In order to conduct inspection under GST, officers are granted with various rules and powers. The implementation of India’s most significant and crucial economic reform, goods and service tax got implemented from July 1, 2017. The Goods and services tax came into the picture and subsumed several taxes like central excise, VAT, service tax, and other taxes. The unified tax system, GST, has brought efficiencies in the business. Talking about the applicability factor, GST is applicable for most of the businesses.

Inspection is a provision that comes under the CGST/SGST Act. In comparison to search, inspection under GST is a softer provision that empowers the officers so that they can access any business place of a taxable person and further, any business place of a person involved in the transportation of goods or who is an operator or an owner of a godown or warehouse.It helps in ascertaining the tax payment as well as preventing tax evasion.

The Purpose behind Arrest, Seizure and Inspection under GST

The prime purpose behind arrest, seizure, and inspection under GST is to safeguard the interest of genuine taxpayers from those taxpayers who evade the tax and violate taxation legalities to take advantage over the honest taxpayers. Certain persons should get special authority to regulate and maintain any law. Officers get the opportunity to use these provisions under unusual circumstances. Furthermore, officers apply these provisions as a last resort by taking the protection of government revenue under consideration.

Also, there is a requirement for authorized officers in the ranks of the joint commissioner to make sure that the provisions are coming into order properly.

Conditions in Which Inspection under GST Takes Place

Inspection under GST is a standard procedure that facilitates goods and service tax officers to access any business place or godown or transport/warehouse. In comparison to search, inspections have lesser consequences and are softer as well. An officer of the CGST department or SGST department carry out the inspection with the authorization in written form of an officer of the Joint Commissioner rank or even above.

The conditions in which inspection under GST occurs when a Joint Commissioner has got the “reasons to believe” that the concerned person has taken one of the following actions in order to evade tax-

- Suppressed stock in hand

- Suppressed transaction concerning the supply of goods or services

- Non-compliance with the provisions of the Act

- Claimed in ITC

- Any transporter or operator/owner of a warehouse has stored certain goods which have evaded payment of tax or have kept goods or accounts in such a manner to escape tax

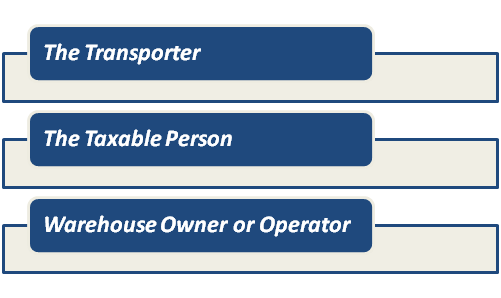

Thereafter, an officer can get authorized in FORM GST INS-01 for inspecting business places of-

The officer can proceed ahead to inspect any other place if he or she assumes it as fit.

‘Reasons to Believe’: Statement for Inspection under GST

- Reasons to believe for inspection under GST is concerned with having knowledge related to facts (excluding direct knowledge) that would let any reasonable person may conclude things in a logical way.

- As prescribed in the Indian Penal Code[1], 1860, ” A person is supposed to have ‘reason to believe’ a few things if he has enough grounds to bank upon that thing”.

- Moreover, we can brief things by saying that the person entirely defines the reasons to believe via evaluation along with the examination of the fact, excluding his or her opinions.

Is it required for an Officer to State Reasons to Believe before Issuance of Inspection Order?

No, Under GST Act, there is no such provision that asserts that the officer needs to bring forward reasons to believe in writing before the issuance of an inspection order.

Read our article:Detention and Confiscation of Vehicles and Goods under GST- Law, and Procedures

Difference between Search and Inspection under GST

If you think that search and inspection under GST are the same things, then you are wrong up to an extent as there is a fine line that differentiates between the two. Let’s check it out-

Search under GST incorporates an endeavour to ascertain something. Basically, the search is an action of a government tax officer or a police officer (Based on the nature of the case) to go ahead and continue with a thorough or cautious investigation of a person, place, object, etc. The objective behind the search is to discover proof of a crime and to locate something covered. As per the proper and legitimate authority of law, the search of a premise, vehicle or person takes place.

Inspection under GST is an act of monitoring and examining things, most of the times, closely. It is a softer provision as compared to search. Furthermore, it allows the officers to access any business site or place of a taxable person and also the business location of a person involved in the movement or transportation of goods or who operates or owns a godown or warehouse.

When can Order Search Pass under GST?

- The officer with a higher rank or the Joint Commissioner has the authority to order search under goods and service tax either on the basis of inspection or if in case, he or she has a “reason tobelieve.” Under the GST regime, the order can get passed when-

- Goods that must get confiscated

- Any documents or account books which will be of much use at the time of proceedings and are hidden

- The officer of higher rank or the Joint Commissioner can give the power to any individual to search as well as seize the goods

Take Away

Inspection under GST makes the officers capable enough to access any business of a person who is a registered person or liable to be a registered person under GST law and, also any business place of a person engrossed in goods transportation or who is an operator or an owner of a godown or warehouse. Furthermore, it helps in protecting the rights of genuine taxpayers against the ill-practices related to taxation by tax evaders. At, Corpbiz, we have got a bunch of skilled and experienced professionals who can sort out your queries related to this aspect of GST.

Read our article:Applicability of ITC on Capital Goods under GST