and Service Tax Network has provided the functionality of the new invoice furnishing facility on the GST Portal. The invoice furnishing facility is a facility where quarterly GSTR-1 filers can choose to upload their challan every month. The quarterly GSTR-1 filer is a small taxpayer with a turnover of Rs. 1.5 crore.

As per Rule 59 of the CGST Act, a nominee is required to provide information to the person opting for the policy of outward supply for the Form GSTR-1 quarter. An individual has the option to enter the outward supply information through the invoice submission facility (IFF) for any registered person for the first and second quarter months. He may consider it mandatory for the first day of the following month until the 13th day of the following months.

Invoice Furnishing Facility Available on GST Portal

The below mentioned points should be fulfilled prior filing Invoice Furnishing Facility.

- The IFF can only be used for the first two months of the quarter.

- Challans related to the last month of the quarter are to be uploaded in GSTR-1 return only.

- If the challan is uploaded in the IFF then there is no need to upload challan in GSTR-1

- The total value of the invoices to be uploaded is limited to Rs 50 lakhs per month.

- The details presented in the IFF will be reflected as GSTR-2A, GSTR-2B, GSTR-4A or GSTR-6A recipients.

- IFF came into effect from 01.01.2021 on GST portal

Read our article:Key Highlights of GST Updates 2021

Who can use the Invoice Furnishing Facility on GST Portal?

Small taxpayers who file their GSTR-1 returns quarterly can use the IFF. It is necessary to note that if a taxpayer chooses not to upload the challan details through the IFF; taxpayer will have to upload all the challan details for the three months of the quarter in the GSTR-1 return.

Purpose of the Invoice Furnishing Facility on GST Portal

Taxpayers whose total income is less than Rs 1.5 crore in the last financial year can file their GSTR-1 every quarter. It is permissible to curtail the compliance burden on small taxpayers. Still, this starts problems for taxpayers who make purchases from small taxpayers in claiming input tax credit. Accordingly, the IFF has been introduced to overcome these difficulties and help small taxpayers claim ITC.

Particulars are to be Submitted in the IFF on GST Portal

The below discussed details are needed to be submitted by small taxpayers if they choose for IFF, those are as follows:-

- B2B Challan details of sale transactions

- Credit & Debit notes of the B2B challan authorized during the month.

How to use the Invoice Furnishing Facility on GST Portal?

As IFF is optional for Quarterly GSTR-1 filers, the GST portal may provide a time to choose for the same. Once the small taxpayers choose for it, the GST portal will provide this facility to these quarterly taxpayers for the first two months of the quarter. The challan should be uploaded to the IFF in the first 13th month.

As of now, the format of the Invoice Furnishing Facility has not yet been announced, and we can expect a notification for the format of invoice uploading as early as possible. There has been no certainity as to whether an offline device will be provided.

Benefits of Using the Invoice Furnishing Facility on GST Portal

The listed below are the advantages of availing the IFF.

- Buyers of small taxpayer goods can claim ITC every month

- This permits the monthly reconciliation of data and prepares GST return filing easier.

- Small taxpayers can enhance their business by giving faster ITC claims.

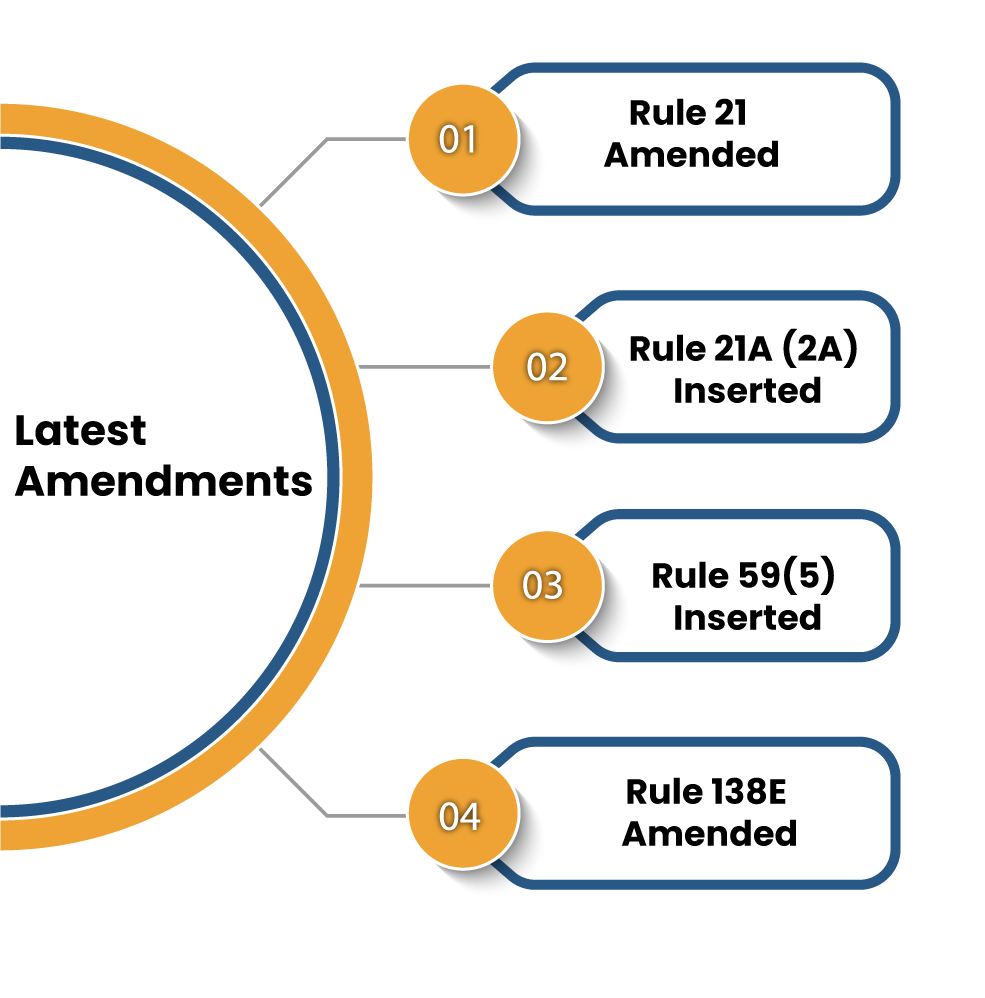

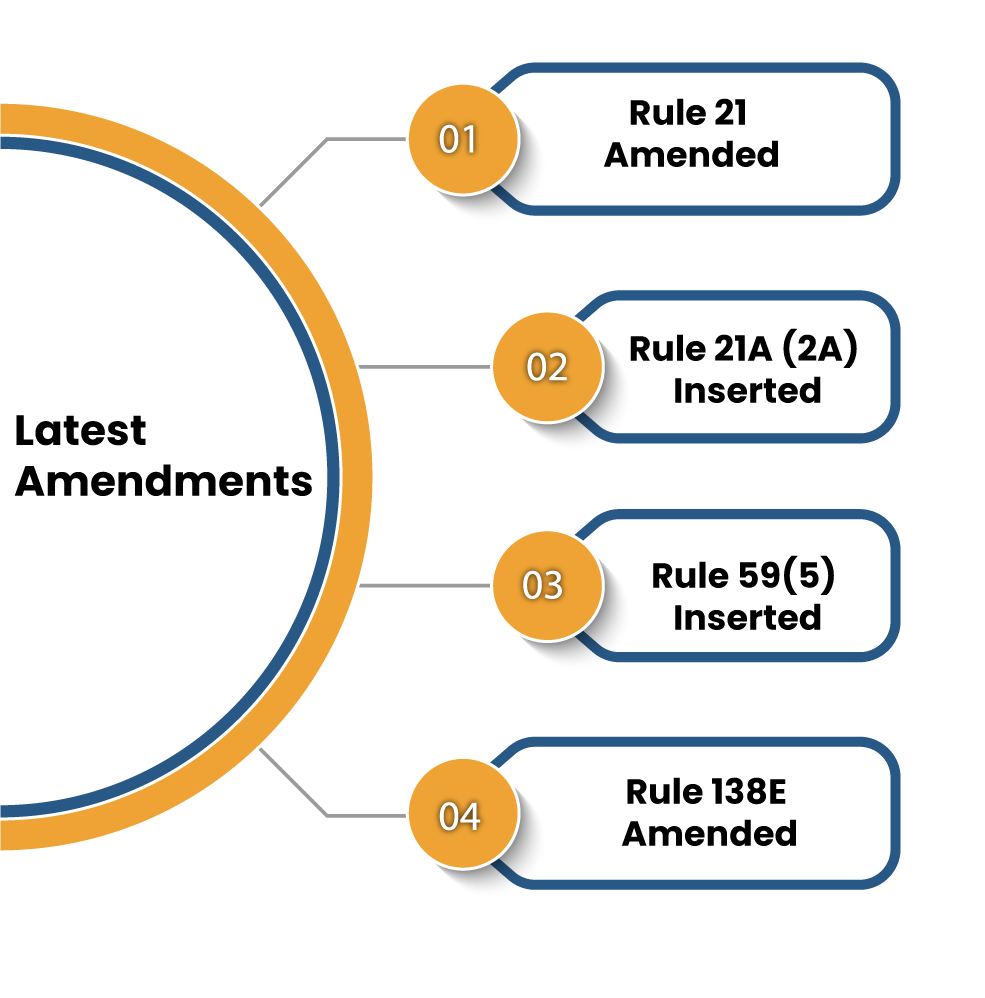

Latest Amendments

The following are the latest amendments, which are as follows:-

Rule 21 Amended

GSTIN can be cancelled if the outward supply stated in Form GSTR-1 exceeds the tax period stated in GSTR-3B

Rule 21A (2A) Inserted

If there are significant differences in the inward supply between GSTR-3B & 1, or GSTR-3B & 2B in violation of the Act/Rules, the tax payer’s GSTIN may be suspended.

Rule 59(5) Inserted

GSTR-1 cannot be filed for current tax period or if IFF cannot be used:

- In the case of GSTR-3B monthly GSTR-1 filers were not filed for the preceding two months

- The GSTR-3B quarterly was not filed for the last tax period in the case of GSTR-1 taxpayers or if where Rule 86B has been disobeyed.

Rule 138E Amended

If the GST registration is suspended on the account of the taxpayer due to cancellation under sub-rule (2) of Rule 21A or due to significant difference / discrepancies between GSTR-3B and 1, the e-way bill is not generated.

Concluding Remarks

This is a good step for both small taxpayers and buyers to help small taxpayers[1]. IFF will indirectly assist small taxpayers in developing their business by giving ITC claims to their buyers. However, this will increase compliance costs for them.

Therefore, one has to make a comparison between the leverage for the IFF and the price involved. Opting for this feature is useful if a small taxpayer picks up more extensive versions of B2B invoices than B2C invoices in a quarter. Kindly associate with the Corpbiz expert to know more about Invoice Furnishing Facility (IFF) functionality available on GST Portal.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty

notfctn-01-central-tax-english-2021