It was a raised concern earlier this year over the directive of recovery of over Rs. 46,000 Crore of unpaid interest on delayed GST payment. The interest was being charged at Gross Tax Liability.

The GST Council inclusive of State and Centre Finance Ministers, in its 39th meeting in March made a decision that the interest required to be paid for delayed GST payment needs to be charged on Net Tax Liability from 1st July, 2017. Hence, earlier the GST law stated that 18% interest needs to be charged on Delayed gross Goods and services tax payment to which the GST liability was considered for interest calculation also included the part which would be offset by input tax credit.

Read our article:Latest : CBIC has notified Provision for Aadhaar Authentication in GST Registration

CBIC Notice regarding Delayed Gst Payment

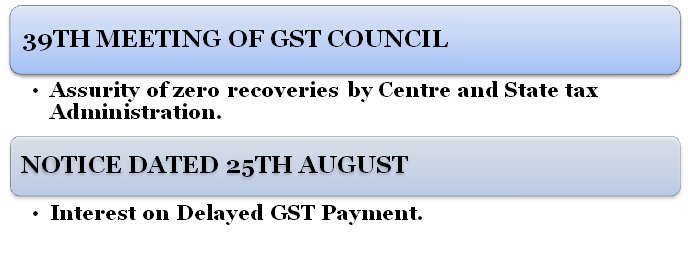

The Central Board of Indirect Taxes and Customs (CBIC) on August 25, 2020 notified that September 1st, 2020 would be the date from which the interest would be charged on Net Tax Liability. It was notified by the Central Board of Indirect Taxes & Customs (CBIC) today clarified that the Notification No. 63/2020- Central tax dated 25th August 2020 which relates to the interest on the delayed GST payment which is issued because of certain technical limitations.

Entitlement of Full Relief

However, an assurance was made that no recoveries would be made for the past period by Centre and State tax administration as according to the 39th meeting of GST council[1]. The taxpayers are entitled to full relief as has been decided by the GST council. This notice came as a response after an assortment of comments on Social Media.

Consideration of Informal Press Release

Several experts mentioned on the condition of anonymity that the actual tax governance mostly takes place solely on the basis of formal notifications and not just by verbal assurances or informal press notes that does not include any legal sanctity. “It will lead to litigation as the field officers will go by formal notification only,” a tax consultant who works for a global consultancy firm said. Businesses are anxious at the prospect of paying over ₹46,000 crore as interest on the delayed payment of GST ever since the new indirect tax regime was launched on July 1, 2017.

Conclusion

From the above-mentioned notice, it can be concluded that the notice seems to be disconnected with the decisions made by GST council where it was assured that the taxpayers would be given this benefit retrospectively from July 1, 2017. This benefit would mean that there would be millions of tax payers that will be looking at demand of interest for over three years ever sine the date of implementation of GST. Businesses are expected that they approach the High Courts for the unjust interest that is demanded on ‘principle of estoppel’.

Read our article:CBIC Notifies to facilitate Interest levied on Net Tax Liability as per Section 100 Finance Act 2019